While there are concerns about oil demand, the supply situation has also not been supportive of oil prices, according to Stratas Advisors citing the Biden administration’s plans to release 1 million barrels of oil every day for the next six months. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $102.78 after closing the previous week at $104.39. The price of WTI ended the week at $98.26 after closing the previous week at $99.42.

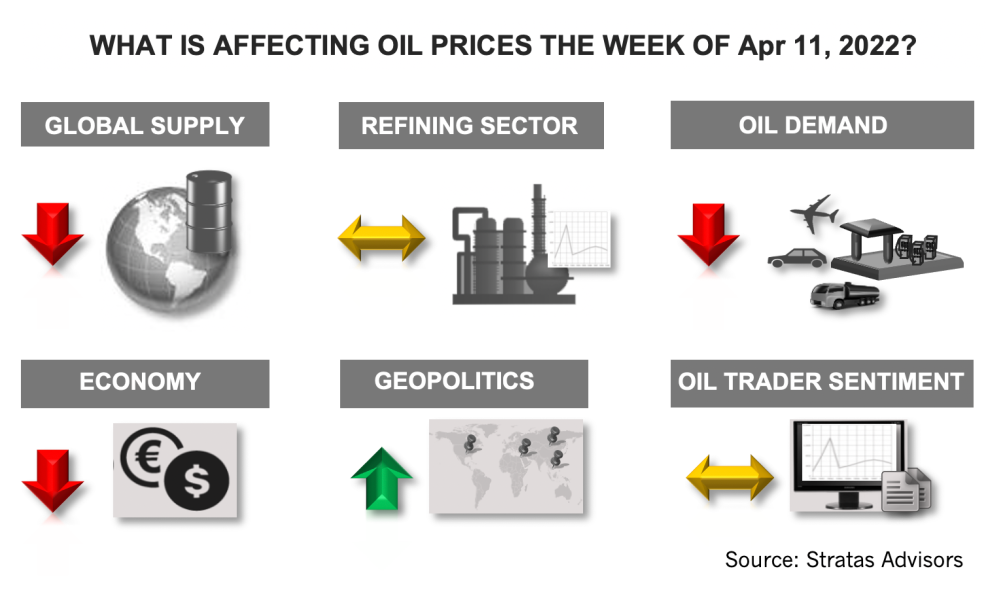

Downward pressure on oil prices is coming from the following factors:

- As has been the case for several weeks, China continues to struggle with the number of COVID-19 cases, even as China sticks with the policy of lockdowns and quarantines. Shanghai and surrounding area remain at the center of the COVID-19, where the efforts to combat COVID-19 are expanding. Currently, Shanghai authorities are converting apartments, and public buildings like exhibit halls into quarantine centers with the number of such facilities now exceeding 60. The zero-COVID policies are also affecting manufacturers, including Apple, Tesla, Volkswagen, and Taiwanese electronic manufacturers. The policies are also affecting port operations with the port of Shanghai operating at 40% of pre-lockdown levels. Meanwhile, the number of cases continue to increase with more than 20,000 new daily cases occurring in Shanghai.

- Oil demand in the U.S. has been weak for the last several weeks. While the latest weekly report from the U.S. Energy Information Administration indicates that gasoline demand in the U.S. increased slightly to 8.56 million bbl/d from the previous week of 8.50 million bbl/d, current gasoline demand (based on the four-week average) is running 708,000 bbl/d less than for the same period of 2019. Based on the four-week average, diesel demand is running 296,000 bbl/d less than in 2019 and jet fuel is running 192,000 bbl/d less than in 2019. The weakness of U.S. oil demand is troubling, not only because the U.S. is the largest consumer of oil, but because its economy has been doing better than the rest of the major economies.

- While there are concerns about oil demand, the supply situation has also not been supportive of oil prices. President Biden announced another release of one million b/d for the next six months starting in May. The release will be the largest in history. In conjunction, another 60 million barrels will be released by other International Energy Agency countries. Additionally, Russia is continuing to export crude oil at levels not dissimilar to the levels prior to the initiation of the Russia-Ukraine conflict. Russia’s Deputy Minister stated that oil production during April will decline by only 4%-5% (around 500,000 bbl/d) from the average in March of 11.01 million bbl/d. The reduction stems, in part, from logistic issues associated with shifting exports towards Asia and away from Europe. Even if Europe further reduces Russia oil imports, Russia has the ability to export barrels to other consumers through ports in the Black Sea, Baltic and Pacific. The impact will be mitigated because there is no need for additional infrastructure, but instead only the rerouting of shipments.

For the upcoming week, we are expecting further pressure on oil prices with oil prices moving toward the lower level of our forecast of Brent prices remaining between $95 and $115 with price movements remaining highly sensitive to news flow.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.

Biden Administration Criticized for Limits to Arctic Oil, Gas Drilling

2024-04-19 - The Bureau of Land Management is limiting new oil and gas leasing in the Arctic and also shut down a road proposal for industrial mining purposes.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.