Key Points

Bloomberg scrapes show us that gas field production was higher by 1.11 billion cubic feet per day (Bcf/d), or nearly 8 Bcf, for the week. Residential sector demand increased marginally by 0.78 Bcf/d or 5.50 Bcf for the week. Demand fell in the power generation sector (1.08 Bcf/d, or 7.53 Bcf, for the week). Export flows to Mexico fell by 0.07 Bcf/d, while Canadian imports also fell by 0.75 Bcf/d.

Our analysis leads us to expect a 24 Bcf withdrawal level for this coming report week. Our expectation is 2 Bcf more than the current consensus of 22 Bcf and much lower than the 55 Bcf five-year average storage withdrawal.

Key Hub Price Call

After reaching highs of $2.80/MMBtu in the beginning of November, Henry Hub has crashed back to below the $2.50 range. Excess supply, warmer-than-expected winter and strong natural gas stockpiles are pressuring prices to reach low levels. Apart from these factors, the low industrial and commercial demand during the Thanksgiving weekend also contributed to the lowering of prices.

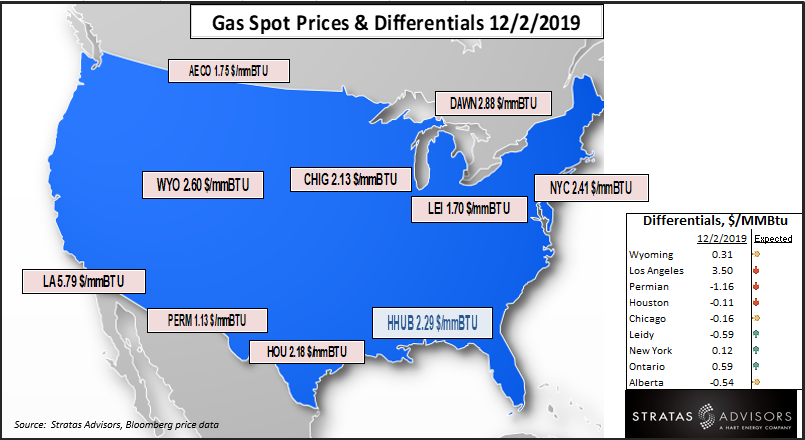

Gas Price Differentials

Temperatures in the Northeast are expected to dip during the latter part of the week, so those differentials (Leidy, New York Hub) could widen with respect to Henry Hub. Regional hub prices are at the premium to Henry Hub. Therefore, with rising demand and warmer temperatures in southern region (where Henry Hub is located), differentials would increase.

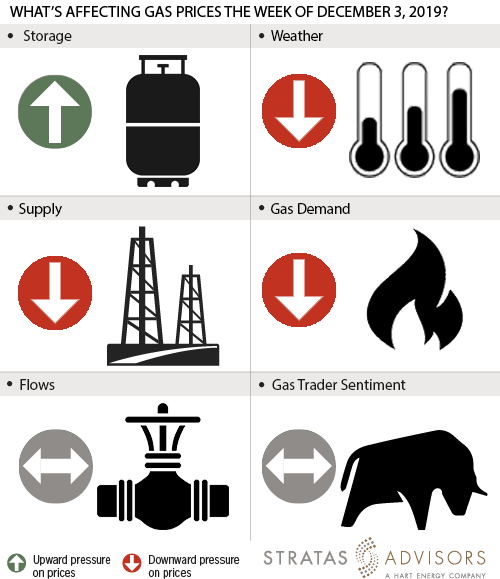

Storage: Positive

We estimate a storage withdrawal of 24 Bcf will be reported by the U.S. Energy Information Administration for the week ended Nov 29. This value is much less than the five-year average value of 55 Bcf. In the prior forecast, we estimated a gas withdrawal of 23 Bcf for the week ended Nov 22. We were within range, but the actual reported 28 Bcf withdrawal was even higher. Storage would continue to be a positive factor for this week as well.

Weather: Negative

The National Weather Service forecasts for the next six to 12 days point toward above-average temperatures for most of Lower 48. The Northeast region is expected to see a cold front later this week. We forecast light demand will continue until mid-late December. Demand could still increase as 84% of heating degree-days are remaining for the 2019/2020 winter. For this week, weather has a negative effect on gas prices.

Supply: Negative

Average field production is showing a week-over-week increase of more than 1.11 Bcf/d ,or 7.80 Bcf, but falling seasonal Canadian imports reduced 0.75 Bcf/d, or 5.23 Bcf, of supply into the market. Overall, we see supply as being a weak negative this week.

Demand: Negative

Although demand fell in power generation for the report week, we infer from Bloomberg data that the demand is going to increase for the current week. For the first three days of the current week, power sector demand is higher by 6 Bcf/d when compared to the same period of the report week. Industrial demand stayed flat while residential demand increased by 0.78 Bcf/d. Demand side drivers have a negative effect on this week’s price activity.

Flows: Neutral

We see flows as a neutral driver this week. LNG flows have stayed flat during the report week.

Trader Sentiment: Neutral

We see trader sentiment as neutral this week. The CFTC's Nov. 29 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on Nov. 26 were 188,289 net short while reportable commercial operator positions came in with a 152,823 net long position. Total open interest was reported for this week at 1,263,702 and was up 45,505 lots from last week’s reported 1,218,197 level. Sequentially, commercial operators this reporting week were adding to longs by 32,071, while cutting shorts by 15,518. Financial speculators added shorts and added longs for the week (52,184 vs 5,484, respectively).

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.