Key Points: Our view of Bloomberg scrapes shows field production increasing marginally by 0.35 billion cubic feet per day (Bcf/d) or 2.4 Bcf over the report week ended Feb. 22. Demand increased in all major categories by 3.58 Bcf/d or 25 Bcf. Canadian imports rose by 0.29 Bcf/d or 2 Bcf while Mexico exports grew slightly by 0.02 Bcf/d.

Synthesizing these analyses together, we expect the EIA to report later this week that there was a 185 Bcf withdrawal for the week ended Feb. 22 (a materially stronger pull than 106 Bcf five-year average withdrawal and above the 172 Bcf consensus whisper expectation).

Despite the above-average withdrawal of 177 Bcf of the prior week, we think the market could easily see average ending levels of gas in working storage at or before the end of March 2019. Our March 31 forecast for gas storage is 1,213 Bcf assuming normal withdrawals for the remaining five weeks of winter and any LNG export deliverability that could come online before the end of the first quarter. This level is still a bit lower than the 2018 winter exit rate of 1,281 Bcf. On forecasts of late-season cold, Henry Hub prices rose from two-month low.

We had written that the gas prices had stabilized for the past two weeks on the expectation that the peak winter demands are behind us. And despite the current cold weather that has settled in across much of the country, we do not expect any sudden price movements upward beyond $3/MMBtu until the end of March.

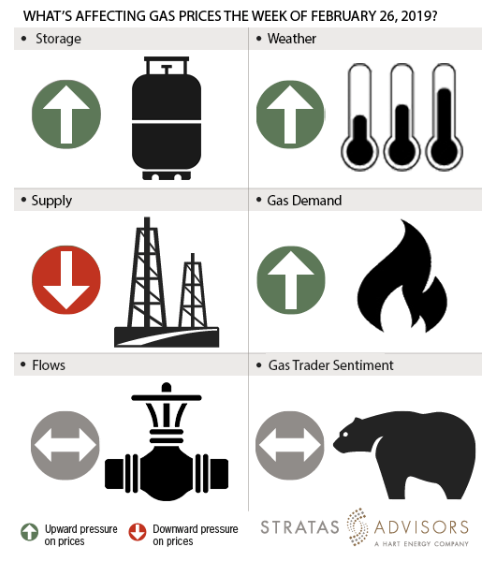

Supply: Negative

Supply: Negative

Average field supply remained robust this week. The weekly dry gas production rose by approximately 2.4 Bcf for the week ended Feb. 22. The average increased from 84.99 Bcf/d to 85.34 Bcf/d. There were no freez-eoffs at wellhead or delayed LNG deliveries. We see supply as being a negative driver for the gas prices this week.

Weather: Positive

The latest NOAA weather forecasts are predicting a sweeping cold front across Ohio Valley and Northeast early this week. It is expected to remain very cold across much of Midwest with lows of -10s to 20s. Based on these forecasts, we expect the national demand to increase. Spot natural gas prices have increased by 10c-15c at press time today compared to the time of our report last week. All in, weather appears to be a positive driver for gas prices this week.

Trader Sentiment: Neutral

Despite the U.S. Federal Government shutdown being over for at least the next few weeks, it is expected that the data reports by the Commodity Futures Trading Commission (CFTC) will show only lagging data for the next few weeks until March 8. We will resume our analytical coverage of CFTC data when the agency resumes reporting CFTC data that are contemporaneous with the other data in these weekly analyses. Trader sentiment appears to be neutral for this week’s price activity.

Storage: Positive

We estimate a storage withdrawal of 185 Bcf will be reported by the EIA this week for the week ended Feb. 22. In our prior forecast, we estimated a gas withdrawal of 155 Bcf for the week ended Feb. 15 that was at that time lower than the 165 Bcf consensus estimate. The actual reported withdrawal surprised us and the street and came in higher at 177 Bcf. EIA reported that stocks are at 1,705 Bcf level at the end of the report week. At the same time last year, the stocks were at 1,760 Bcf or 4% higher than current levels. Our 185 Bcf withdrawal expectation for this week is just a bit more severe than the last week’s reported figure. All in, we see storage changes as a positive driver for the gas prices this week.

Demand: Positive

We see a slightly positive effect from structural demand side drivers this week. The demand for natural gas in power generation and industrial sector is showing an upward trend for the report week when compared to prior week. The week-on-week the change was equal to 10 Bcf.

Flows: Neutral

Absent from any freeze-offs or other upset conditions, we see flows as a neutral driver this week.

Recommended Reading

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.