Key Points: Average dry gas production was on the increase week-over-week by 0.45 billion cubic feet (Bcf/d) or 3.12 Bcf for the report week ending July 5. Demand from power generation reached a high of 40.56 Bcf/d during the report week. The average demand from power generation was 38.29 Bcf/d, an increase of 2.73 Bcf/d or 19.12 Bcf. LNG net exports from U.S. also posted a year-to-date high of 6.31 Bcf/d indicating that export terminals that were under construction are shipping high send-out levels. We expect the levels to reach 9-10 Bcf by the end of 2019.

Our analysis leads us to expect a 73 Bcf injection level for the report week. Our expectation is 3 Bcf more than the current consensus of 70 Bcf and 4 Bcf less than the 77 Bcf five-year average storage build.

Delayed LNG deliveries, light industrial demand and low weather-related demand has allowed inventory levels to rise quicker than expected. We are comfortably above year-ago levels. In addition, there is huge opportunity for growth if weather-related demand does not come in during the summer. We see Henry Hub prices reaching $2.50/MMBtu levels in the near term.

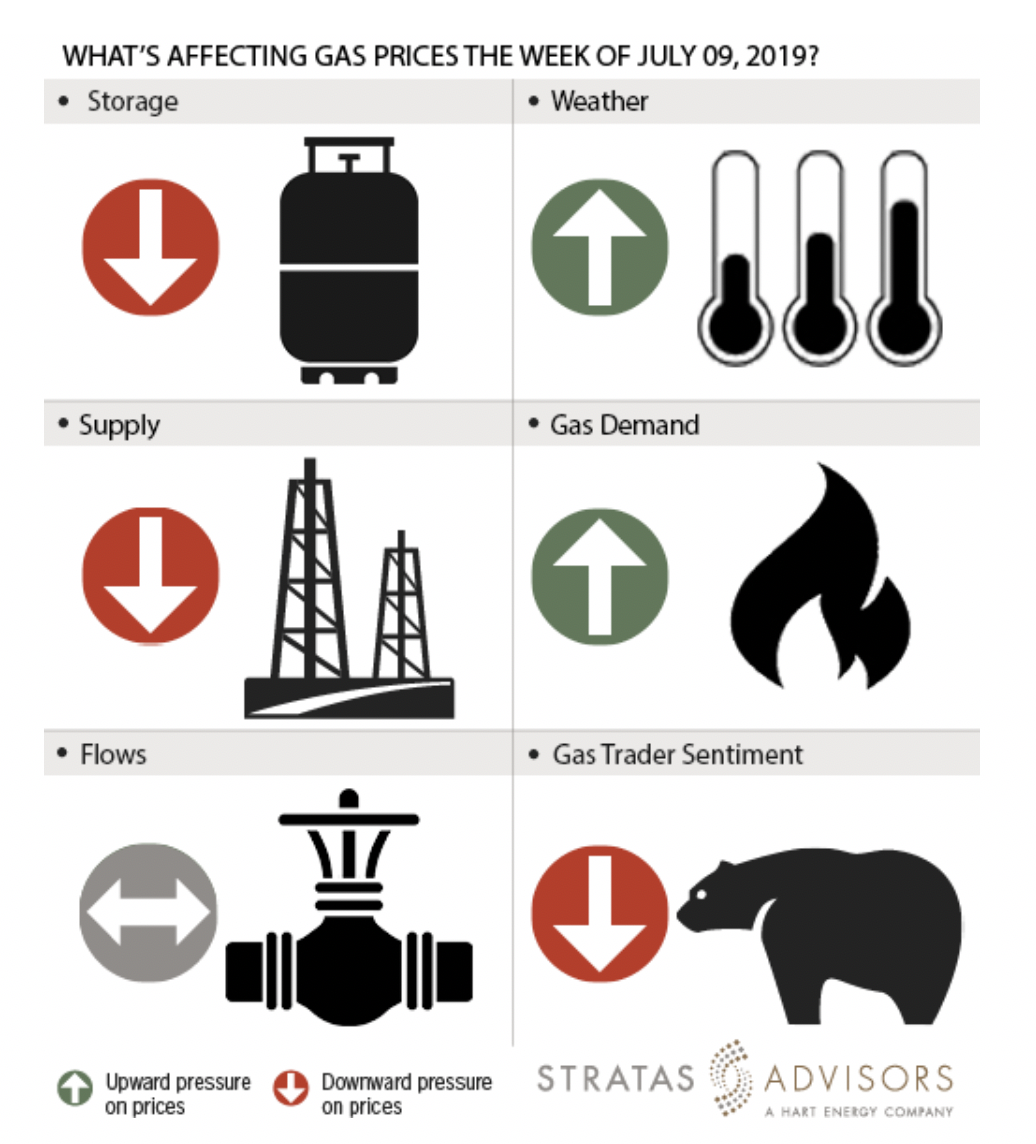

Storage: Negative

We estimate a storage build of 73 Bcf will be reported by EIA this week for the week ended July 5. Inventory levels are still 152 Bcf below the five-year average and 249 Bcf higher than last year. Stocks have replenished compared to last year. EIA reported an 89 Bcf withdrawal for the prior week. We had predicted the same value in our report last week. All in, we see storage changes as a negative driver for gas prices this week.

Weather: Positive

The NOAA eight-to-14-day short-term temperature forecast predicts colder-than-average weather for the northern U.S. The southern U.S. from Texas to Southeast has warmer-than-normal seasonal temperatures over the period. Demand would range from moderate to high depending on the region. As the weather outlook improves, it would support natural gas prices. We see weather as a positive driver this week.

Supply: Negative

Field supply has dropped by 0.45 Bcf/d week-on-week. Supply has remained strong all through the summer and is projected to reach 90 Bcf/d before the end of the year. Alltogether, we see supply as exerting negative pressure to prices this week.

Demand: Positive

Demand from power generation continues to increase as has happened in July in previous years. Average demand from power generation has risen by 2.73 Bcf/d over the report week. Demand from the industrial sector has stayed at approximately 20 Bcf/d. All in, we see a positive effect from demand side drivers for this week’s gas prices.

Flows: Neutral

Flows can be considered as neutral this week as there were no new upset conditions.

Trader Sentiment: Negative

Markets were prepared for the hotter July than the prevailing temperatures; as a result, Henry Hub prices are staying below $2.30/MMBtu levels. We see trader sentiment as being negative for gas price activity. The CFTC’s July 5 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on July 2 were 163,401 net short while reportable commercial operator positions came in with a 131,852 net long position. Total open interest was reported for this week at 1,323,436 and was up 15,517 lots from last week’s reported 1,307,919 level.

Recommended Reading

Energy Transition in Motion (Week of Feb. 2, 2024)

2024-02-02 - Here is a look at some of this week’s renewable energy news, including a utility’s plans to add 3.6 gigawatts of new solar and wind facilities by 2030.

NextEra Energy Dials Up Solar as Power Demand Grows

2024-04-23 - NextEra’s renewable energy arm added about 2,765 megawatts to its backlog in first-quarter 2024, marking its second-best quarter for renewables — and the best for solar and storage origination.

CERAWeek: NextEra CEO: Growing Power Demand Opportunity for Renewables

2024-03-19 - Natural gas still has a role to play, according to NextEra Energy CEO John Ketchum.

RWE Boosts US Battery Storage with Three Projects

2024-02-14 - The three projects—two in Texas and one in Arizona—will lift RWE’s total U.S. battery storage capacity to about 512 megawatts.

Could Concentrated Solar Power Be an Energy Storage Gamechanger?

2024-03-27 - Vast Energy CEO Craig Wood shares insight on concentrated solar power and its role in energy storage and green fuels.