Key Points

We think cold temperatures have interfered with normal operations to depress dry gas production marginally by 0.56 billion cubic feet per day (Bcf/d) or approximately 4 Bcf over the report week. Canadian imports rose by 0.13 Bcf/d at 5% week-on-week to partly offset the decline in production. Exports to Mexico dropped slightly by 0.05 Bcf/d. Cold weather pushed up demand sharply by 6.55 Bcf/d or 46 Bcf over the report week.

Our analysis leads us to expect that a 49 Bcf injection will be reported by the U.S. Energy Information Administration (EIA) on Nov. 7. This is less than the 51 Bcf five-year average build as well as a 52 Bcf consensus whisper expectation.

Key Hub Price Call

Henry Hub prices reached $2.70/MMBtu over the report week, an 18% increase week over week. We are surprised that the weather affected gas prices in such a pronounced way despite strong supply. In our opinion, Henry Hub should stay near the $2.50-$2.80 range in the short term, although cold blasts may drive market participants to push prices to breach the $3 mark.

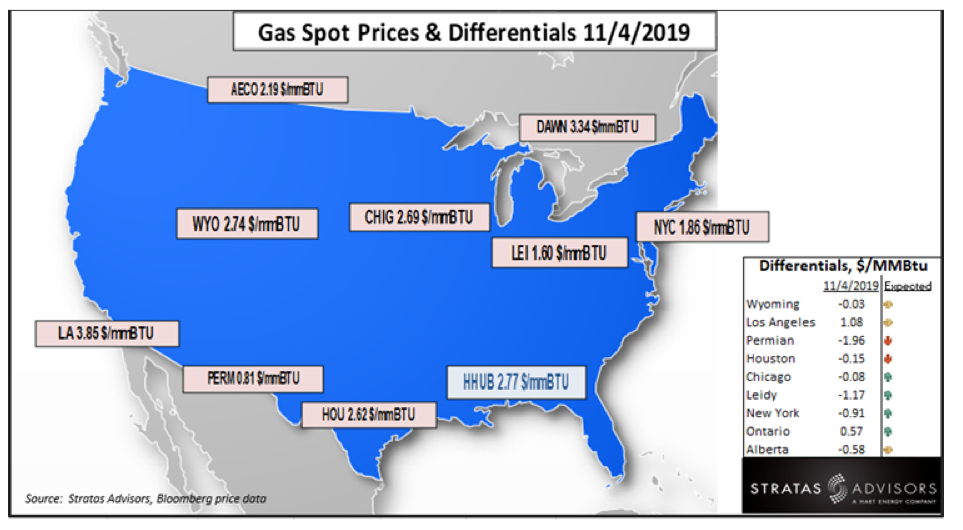

Gas Price Differentials

Cold weather is boosting regional gas prices and the Henry Hub price. For the current week, we anticipate that the differentials in the frigid Northeast (the New York Hub, Leidy and Chicago City Gate price points) will go up based on increasingly severe weather patterns this week. We forecast all other differentials to revert to more normal patterns yet remain volatile in the short term.

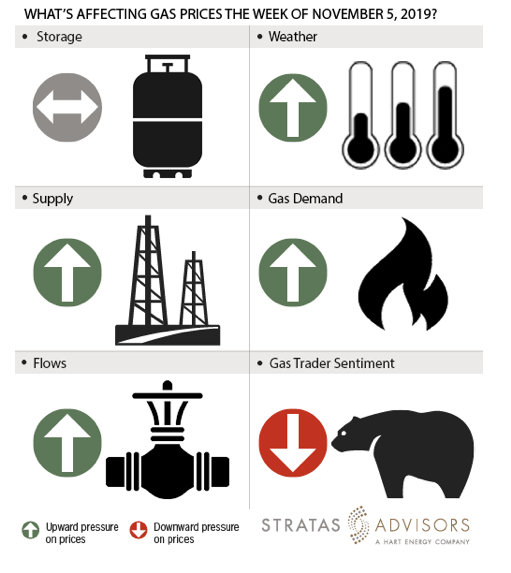

Storage: Neutral

We estimate a storage injection of 49 Bcf will be reported by the EIA for the week ended Nov 1. The build is bound to be less than the five-year average injection because of the strong demand across the United States, besides the East, during the report week. This could be the last storage build before entering the winter season as well. EIA reported an 89 Bcf build for the prior week resulting in 3,695 Bcf of stocks, which is 1.4% higher than the five-year average for the same week. We see a subnormal injection this week due to tight production and cold weather demand. That theoretically could drive an upward price reaction in the marketplace. However, working gas storage levels are already above normal in storage. So the addition of a smaller than normal injection on top of an above-normal stockpile may ultimately be seen as a net neutral.

Weather: Positive

We see weather as a strong positive factor for this week’s price activity. The NOAA six- to 10-day forecasts show that the northern U.S. will see snow showers and chilly lows of 30s this week. The west, south and southwest are to remain mostly mild to warm and maintain normal temperatures. Therefore, we expect demand to be moderately high, especially in the North.

Supply: Positive

Production levels have remained very strong at 94.13 Bcf/d over the report week. We noticed a slight dip in the levels by 0.56 Bcf/d or 4 Bcf. The supply reduction is likely because of freezes amid subnormal temperatures in producing regions. However, there have been no reported freezes for the report week. All together, we see supply as exerting positive pressure to prices this week.

Demand: Positive

The demand for natural gas in power generation shows a downward trend, while the industrial sector shows an upward trend for the report week. However, the biggest delta week over week was seen in demand from the residential and commercial sector. We recorded a gain of a whopping 6.54 Bcf/d from previous week. Accordingly, demand is a strong positive factor for gas prices.

Flows: Positive

Flows to LNG terminals rose by an average of 0.55 Bcf/d over the report week. The increase of LNG flows would be a positive effect of gas prices.

Trader Sentiment: Negative

The CFTC’s Nov. 1 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on Nov. 29 were 185,793 net short while reportable commercial operator positions came in with a 155,052 net long position. Total open interest was reported for this week at 1,240,043 and was down 37,254 lots from last week's reported 1,277,297 level. Sequentially, commercial operators this reporting week were cutting longs by 18,825 while adding to shorts by 2,248. Financial speculators cut shorts and cut longs for the week (-27,159 vs -1,103, respectively). We see trader sentiment as negative driver for this week’s gas prices.

Recommended Reading

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Civitas, Prioritizing Permian, Jettisons Non-core Colorado Assets

2024-02-27 - After plowing nearly $7 billion into Permian Basin M&A last year, Civitas Resources is selling off non-core acreage from its legacy position in Colorado as part of a $300 million divestiture goal.

Sitio Royalties Dives Deeper in D-J with $150MM Acquisition

2024-02-29 - Sitio Royalties is deepening its roots in the D-J Basin with a $150 million acquisition—citing regulatory certainty over future development activity in Colorado.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.