Stratas Advisors still forecasting that the price of Brent crude oil will move toward $90 during the second half of the year based on our reference forecast of supply/demand and other factors. (Source: Shutterstock)

The price of Brent crude ended the week at $75.30 after closing the previous week at $79.54. The price of WTI ended the week at $71.34 after closing the previous week at $76.51.

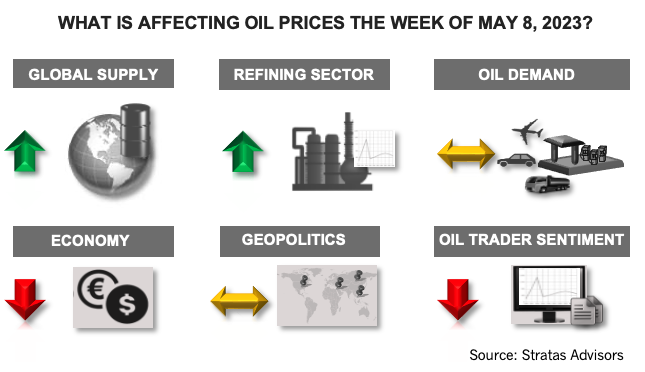

The decrease in prices was driven, in part, by the concerns about the regional banking sector in the U.S., with First Republic Bank becoming the third large regional bank to fail, while PacWest emerged as the next bank under severe pressure. Oil prices are also not being helped by the ongoing releases from the Strategic Petroleum Reserve (SPR), which decreased by 2.00 million during the previous week. Weekly withdrawals have been averaging 1.25 MMbbl during the last five weeks.

We are still forecasting that the price of Brent crude oil will move toward $90 during the second half of the year based on our reference forecast of supply/demand and other factors. Embedded in the forecast is that expectation that OPEC+ will move forward with the additional supply cuts of 1.16 MMbbl/d starting in May. Additionally, we are forecasting that oil demand will increase in the second half of the year, which will result in the oil market moving into a deficit.

At this time, we think there is minimal risk associated with supply being greater than our forecast, given the muted response from non-OPEC producers (including U.S. shale) and our view that OPEC+ will remain proactive in adjusting supply to align with demand. It has been reported that Russia’s exports have not decreased, but we did not expect any major decrease because the announced cuts in supply stemmed mainly from Russia reducing its domestic refinery crude runs, while leaving crude exports relatively unchanged.

The bigger risk is associated with the demand side.

- The recovery in China remains moderate, in part, because of the weakness in the export markets, which is stifling growth in China’s manufacturing sector. Also, while China is not dealing with an inflation issue, it is dealing with a debt issue.

- Reported oil demand in the U.S. continues to lag – especially with respect to gasoline. The latest weekly report from EIA indicates that gasoline demand in the U.S. decreased to 8.62 MMbbl/d from the previous week of 9.51 MMbbl/d. In comparison, for the same period of the previous year, gasoline demand was 8.74 MMbbl/d. Based on the 4-week average, current gasoline demand is running 570,000 bbl/d less than for the same period of 2019, which represents a difference of 6.02%. Gasoline demand is greater than last year’s demand for the last four weeks by 170,000 bbl/d. Diesel demand in the U.S. increased to 3.87 from the previous week at 3.73 MMbbl/d. In comparison, for the same period of the previous year, diesel demand was 3.83 MMbbl/d. Based on the four-week average diesel demand is running essentially the same as for same period of 2019. Diesel demand is 85,000 bbl/d greater than last year’s demand during the last four weeks. Jet fuel demand increased slightly to 1.54 MMbbl/d from the previous week of 1.53 MMbbl/d. In comparison, for the same period of the previous year, jet fuel demand was 1.59 MMbbl/d. Based on the four-week average, jet fuel demand is running 160,000 bbl/d less than in 2019, which is 9.33% less. Jet fuel demand is running ahead last year’s demand for the last four weeks by 13,000 bbl/d.

- The EU’s economy continues to be under pressure with the ECB intent on raising interest rates further to address elevated inflation. At the same time, economic growth has been weak, and the outlook does not look very bright. Germany’s industrial production decreased by 3.4% in March, which is the largest decrease in 12 months. Most worrisome is that factory orders decreased by 10.7% in March.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

SAF End-users, Producers Talk Challenges, Solutions

2024-02-07 - The lower lifecycle emissions of sustainable aviation fuel are seen as a key lever for airlines to reduce carbon emissions, but cost is a challenge.

Column: There’s Methane to Our Madness

2024-01-30 - The EPA’s methane rule will likely face resistance—but it shouldn’t.

Qnergy Tackles Methane Venting Emissions

2024-03-13 - Pneumatic controllers, powered by natural gas, account for a large part of the oil and gas industry’s methane emissions. Compressed air can change that, experts say.

SEC Adopts Climate Disclosure Rules in 3-2 Vote

2024-03-06 - The regulation requires companies to disclose Scope 1 and 2 emissions, weather-related risks and other climate-related data that could have a material business impact.

MethaneSAT: EDF’s Eye in the Sky Targets E&P Emissions

2024-03-07 - The Environmental Defense Fund and Harvard University recently launched MethaneSAT, a satellite tracking methane emissions. The project’s primary target: oil and gas operators.