Key Points:

Average dry gas production fell marginally by 0.45 billion cubic feet per day (Bcf/d) or 3.13 Bcf for the report week ended Dec. 6. Imports from Canada increased by 0.68 Bcf/d or 4.78 Bcf and more than made up for the drop in production. Mexico exports rose slightly by approximately 1 Bcf. Demand rose more meaningfully in the residential, commercial, power generation and industrial sectors by 8.07 Bcf/d combined.

Our analysis leads us to expect a 76 Bcf withdrawal for this coming report week. Our expectation is at the current consensus level yet below the 85 Bcf five-year average storage withdrawal.

Key Hub Price Call:

Henry Hub prices are receding after a short bout of winter weather. NOAA forecasts show warming weather trends until the end of December and thereafter a weak winter through February. We are bearish on gas prices in 2020. If Henry Hub dips below $2, it would be the first time in three years that it would have reached this low level.

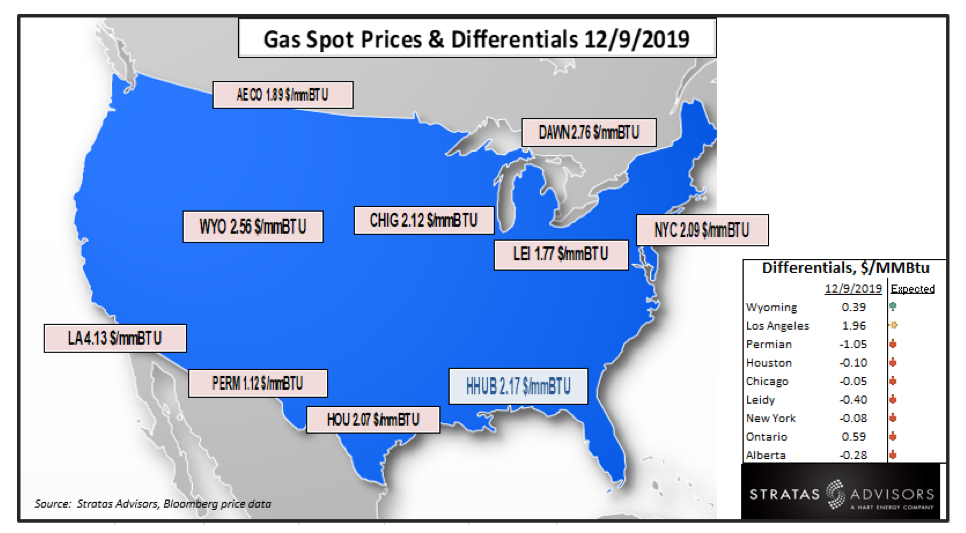

Gas Price Differentials:

Based on weather patterns, we expect all differentials except those in Midwest and West (Los Angeles, Opal Hub) to narrow with respect to Henry Hub.

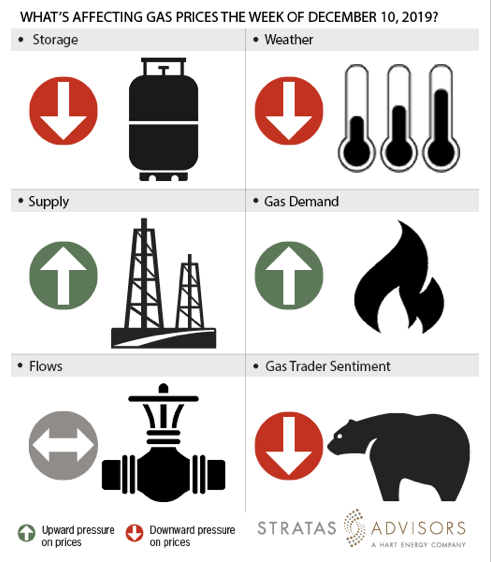

Storage: Negative

We estimate a storage withdrawal of 76 Bcf will be reported by the U.S. Energy Information Administration (EIA) for the week ended Dec. 6. In our prior forecast, we estimated a gas withdrawal of 24 Bcf for the week ended Nov. 29 vs. the actual of 19 Bcf. Inventory stockpiles dropped in all regions except South Central. Our 76 Bcf withdrawal expectation for this week is lower than the five-year average value of 85 Bcf for the same week, so we see this poor draw as a negative driver this week.

Weather: Negative

NOAA and NWS short term forecasts for short term predict a 33% to 50% chance for warmer-than-normal weather in almost every U.S. region. A cold spell is expected in Midwest and East later this week but temperatures are forecast to return to the 50s to 70s. Natural gas prices as of Dec. 10 are at $2.26/MMBtu. The highest spot prices since start of withdrawal season have been $2.87/MMBtu. All in, light to moderate demand is expected. We see weather as a negative factor for gas price activity.

Supply: Positive

Average field supply has decreased slightly for the week ended Dec. 6. The weekly average dry gas production decreased from 96.40 Bcf/d to 95.95 Bcf/d. Accordingly, supply will likely offer a slightly positive pressure to this week’s price activity.

Demand: Positive

Week-on-week, the average residential and commercial demand has risen by a 5 Bcf/d or 35 Bcf. Power generation and industrial demand also increased by 3.11 Bcf/d or 22 Bcf. Accordingly, we think that demand will offer a positive effect on the prices this week. Last week’s winter-related demand growth is being followed by another cold front this week but temperatures remain warmer-than-normal throughout the Lower 48.

Flows: Neutral

LNG net flows have stayed at 7.35 Bcf/d for the past two weeks. We see no reason to expect change. Accordingly, flows are a neutral factor for gas prices.

Trader Sentiment: Negative

The most bearish market participants expect Henry Hub to potentially reach $2/MMBtu. Strong production and mild weather are forecasted to result in surplus natural gas stockpiles by the end of winter. The CFTC’s Dec. 6 commitment of traders report for NYEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on Dec. 3 were 223,176 net short while reportable commercial operator positions came in with a 188,905 net long position. Total open interest was reported for this week at 1,338,205 and was up 74,503 lots from last week’s reported 1,263,702 level. Sequentially, commercial operators this reporting week were adding to longs by 23,696 while cutting shorts by 12,386. Financial speculators added shorts and added longs for the week (38,182 vs 3,295, respectively).

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.