Key Points

Dry gas production moved up by 0.74 billion cubic feet per day (Bcf/d) to average at 94.19 Bcf/d for the report week. As fall temperatures slowly crawl in, demand from power generation continues to drop. Power generation dropped by 1.24 Bcf/d or 8.68 Bcf to average 28.55 Bcf/d for the report week. This marks the second week that power generation has fallen. Dry gas exports to Mexico fell by 0.16 Bcf/d or 1.12 Bcf to average 5.54 Bcf/d, while dry gas imports from Canada trended upward by 0.20 Bcf/d to average 4.64 Bcf/d for the report week.

Our analysis leads us to expect 85 Bcf storage build would be reported by EIA for the report week. This would be slightly lower than the current 86 Bcf consensus expectation and 12 Bcf above the five-year average storage build of 73 Bcf.

We anticipate Henry Hub prices to trade within 10 cents of the Oct. 21 $2.13/MMBtu closing price this week.

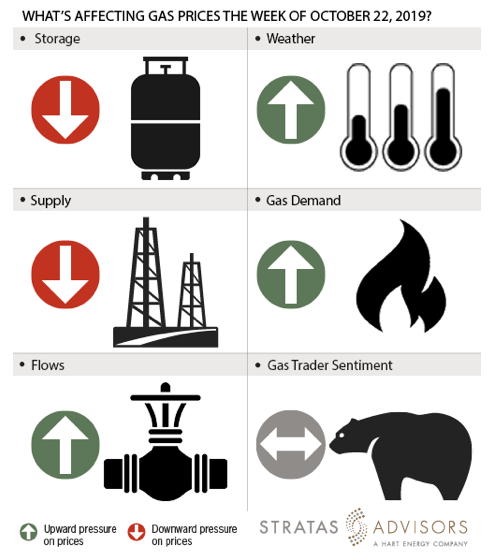

Storage: Negative

We estimate a storage injection of 86 Bcf will be reported for the week ended Oct. 18. If our forecast holds, our expectation will nearly be 18% higher than the five-year average value of 73 Bcf. Currently, the inventory levels are at 3,519 Bcf, 494 Bcf higher than a year ago levels and 14 Bcf higher than five-year average values. This marks the first time that working gas inventories have exceeded the previous five-year average since Sept. 22, 2017. In all, we see the above average storage injections as a negative driver for this week’s natural gas market.

Weather: Positive

The latest NOAA weather forecasts are predicting below-normal temperatures, particularly over parts of the Northern Great Basin, Rockies and Plains, while above-normal temperatures for the Southeast and Mid-Atlantic are being projected. Upslope flow associated with some cyclogenesis expected in the lee of the Rockies increases chances of above-normal precipitation for parts of the Northern and Central Plains. The cold front predicted in the central U.S. may bring relatively large amounts of rain into the eastern U.S., favoring above-normal precipitation there. Overall, we expect the weather to have a positive effect on gas prices this week.

Supply: Negative

Average field supply ascended by 0.74 Bcf/d or 5.18 Bcf to average at 94.19 Bcf/d for the report week. Accordingly, an increase in supply should likely exert negative pressure to this week’s price activity.

Demand: Positive

Residential and commercial sector demand soared by nearly 30% or 4.03 Bcf/d to average 16.19 Bcf/d for the report week. Industrial demand marginally moved up by 0.59 Bcf/d for a weekly average value of 22.15 Bcf/d. We expect structural demand side drivers for the report week to have a positive effect on prices.

Flows: Positive

After stalling at 6.15 Bcf/d the previous report week, flows to LNG terminals rose by 0.5 Bcf/d or 3.5 Bcf 6.15 Bcf/d for an average of 6.65 Bcf/d this report week. We see the increase of flows to LNG terminals as a positive effect on gas prices this week.

Trader Sentiment: Neutral

The CFTC’s Oct. 18 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on Oct. 15 were 187,152 net short while reportable commercial operator positions came in with a 154,604 net long position. Total open interest was reported for this week at 1,286,937 and was up 29,255 lots from last week's reported 1,257,682 level. Sequentially, commercial operators this reporting week were adding to longs by 22,382 while cutting shorts by 1,888. Financial speculators added shorts and added longs for the week (29,923 vs 5,674, respectively). Due to no strong indicator, we see trader sentiment neutral this week.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers.

Novo II Reloads, Aims for Delaware Deals After $1.5B Exit Last Year

2024-04-24 - After Novo I sold its Delaware Basin position for $1.5 billion last year, Novo Oil & Gas II is reloading with EnCap backing and aiming for more Delaware deals.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.