Key Points: With last week’s cold weather interfering with normal operations, field production dropped by a good margin of 8.5 billion cubic feet (Bcf) week on week to average 83.88 Bcf per day (Bcf/d) for the report week ended March 8. Canadian imports rose by 0.64 Bcf/d partly offsetting the decline in production. The same cold weather pushed up net demand sharply by 8.63 Bcf/d week over week. Imports by Mexico stayed rather flat at just above 5 Bcf/d.

Our analysis leads us to expect a 215 Bcf withdrawal will be reported by EIA on March 14, almost double the 118 Bcf five-year average withdrawal and higher than the current 210 Bcf consensus whisper expectation.

Late-season cold is resulting in above-normal withdrawals in March. Despite larger-than-expected withdrawals and strong demand, Henry Hub spot prices have settled comfortably below $3/MMBtu. Our expectation of end-of-winter storage remains at 1,100 Bcf. Unless winter lasts beyond March and supra-normal withdrawals continue for the remaining few weeks of the classically defined winter season (ending March 31), we believe that the 2018-2019 winter heating season in the U.S. will end with gas working storage levels above 1 Tcf.

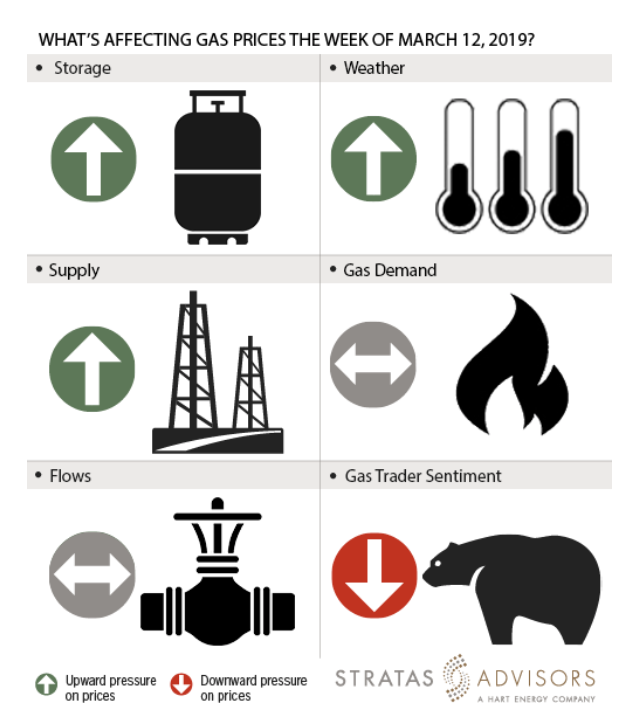

Storage: Positive

Storage: Positive

We estimate a storage withdrawal of 215 Bcf will be reported by EIA this week for the week ended March 8. EIA reported a 149 Bcf withdrawal for the prior week resulting in 1,390 Bcf left in stocks, which is 25% lower than the five-year average for the same week. All in, we see storage changes as a positive driver for gas prices this week.

Weather: Positive

The NOAA eight-to-14-day short term temperature forecasts predict colder than average weather for much of Lower 48. Only the West Coast has warmer than normal seasonal temperatures over the period. The more important consuming/producing regions of Texas and Gulf Coast are forecasted to have lower than normal temperature conditions. We see weather as being a positive driver this week.

Supply: Positive

Field supply has dropped by 1.21 Bcf/d week-on-week. The supply reduction is likely because of freeze-offs amid subnormal temperatures in producing regions. However, there have been no reported freeze-offs for the report week. All together, we see supply as exerting positive pressure to prices this week.

Demand: Neutral

We see a neutral effect from demand-side drivers this week. The demand for natural gas in power generation and industrial sector showed an upward trend for the current week. The biggest rise in demand has been from the residential and commercial sector that equals 45 Bcf from previous week. But week-to-date averages in the major demand sectors we track are showing a drop from the previous week’s averages. So demand is expected to drop into the coming week which underpins our neutral view when combined with a decent growth in demand for last week.

Flows: Neutral

An avalanche along Interstate 70 has ruptured a natural gas line close to Denver. The effect of the rupture is expected to be contained within a small area. Therefore, we expect flows to be a neutral driver this week. Given what we believe are extreme bottlenecks in the Permian Basin, home to the Waha hub, the prices there in the most recent period crashed to below $1.00/MMBtu as a result of poor outflow capacity. This is not necessarily a new condition. Rather it is one which we anticipate will last for months until new pipeline capacity out of the Permian due in the third and fourth quarters can enable more flow to more markets.

Trader Sentiment: Negative

The market is looking bearish for natural gas prices. We expect Henry Hub prices to drop below the current $2.87/MMBtu level. The CFTC’s March 8 commitment of traders report for New York Mercantile Exchange natural gas futures and options showed that reportable financial positions (Managed Money and Other) on March 5 were 47,449 net short while reportable commercial operator positions came in with a 11,161 net long position. This week we see trader sentiment as negative.

Recommended Reading

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

BP Pursues ‘25-by-‘25’ Target to Amp Up LNG Production

2024-02-15 - BP wants to boost its LNG portfolio to 25 mtpa by 2025 under a plan dubbed “25-by-25,” upping its portfolio by 9% compared to 2023, CEO Murray Auchincloss said during the company’s webcast with analysts.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Aramco Reports Second Highest Net Income for 2023

2024-03-15 - The year-on-year decline was due to lower crude oil prices and volumes sold and lower refining and chemicals margins.