Key Points: Average dry gas production increased week-over-week and reached about 90 billion cubic feet per day (Bcf/d) for the report week ending July 26. Demand from power generation dropped from the year-to-date highs set earlier in the month of July. The average demand for power generation was 38.78 Bcf/d, a decrease of 3.13 Bcf/d or 22 Bcf. LNG net exports from the U.S. were 6 Bcf/d during the report week. Imports from Canada dropped by 0.23 Bcf/d or 1.58 Bcf/d, while exports to Mexico stayed flat.

Our analysis leads us to expect a 60 Bcf injection level for the report week. Our expectation is 1 Bcf more than the current consensus of 59 Bcf, and 18 Bcf more than the 42 Bcf five-year average storage build.

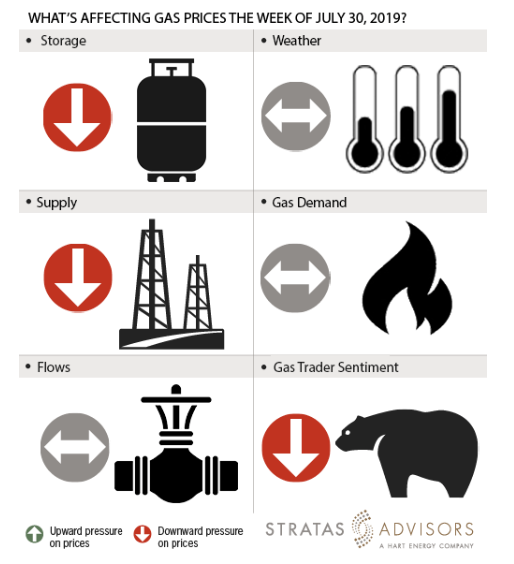

Storage: Negative

We estimate a storage build of 60 Bcf will be reported by the EIA for the week ended July 26. Last week, EIA reported a 36 Bcf withdrawal for the prior week. This was smaller than the five-year average storage build for the second week in a row. The build increased inventory levels to 2,569 Bcf and increased deficits to 151 Bcf compared to the five-year average. This week we expect the build to be higher than the five-year average. All in, we see storage changes as a negative driver for gas prices this week.

Weather: Neutral

Demand will be moderate for the next eight to 10 days, according to forecasts by National Oceanic and Atmospheric Administration. We are expecting weather systems to bring showers and cooling to the Midwest and East. Southwest and Texas temperatures are expected to hit 100 degrees. The peak of the summer is almost over but the temperatures are not falling yet. This might have an effect on demand, but since supply levels are so strong this year we think the effect of weather will be a neutral driver for gas prices this week.

Supply: Negative

Field supply increased to almost 90 Bcf/d during the report week. We had expected the level to reach 90 Bcf/d, however, the increase has occurred sooner than expected. Supply has remained strong all through the summer except for a temporary dip during storm Barry. All together, we see supply as exerting negative pressure to prices this week.

Demand: Neutral

Gas demand for power, which averaged 39 Bcf/d, accounts for more than half of the total natural gas demand in the United States. Demand from industrial plants has stayed flat at about 20 Bcf/d. We think demand would be a neutral driving factor for gas prices.

Flows: Neutral

Flows can be considered neutral this week as there were no new upset conditions.

Trader Sentiment: Negative

Henry Hub prices plunged to the $2.20 range during the report week and stayed there in the current week as well. Natural gas futures for August dropped during trading on the morning of July 29. It appears as though the markets are not finding any incentive to raise prices. We see trader sentiment as being negative for the gas price activity. The CFTC’s July 26 traders’ report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on July 23 were 196,431 net short while reportable commercial operator positions came in with a 165,039 net long position. Total open interest was reported for this week at 1,330,819, and was down 3,013 lots from last week’s reported 1,333,832 level.

Recommended Reading

Defeating the ‘Four Horseman’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production — and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.