Key Points: Strong natural gas production continued for the report week with a weekly average of 85.28 Bcf/d. Storage is having less of an impact on Henry Hub gas prices during May and June compared to winter months. The high production is helping with the improving storage deficit created over 2018-2019 winter and has helped stabilize prices around the $2.60/MMBtu range.

Our analysis leads us to expect 103 Bcf storage build will be reported by the U.S. Energy Information Administration (EIA) for the report week, in comparison to the current 105 Bcf consensus whisper expectation and almost 15% higher than the five-year average of 87 Bcf.

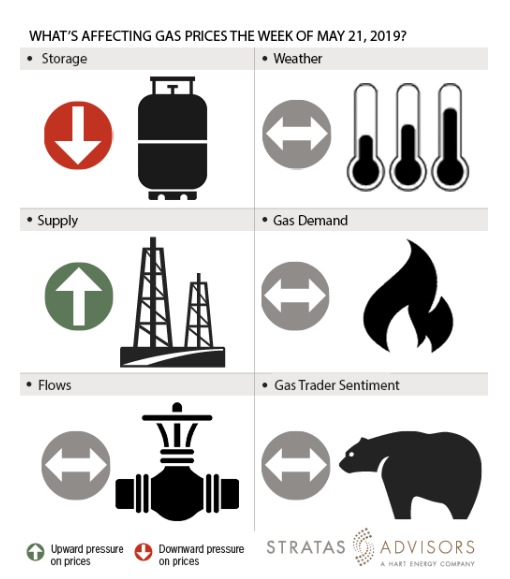

Storage: Negative

The reported EIA storage build for prior week ending in May 10 is 106 Bcf. The final inventory level after last week’s injection is 1,653 Bcf, 130 Bcf above year ago inventories and 286 Bcf below five-year average values. The East region is only 4% below five-year average while Midwest region is 14% below corresponding five-year average. We expect the inventory levels to fill up to average levels over the summer months. For the report week of May 17, we expect to see a 103 Bcf storage build. Accordingly, we see storage as a negative driver this week.

Weather: Neutral

The latest six- to 10-day temperature forecast from NOAA shows that average temperatures will continue through eastern parts of U.S. through May 26. The West Coast and the Rockies could see below-normal weather conditions. In the presence of mixed weather data, we see weather as having a neutral impact on gas prices.

Supply: Positive

Average field supply remained robust for the report week maintaining greater than 85 Bcf/d levels. However, for the current week the reported values from Bloomberg indicate a hefty drop of 2.0 Bcf/d on average for the first three days compared to the same period of last week. This drop is attributed to shoulder season maintenance events and we do not anticipate this temporary supply reduction to continue into the future. Accordingly, supply will offer little but positive pressure to this week’s price activity.

Demand: Neutral

Week-on-week, demand from major structural drivers remained the same. Three-day average for current week for residential/commercial is approximately 4.0 Bcf/d lower than the three-day average for the same period last week. All in, we see demand offering a neutral pressure on this week’s price activity.

Flows: Neutral

We have seen reports of maintenance that could affect ~200 MMcf/d of natural gas flows through the California-Arizona border. However, this is not expected to impact prices at Henry Hub. Accordingly, flows will be a neutral driver for gas prices this week.

Trader Sentiment: Neutral

As the deficit vs. five-year average values narrow with the strong injection levels and in the midst of mixed weather forecasts, we see trader sentiment as neutral. The CFTC’s May 17 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on May 14 were 74,034 net short while reportable commercial operator positions came in with a 45,623 net long position. Total open interest was reported for this week at 1,332,839 and was up 46,928 lots from last week’s reported 1,285,911 level.

Recommended Reading

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.