Key Points: Bloomberg scrapes show us that gas field production fell slightly by 0.3 Bcf/d or 2.0 Bcf for the report week ended Feb 8. Warmer weather caused demand to fall in all major categories. Especially in residential and commercial sectors, demand decreased by 18.7 billion cubic feet per day (Bcf/d) or 177 Bcf week-on-week. Canadian imports dropped by 2.21 Bcf/d and Mexico exports also decreased by 0.18 Bcf/d.

Our analysis leads us to expect the U.S. Energy Information Administration (EIA) to report later this week that there was a 77 Bcf withdrawal for the report week ended Feb 8. (a lighter pull compared to the five-year average withdrawal of 165 Bcf and in comparison with the 79 Bcf consensus whisper expectation)

The lighter-than-normal withdrawal for the second week of February follows the above-average withdrawal that we saw during the week of the polar vortex. Temperatures became much warmer after the polar vortex had passed the Midwest region. Heating demand then fell in the subsequent week. The EIA reported a gas storage build of 1,960 Bcf at the end of Feb 1. Considering normal withdrawals and expected export gains, we expect the inventory to stay above 1,170 Bcf until the end of March. That estimate includes five-year average withdrawals for the last eight weeks of winter as well as LNG export terminals that are due to come online in first-quarter 2019.

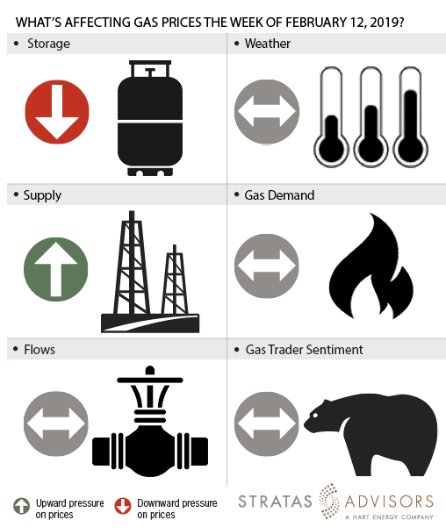

Supply: Positive

Supply: Positive

Average field supply decreased by 0.3 Bcf/d or 2.0 Bcf during the report week. There have been no reported freeze-offs for the report week. However, we believe that freeze-offs at wellhead could be the reason for the marginal decrease in the production. Accordingly, supply should likely offer positive pressure to this week’s price activity if freeze-offs are more publicly disclosed amid the upcoming cold weeks.

Weather: Neutral

The NOAA short-term HDD forecast show 5% fewer heating degree-days. Therefore we expect a milder-than-normal end of winter. Accordingly, natural gas prices have been sinking rapidly from the $4.50/MMBtu highs that we saw during the last two months of 2018. Natural gas prices as of today are at $2.60/MMBtu. Spot intraday prices at the time of our report last week was at $2.70/MMBtu. However, NOAA’s latest six-to-10-day temperature outlook shows high probability of cold temperatures over the entire Lower 47 (except for Florida). Balancing the weekly outlook with an end of winter forecast, we see weather as being a neutral driver for the gas prices this week.

Trader Sentiment: Neutral

Despite the U.S. Federal Government shutdown being over for at least the next few days, it is expected that the data reports by the Commodity Futures Trading Commission (CFTC) will show only lagging data for the next few weeks until March 8. We will resume our analytical coverage of CFTC data when the agency resumes reporting CFTC data that are contemporaneous with the other data in these weekly analyses. Trader sentiment appears to be neutral for this week’s price activity.

Storage: Negative

We estimate a storage withdrawal of 77 Bcf will be reported by the EIA this week for the week ended Feb. 8. In the prior forecast, we estimated a gas withdrawal of 218 Bcf for the week ended Feb. 1 which was at that time higher than the 225 Bcf consensus estimate. We were within range, but the actual reported 237 Bcf withdrawal was even higher. The withdrawal of 237 Bcf for the Feb. 1 week is likely to be the highest withdrawal for the winter season of 2018-19. Our 77 Bcf withdrawal expectation for this week is a little less than a third of our prior week’s expectation and much less than the last week’s reported figure. All in, we see storage changes as being negative driver for gas prices this week.

Demand: Neutral

Total demand for natural gas dropped by almost 25 Bcf/d in major categories but is projected to rebound next week. We already see that the average demand has increased by almost 20 Bcf/d for the first three days of this week when compared to the same period in the report week. If the trend continues, the demand will bounce back to average values for the next week report. The low demand during the report week could be attributed to the abnormal warm weather that followed the polar vortex in several parts of the country. So we see both positive and negative indications on the demand side, which we equally weight to yield a neutral outlook for the effect on price.

Flows: Neutral

There were no reported upset conditions during the report week. We see flows as being a neutral driver for gas prices this week.

Recommended Reading

Matador Resources Declares Quarterly Dividend

2024-02-14 - Matador Resources will pay a $0.20 dividend on March 13 to shareholders of record by Feb. 23.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.