Key Points: Dry gas production remains robust at an average of 85.86 billion cubic feet per day (Bcf/d), with a 0.18 Bcf/d or 1.24 Bcf week-on-week increase. Demand from the power generation sector increased by 2.34 Bcf/d in the report week. Demand from other major sectors appears to have held at the same levels as prior week.

Dry gas imports from Canada have dropped by 0.75 Bcf/d or 5.24 Bcf. We attribute this to unscheduled maintenance on the 1.6 Bcf/d Alliance Pipeline that transports natural gas from the Saskatchewan region in Canada into the Chicago market. Our analysis leads us to expect a 99 Bcf storage build for the report week of June 21. Our expectation is slightly below the current 105 Bcf consensus whisper expectation, and 30% higher than the five-year average of 72 Bcf.

Natural gas prices are at three-year lows at around $2.31 per million British thermal units (MMBtu). At the same time last year, the natural gas price was $3. The downward trend would have been tough to foresee at its peak of nearly $5 late last year. Strong production levels, higher-than-five-year average storage builds and lack of pre-summer cooling demand are all contributing factors in 2019.

We are analyzing the trends and are estimating a 3.4 Tcf to 3.8 Tcf range for the storage build at the end of injection season that runs until Oct. 31. We are fine-tuning the numbers as the summer progresses and will post updates as and when the range tightens.

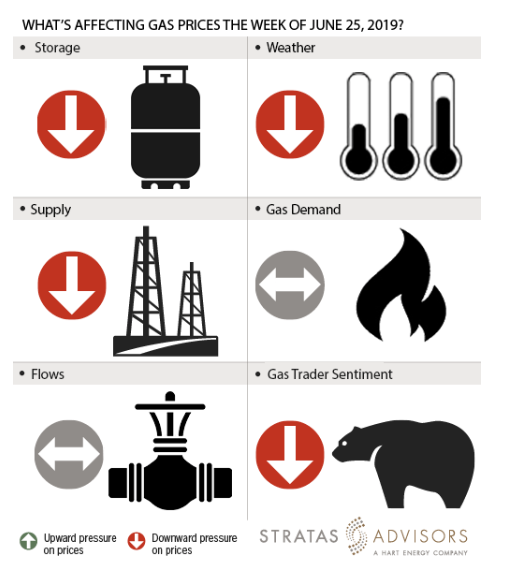

Storage: Negative

EIA reported a weekly injection of 115 Bcf in domestic stockpiles, 11 Bcf less than analyst estimates. The current stocks are at 2,203 Bcf and have surpassed year-ago levels by 209 Bcf and are only 199 Bcf short of five-year-average values. The gas stock rebuild in April and May 2019 has surpassed the record for this period set in 2015 for this period by 0.04 Tcf. Our storage build expectation this week of 99 Bcf is almost 30% more than the five-year average value of 72 Bcf. All in, storage dynamics offer a negative driver for the gas prices this week.

Weather: Negative

For the report week of June 17-21, there was no widespread heat through much of the Lower 48, which affected natural gas prices negatively. We do not expect the situation to improve much. NOAA weather forecasts through end of June are still projecting moderate demand. California, parts of Texas, the South, Southeast and Mid-Atlantic Coast will remain in the 80s to 90s range for temperature. Several weather systems forming across the country are producing showers and thunderstorms that will bring down the heat, especially in the Northwest and Rockies. Accordingly, we expect weather to be negative driver for this week’s price activity.

Supply: Negative

Like the past several weeks, production has remained above 85 Bcf/d. It even increased by 0.18 Bcf/d week-on-week or 1.24 Bcf. From here, we see a relatively flat production profile for the rest of the injection season. At these low prices and poor takeaway capacity in Permian and Appalachia, producers have little incentive to increase dry gas production but associated gas will likely continue to grow. That said, we believe supply would continue to offer a mild negative pressure for gas prices.

Demand: Neutral

We see a neutral effect from structural demand-side drivers for the report week. Gas-fired power generation has risen steadily and averages 33.52 Bcf/d or 16 Bcf for the report week. From the residential and commercial sector, demand has dropped to around 8 Bcf/d for the report week compared to the highs of 50 Bcf/d seen during peak of winter. Unless temperatures rise across the country and that too in heavily populated areas, we do not see demand helping prices to recover.

Flows: Neutral

The Alliance Pipeline is undergoing an unscheduled maintenance event that shut down operations completely from Tuesday to Friday of the report week. Canadian imports have been affected by the maintenance and imports dropped to zero this week. We didn’t see any impact on Chicago City Gate prices because of the shutdown. It has certainly not affected Henry Hub prices. So, we consider flows as a neutral driver for gas prices.

Trader Sentiment: Negative

Natural gas futures have fallen to multi-year lows and mirror the spot price trend. We believe the natural gas market will be bearish until the summer demand picks up. The CFTC’s June 21 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on June 18 were 145,956 net short while reportable commercial operator positions came in with a 107,506 net long position. Total open interest was reported for this week at 1,365,544 and was up 12,503 lots from last week’s reported 1,353,041 level.

Recommended Reading

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.