Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Key Points: Average field production increased by over 1.3 billion cubic feet per day (Bcf/d) or nearly 10 Bcf this week according to Bloomberg scrapes. We see a sharp decrease in demand across major categories by about 7.4 Bcf/d. Canadian imports fell by 0.4 Bcf/d and Mexico exports rose by 0.1 Bcf/d for the report week.

Our analysis leads us to expect a 10 Bcf storage build to be reported by EIA on April 4, which will be the last report for the withdrawal season that ended March 31. This is in contrast to the 34 Bcf withdrawal that was the five-year average. The current consensus whisper expectation tells that analysts have a mixed opinion with few values in withdrawal and few values in build.

The EIA reported a 36 Bcf withdrawal last week with inventory levels ending at 1,107 Bcf. We expect the winter March exit that will be reported this week is likely to be above 1,100 Bcf as well. There appears to be no effect on Henry Hub natural gas prices with levels staying stable.

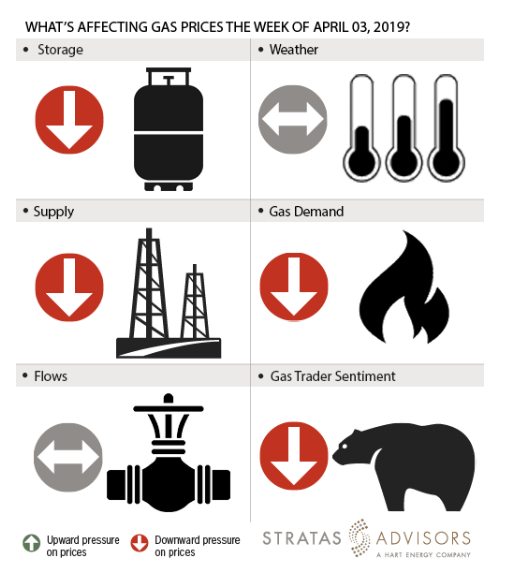

Storage: Negative

We estimate a storage build of 10 Bcf will be reported by EIA for the report week ended March 29. There could be a storage build or a withdrawal for this week as the consensus whisper expectation has values on both sides of zero. We expect a mild storage build for the Lower 48 overall, however this could vary from region to region.

Weather: Neutral

The updated National Oceanographic and Atmospheric Administration six- to 10-day forecasts show that a warming trend is on the way. Weather forecasts are cooler than normal for the week of April 10-15, however, demand would still be light. Except the Pacific Northwest, temperatures are rising in large portions of Lower 48. We see weather as neutral this week.

Supply: Negative

Production is on the upward trend for the past three weeks and Stratas Advisors expects the trend to continue well into spring and summer. The average weekly production reached 86 Bcf/d for the report week. The power plants and industrial units starting in the injection season would benefit from the increase in production. All in, we see supply exerting a negative pull on prices.

Demand: Negative

We expect demand to be light going forward. This winter has seen highs and lows in demand because of erratic low temperatures in November and February, considerably early and late in the season. The highest withdrawal recorded during this winter was 237 Bcf during the week of Feb. 4. The lowest value is possibly from the report week that is a storage build of 10 Bcf. Accordingly, we see demand as being negative for prices this week.

Flows: Neutral

Throughout the winter, natural gas supply has been disrupted in the Pacific Northwest due to the breakdown of the Enbridge BC pipeline. Sumas prices reached all time high of $161 in March and have since fallen to less than $4/MMBtu. It is likely that alternate sources of gas have been established from storage facilities and rocky mountain pipelines that help to combat the disruption. However, there has been no effect on Henry Hub prices and flows are expected to be a neutral driver this week.

Trader Sentiment: Negative

We see natural gas futures prices are falling despite forecasts of returning cold. We see trader sentiment as negative. The CFTC’s March 29 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on March 26 were 24,045 net short while reportable commercial operator positions came in with a 14,396 net short position as well. The net long decline this week which follows a net long gain last week shows operators clearly seem to be less optimistic this week, while financial speculators appear to be more bullish given a net long gain this week after a net long decline last week.

Recommended Reading

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.

Oil Settles at Highest in Nearly 8 Weeks on Strong Economic Growth

2024-01-26 - Oil prices settled at their highest in nearly two months on Jan. 26 as positive U.S. economic growth and signs of Chinese stimulus boosted demand expectations.

Oil Prices Edge Lower on False Report of Israeli Ceasefire, Sustained OPEC Cuts

2024-02-01 - Oil prices fell 2% on the false speculation that Israel and Hamas had tenatively agreed to a ceasefire, but losses were subsequently pared.

Oil Prices Edge Up on Big US Crude Withdrawal, China Stimulus

2024-01-24 - U.S. crude storage withdrawal, Chinese economic stimulus and geopolitical tensions countered concerns over tepid demand.

What's Affecting Oil Prices This Week? (March 4, 2024)

2024-03-04 - For the upcoming week, Stratas Advisors expect the price of Brent will move sideways and will struggle to break through $85.