Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Key Points

Field production held above 95 billion cubic feet per day (Bcf/d) for the report week ended Oct 25. Imports of natural gas from Canada fell by 0.20 Bcf/d or 1.4 Bcf. Exports of natural gas from Mexico also fell by 0.14 Bcf/d or 1.0 Bcf. Demand from major categories saw a gain of 0.70 Bcf/d week-on-week. Majority of this demand gain was from power generation and residential and commercial sectors.

Our analysis leads us to expect another strong injection of 87 Bcf would be reported by EIA for the report week. This is in comparison to the current 88 Bcf consensus whisper expectation and almost 45% higher than the five-year average storage build of 60 Bcf.

Natural gas prices have rebounded slightly to stay around $2.49/MMBtu as of early this week. We may see a small upside to the prices in short term contingent on arrival of cold weather conditions.

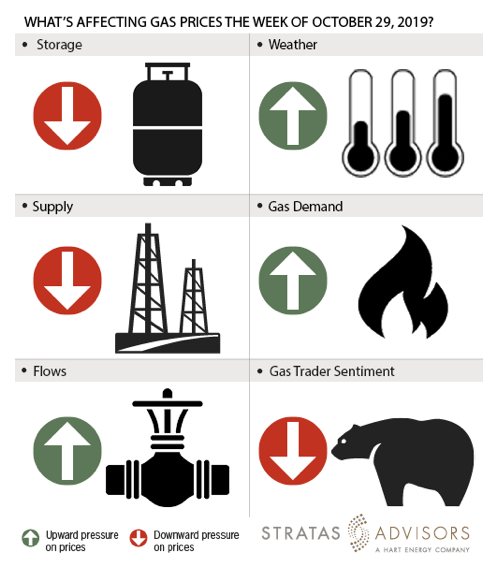

Storage: Negative

We estimate a storage injection of 87 Bcf will be reported for the week ended Oct 25. EIA reported an 87 Bcf injection last week with an increase in stocks in all regions. The total natural gas stocks after this injection is 3,606 Bcf, a 2.5% week-on-week increase. The actual build came very close to our prediction of 85 Bcf. Natural gas inventories have reached 3.6 Tcf with two weeks left for the injection season to end. All in, yet another strong injection this week would have a negative effect on gas prices.

Weather: Positive

The NOAA outlook for the next six to 10 days shows lower than normal temperatures for large parts of United States. A cold front is expected to push the temperatures prevailing in the western and central U.S. to single digits. This cold front is expected to gradually spread into Texas and South later in the week, lowering temperatures as it moves from West Coast to East Coast. The NOAA eight-to-14-day forecasts shows that cooler temperatures are prevailing in short term. We see weather having a positive effect on gas prices.

Supply: Negative

Production levels have been extremely strong throughout the summer and this trend continues into the fall season. Supply has reached 95 Bcf/d during the report week and has stayed up ever since. Dry gas production has increased by 0.84 Bcf/d or 5.9 Bcf during report week compared to prior week. Production growth hasn’t helped raise prices. Accordingly, we believe supply will exert a negative pressure on gas price activity.

Demand: Positive

Residential and commercial sector demand increased by 0.32 Bcf/d or 2.1 Bcf with the heating demand coming in as temperatures plunge. Power generation demand also rose, interestingly, by 0.35 Bcf/d during report week. Industrial demand rose marginally by 0.02 Bcf/d. We expect the demand side drivers to have a positive effect on prices.

Flows: Positive

Flows to LNG terminals rose by an average of 0.21 Bcf/d or 1.4 Bcf/d during the report week. We believe that the increase of LNG flows would exert a positive pressure on gas price activity.

Trader Sentiment: Negative

The CFTC’s Oct. 25 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on Oct. 22 were 211,849 net short while reportable commercial operator positions came in with a 176,125 net long position. Total open interest was reported for this week at 1,277,297 and was down 9,640 lots from last week's reported 1,286,937 level. Sequentially, commercial operators this reporting week were cutting longs by 6,926 while cutting shorts by 28,447. Financial speculators added shorts and cut longs for the week (24,532 vs. -384, respectively). We see trader sentiment as a negative driver for this week’s gas prices.

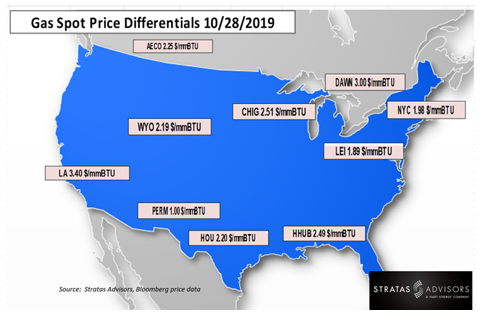

Tracking Gas Price Differentials

Cold weather conditions are boosting Henry Hub prices higher compared to week ago prices. With increasing Henry Hub prices, the differentials to Permian is expected to widen. We forecast the differentials to remain volatile at least until Permian Highway pipeline comes into service in 2021.

Recommended Reading

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

Range Resources Expecting Production Increase in 4Q Production Results

2024-02-08 - Range Resources reports settlement gains from 2020 North Louisiana asset sale.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.