Key Points: Dry gas production dropped below 85 billion cubic feet per day (Bcf/d) for the first time during the injection season. There was a reduction of 1.21 Bcf/d or 8.5 Bcf over the report week ending July 19. We think this is a temporary drop because of tropical storm Barry, and we expect supply levels to go back to the 85-87 Bcf/d range next week. Gas demand for power generation as well as LNG exports rose by 1.22 Bcf/d and 0.15 Bcf/d, respectively, week-on-week. Imports from Canada dropped by 0.22 Bcf/d or 1.56 Bcf/d while exports to Mexico stayed flat.

Our analysis leads us to expect a 40 Bcf injection level for the report week. Our expectation is same as the current consensus of 40 Bcf and 5 Bcf less than the 45 Bcf five-year average storage build.

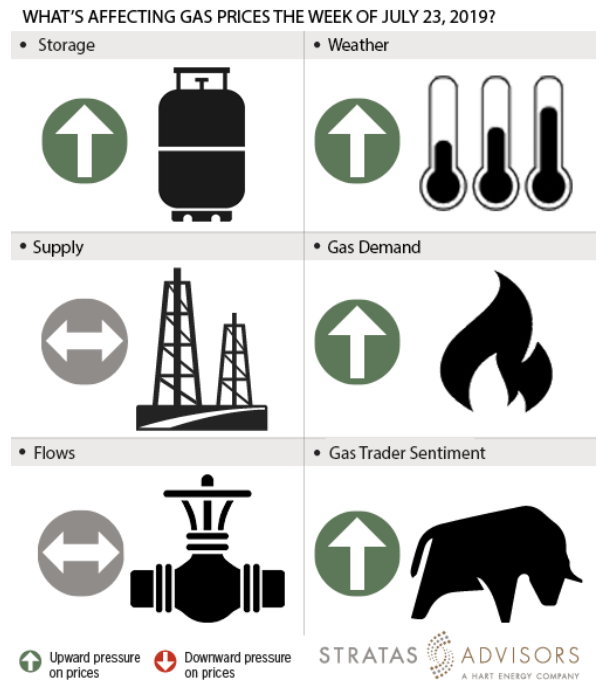

Storage: Positive

Storage: Positive

The U.S. Energy Information Administration’s (EIA) weekly natural gas storage reported a build of 62 Bcf. We had predicted a 68 Bcf storage build that was 5 Bcf less than the consensus of 73 Bcf. We were right directionally; however, the actual build came in lower than our expectations. It was also less than the five-year average injection level (65 Bcf) for the first time in more than 18 weeks. For this week, we expect a 40 Bcf build. Given that the five-year average build is 45 Bcf, it is likely the actual build comes in a little less than that level. Accordingly, we see storage changes as a positive driver for this week’s prices.

Weather: Positive

The NOAA’s latest six-to-10-day temperature forecast shows a warming trend across the United States from late July to early August. We expect national demand to go up over the next fortnight. Natural gas futures for August were trading 2.5 cents higher on the morning of July 22 based on weather forecasts. Accordingly, weather is a positive driver on price activity for the short term.

Supply: Neutral

Supply levels have dropped more than 1.2 Bcf/d week-on-week, possibly due to Gulf Coast shut-ins during Barry. We expect the levels to revert to pre-Barry levels for the current week. The production levels for the first three days of the current week are almost 0.8 Bcf/d higher when compared to the same period of the report week. All in, supply is a neutral factor.

Demand: Positive

Gas demand for power, which averaged 41 Bcf/d, accounts for almost half of total natural gas demand in the United States, as is the norm for the summer. Net increase across structural demand side drivers accounted for 1.32 Bcf/d or 9 Bcf week over week. Demand is definitely a positive driving factor for gas prices.

Flows: Neutral

There were no new upset conditions. We see flows as a neutral factor for this week’s price activity.

Trader Sentiment: Positive

Weather forecasts that indicate warmer August than normal have provided incentive for the markets to increase the futures prices. Henry Hub prices could go up to $2.50/MMBtu mark if the hotter weather prevails. We see trader sentiment as positive for short term unless weather forecasts change drastically over the next two weeks. The CFTC’s July 19 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on July 16 were 160,153 net short while reportable commercial operator positions came in with a 131,521 net long position. Total open interest was reported for this week at 1,333,832 and was up 19,697 lots from last week's reported 1,314,135 level.

Recommended Reading

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.