Key Points: Average dry gas production dropped by 0.73 billion cubic feet per day (Bcf/d) or 5 Bcf during the report week of Jun 7. Over the last month, demand from power generation rose 7.0 Bcf/d (~20%) while demand from residential and commercial users dropped by around 5 Bcf/d. Demand from other sectors has remained stable. Dry gas imports from Canada has increased by 0.39 Bcf/d or 2.7 Bcf while exports to Mexico have also risen slightly by 0.09 Bcf/d or 0.6 Bcf.

Our analysis leads us to expect a 109 Bcf storage build for the report week. Our expectation compares to the current 114 Bcf consensus whisper expectation and is almost 20% more than the five-year average of 92 Bcf.

Henry Hub prices have sunk slightly into the $2.40/MMBtu range and we believe the uncertainty surrounding tariffs could be one of the causes for the downward movement. Other reasons are bearish weather forecasts leading to weak demand until the heat intensifies. The strong injection levels for the past couple of weeks are also a contributing factor. All in, we don’t see any marked improvement in the prices until mid-June.

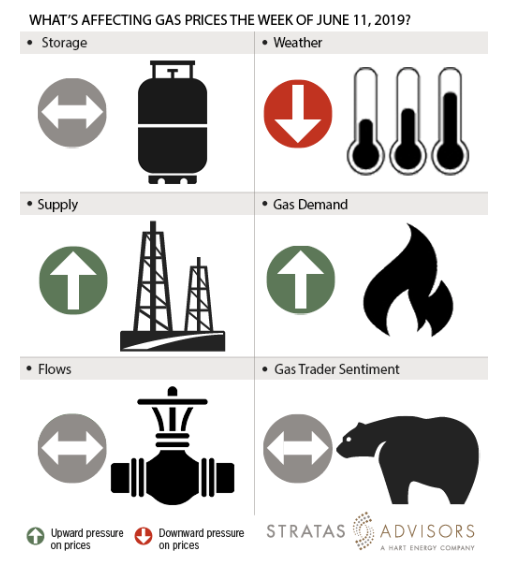

Storage: Neutral

EIA revealed a weekly injection of 119 Bcf in domestic stockpiles, much more than expected. The reporting period included the Memorial Day holiday that could have helped with the high injection. This was 10 Bcf above consensus estimates. The current stocks at 1,986 Bcf have surpassed year ago levels by 182 Bcf and are only 240 Bcf short of five year average. Our 109 Bcf storage prediction this week is 20% more than five-year average and 10 Bcf less than the last week’s actual storage build. Accordingly, storage offers neutral pressure to this week’s price activity.

Weather: Negative

For the week of June 10 to June 16, a cool front is sweeping the northern and central US with highs of 60s to 70s. This weather system will also reduce temperatures in Texas, South and Southeast into the comfortable 80s. Overall, demand will be low. Only a warmer than normal outlook would help to push prices higher. For this reason, we believe weather will be a negative driver for gas prices this week.

Supply: Positive

Average field production fell marginally by 0.73 Bcf/d or 5 Bcf over the report week. Despite the lower supply, Henry Hub prices didn’t recover from last week levels. Spot intraday prices of Henry Hub closed last week at $2.54/MMBtu while as of June 11, prices were at $2.43/MMBtu. We see supply dynamics exerting mild positive pressure for gas prices this week.

Demand: Positive

Within the structural demand side drivers this week, we see generally a positive effect. Power generation showed a 2.3 Bcf/d or 16 Bcf increase week-on-week. This amounts to an increase of 7 Bcf/d from 25.30 Bcf/d a month ago to 32.42 Bcf/d for the report week. Demand from industrial plants has remained around 20 Bcf/d during four weeks. The FERC energy infrastructure reports show that the total additions for power plants so far in 2019 has only reached 13% of the total recorded in 2018. We expect material additional capacity to startup through the rest of the year.

Flows: Neutral

There were no reported upset conditions during the report week. We see flows as being a neutral driver for gas prices.

Trader Sentiment: Neutral

The bearish injection resulted in the July Nymex futures contract falling to three-year lows last week. The numbers have rebounded slightly by 1.2 cents to end at $2.35 as of June 11. Traders are depending on new weather forecasts to make any corrections to pricing. Trader sentiment appears to be neutral after the extraordinary collapse in gas prices year to date. The CFTC’s June 7 commitment of traders report for NYMEX light, sweet crude oil futures and options showed that reportable financial positions (Managed Money and Other) on June 4 were 463,841 net long while reportable commercial operator positions came in with a 481,480 net short position. Total open interest was reported for this week at 2,812,517 and was up 60,232 lots from last week’s reported 2,752,285 level.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.