Key Points

Our view of Bloomberg scrapes shows field production increasing marginally by 0.44 billion cubic feet per day (Bcf/d) or 3.05 Bcf over the report week ended Nov 22. Demand decreased in all major categories by 10.91 Bcf/d or 76 Bcf. Canadian imports fell by 0.80 Bcf/d, while Mexico exports fell by 0.15 Bcf/d.

Our analysis leads us to expect a 23 Bcf withdrawal level for this coming report week. Our expectation is 4 Bcf less than the current consensus of 27 Bcf and much lower than the 50 Bcf five-year average storage withdrawal.

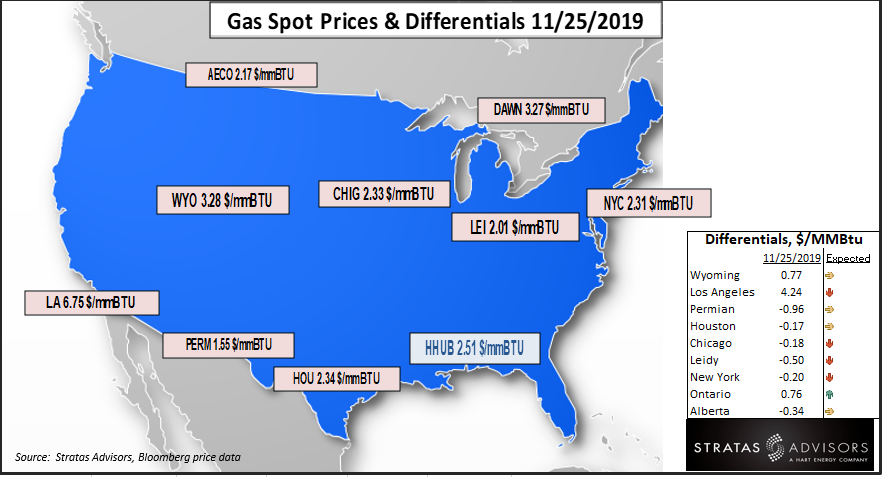

Key Hub Price Call

Henry Hub prices are falling toward the $2.50 range on forecasts of a mild winter ahead. This is in line with our expectation based on National Oceanic and Atmospheric Administration (NOAA) forecasts. The upcoming Thanksgiving weekend is bound to reduce the industrial and commercial demand thereby keeping Henry Hub prices at or below $2.50/MMBtu.

Gas Price Differentials

We expect the Eastern differentials (Leidy, New York Hub, Chicago Citygate) to trend downward based on weather patterns. The western and central regions are expected to maintain their prices with respect to Henry Hub.

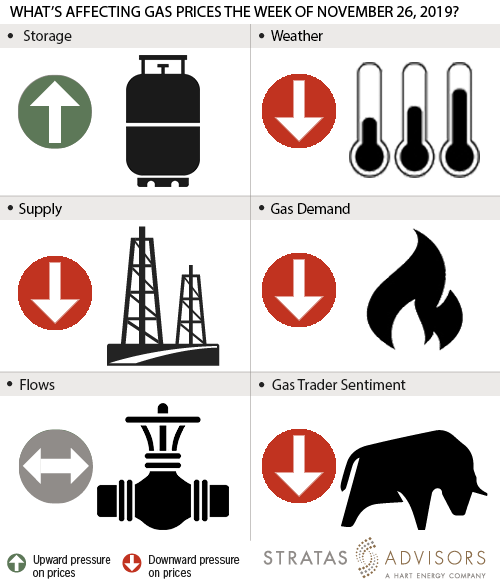

Storage: Positive

We estimate a storage withdrawal of 23 Bcf will be reported by the Energy Information Administration for the week ended Nov. 22. That’s far below the five-year average 50 Bcf draw. The cold front of the prior week gave way to warmer than normal temperatures for this report week, resulting in much less demand. All in, we see the storage changes as a positive driver for gas prices this week.

Weather: Negative

NOAA’s forecasts for the next eight to 14 days point toward mild to moderate weather throughout the Lower 48. Temperatures will be in the 40s and 50s from the Great Lakes to the Northeast and in the 60s and 70s from Texas to Mid-Atlantic Coast. Overall, we expect light demand throughout the week. Accordingly, weather is a negative effect on gas price activity.

Supply: Negative

Average field supply is showing a week-on-week increase of more than 0.44 Bcf/d or 3 Bcf. However, falling seasonal Canadian imports reduced 0.80 Bcf/d, or 5.62 Bcf, of supply into the market. Overall, we see supply as being a weak negative this week.

Demand: Negative

Demand fell in all major categories with a more than 7.90 Bcf/d drop in residential and commercial demand. Power generation and industrial sector demand also declined by 1.94 Bcf/d and 1.07 Bcf/d, respectively. We expect the demand to stay at or around these levels for rest of the week. Demand is a negative effect on this week’s prices.

Flows: Neutral

We see flows as a neutral driver this week. There were no freeze-offs and no new upset conditions for the week ended Nov 22.

Trader Sentiment: Negative

Warming weather trends in the short term are keeping market prices low. We see trader sentiment as negative this week. The CFTC's Nov. 22 commitment of traders’ report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on Nov. 19 were 141,589 net short while reportable commercial operator positions came in with a 105,234 net long position.

Total open interest was reported for this week at 1,218,197 and was up 24,149 lots from last week's reported 1,194,048 level. Sequentially, commercial operators this reporting week were adding to longs by 4,209 while cutting shorts by 13,466. Financial speculators added shorts and added longs for the week (23,615 vs 3,029, respectively).

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.