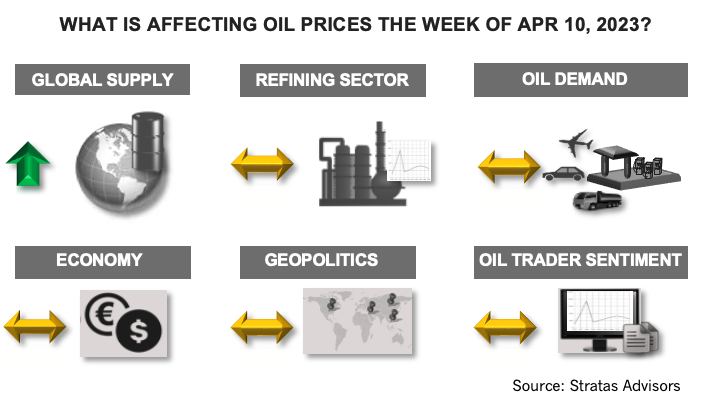

When considering the concerns about the U.S. economy, Europe and moderate growth expectations associated with China, Stratas Advisors believes there is more downside risk to our revised forecast than upside risk. (Source: Shutterstock)

The price of Brent crude ended the week at $85.12 after closing the previous week at $79.89. The price of WTI ended the week at $80.70 after closing the previous week at $75.67.

The increase in prices continues the upward movement that was initiated with OPEC+ announcing on March 26 additional production cuts of 1.16 million bbl/d that are to start in May and last through the end of the year. The price movement aligned with our expectations including our view that the price of Brent would hit resistance at $86.00 and WTI would hit resistance at $82.00.

Looking forward, we are expecting that the production cuts will ultimately push oil prices higher. For the rest of the year, we are forecasting that the price of Brent crude oil will average $93.13, which compares to our previous forecast of $88.57.

The forecast is based, in part, on the U.S. not falling into a recession, but, instead, being able to maintain moderate growth. That said, there are certainly risks associated with the outlook for the U.S. economy. The U.S. Federal Reserve released data last week indicating that bank deposits increased for the first time since the beginning of March with increases for the largest 25 banks, as well as for the smaller banks. However, there remain concerns about the impact on the credit markets. While the amount of lending by banks increased slightly from the previous week, the increased stemmed from higher credit card balances, which offset a decrease in loans for real estate and for commercial and industrial entities.

Another concern is signs of weakness in the jobs market. We have been highlighting for months that the strength of the U.S. jobs market was being overstated. Last week, the U.S. Labor Department issued its jobs report for March, which indicated that the U.S. economy added 236,000 jobs. The number of additional jobs is the lowest level of monthly increases since December 2020, while being led by relatively low-paying jobs associated with the leisure and hospitality sector, which still has 368,000 less jobs in comparison to pre-COVID levels. Additionally, the number of job openings dropped to 9.93 million, which is the first sub-10 million reading in nearly a decade. The number of layoffs increased to nearly 90,000, which is a 15% increase in comparison to February. Continuing jobless claims reached 1.823 million, which is the highest level since December 2021.

When considering the concerns about the U.S. economy and the issues being faced by Europe and the moderate growth expectations associated with China, we believe there is more downside risk to our revised forecast than upside risk.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Kinder Morgan Nominates Deloitte’s Amy Chronis to Board

2024-04-03 - Amy Chronis, currently a senior partner with Deloitte, will stand for election along with Kinder Morgan’s current directors at the company’s annual meeting on May 8.

Jerry Jones Invests Another $100MM in Comstock Resources

2024-03-20 - Dallas Cowboys owner and Comstock Resources majority shareholder Jerry Jones is investing another $100 million in the company.

73-year Wildcatter Herbert Hunt, 95, Passes Away

2024-04-12 - Industry leader Herbert Hunt was instrumental in dual-lateral development, opening the North Sea to oil and gas development and discovering Libya’s Sarir Field.

Matador Stock Offering to Pay for New Permian A&D—Analyst

2024-03-26 - Matador Resources is offering more than 5 million shares of stock for proceeds of $347 million to pay for newly disclosed transactions in Texas and New Mexico.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.