(Source: Shutterstock, HartEnergy.com)

Key Points: Average dry gas production increased week-on-week by 0.13 billion cubic feet (Bcf) to reach an average value of 92.1 Bcf/d for the report week ending Aug. 16. Cooler temperatures compared to the previous week saw demand from power generation decline from 42.45 Bcf/d to 41.5 Bcf/d. LNG net exports from the U.S. remained relatively flat at 4.14 Bcf during the report week. Imports from Canada dropped by nearly 4% to average at 5.43 Bcf/d, while exports to Mexico stalled at 5.4 Bcf/d for a consecutive week.

Our analysis leads us to expect a 53 Bcf injection level for the report week. Our expectation is below the current consensus of 57 Bcf, and 2 Bcf more than the 51 Bcf five-year average storage build.

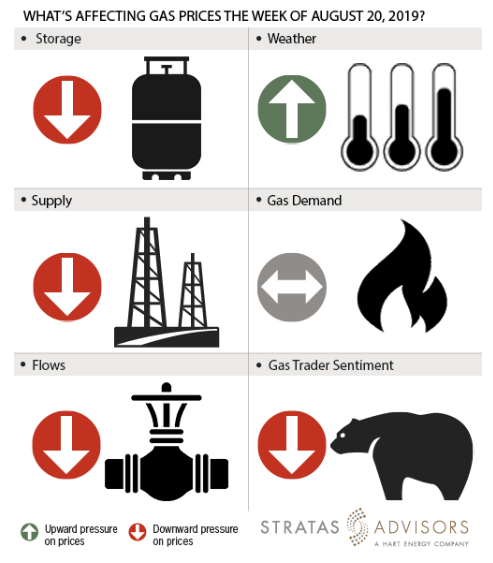

Storage: Negative

We estimate a storage build of 53 Bcf will be reported by the U.S. Energy Information Administration (EIA) for the week ended Aug 16. Last week, the EIA reported a 49 Bcf injection for the prior week. The build increased inventory levels to 2,738 Bcf and increased deficits to 111 Bcf compared to the five-year average. This week we expect the build to exceed the five-year average. All in, we expect the storage injection to be a negative driver for gas prices this week.

Weather: Positive

The NOAA projects high to moderate temperatures ranging between the 80s and 90s for the Midwest and Northeast regions at the beginning of the week, before cooling off at the tail end of the forecast period. That, along with high temperatures ranging from the 90s to 100s for the Western and Southern regions, has the NOAA estimating a hot weather forecast for the next eight to 10 days. We see weather as a positive driver this week.

Supply: Negative

Field supply increased to more than 92.1 Bcf/d during the report week. Average total dry gas production increased by about 0.13 Bcf compared to the prior week. All together, we see supply as exerting negative pressure to prices this week.

Demand: Neutral

Demand from the industrial sector showed gains of 0.02 Bcf/d to average about 20.93 Bcf/d. Looking forward, industrial gas demand may be in question due to perceived weakness in economic growth We see a neutral effect from demand-side drivers for this week’s gas prices.

Flows: Negative

News hit about the commencement of linefill on Kinder Morgan’s 2 Bcf/d Gulf Coast Express pipeline from Waha to Agua Dulce. The increased flow of discounted Permian gas is likely to contribute to an oversupply on the Gulf Coast region as we analyzed in our report last week, The Long and Short of Permian Gas Infrastructure. Accordingly, as Waha prices have gapped upward on the linefill start, we could see Henry Hub prices come under pressure as the discounted gas deliveries become fully operational.

Trader Sentiment: Negative

We project the Henry Hub prices to improve but average lower than $2.30 for the current week. The CFTC’s Aug. 16 commitment of traders’ report for NYMEX natural gas futures and options showed that reportable financial positions (managed Money and other) on Aug. 13 were 216,003 net short while reportable commercial operator positions came in with a 174,621 net long position. Total open interest reported for this week was 1,399,057, down 1,322 lots from last week’s reported 1,400,379 level.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Novo II Reloads, Aims for Delaware Deals After $1.5B Exit Last Year

2024-04-24 - After Novo I sold its Delaware Basin position for $1.5 billion last year, Novo Oil & Gas II is reloading with EnCap backing and aiming for more Delaware deals.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.