Key Points: Field production decreased marginally during the report week of April 12 by 0.6 billion cubic feet per day (Bcf/d) or 4.25 Bcf. With warm weather sweeping across the United States, the demand for natural gas has gone down considerably. The demand from major categories has reduced by almost 17 Bcf/d for the report week compared to four weeks ago. Imports from Canada rose by 0.06 Bcf/d or 0.4 Bcf while exports to Mexico fell by 0.6 Bcf/d or 4.3 Bcf week-on-week.

Our analysis leads us to expect a 102 Bcf storage build would be reported by EIA for the report week, in comparison to the current 87 Bcf consensus whisper expectation and almost 50% higher than the five-year average storage build of 63 Bcf.

We anticipate that storage levels should rise through the summer injection season as the weather changes to mild to warm throughout the U.S. Working stocks are currently at 1,247 Bcf at the end of report week. The five-year average value for this week is 1,661 Bcf, which is 25% lower than the current levels. Henry Hub natural gas prices dipped to $2.50/MMBtu and recovered to slightly above $2.60/MMBtu as April 23.

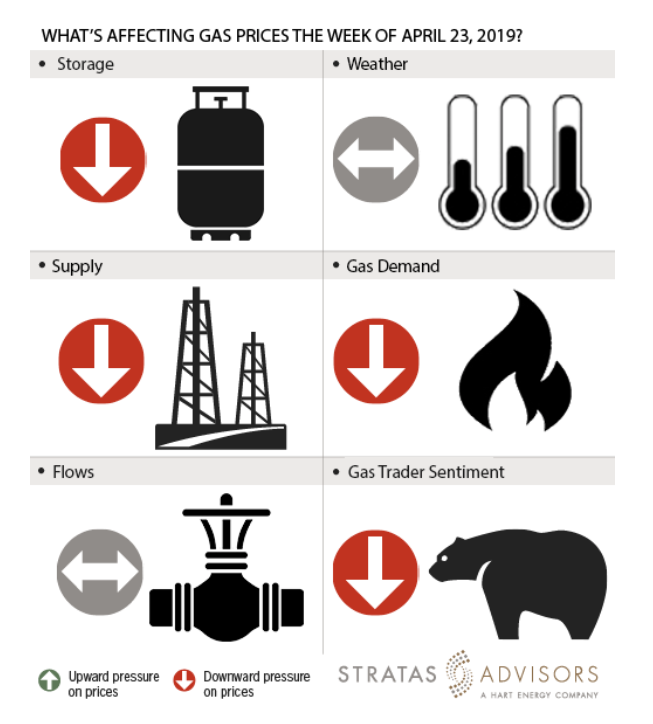

Storage: Negative

EIA reported a storage build of 92 Bcf for the prior week of April 12. All regions saw a build this week with the largest build seen in the South Central region of 48 Bcf. For the report week, we anticipate a storage build of 102 Bcf would be reported by the EIA. The injection into working gas stocks has been higher this year compared to 2018 because of higher supply. All in, we see heavy storage additions as negative driver for gas prices this week.

Weather: Neutral

The NOAA six-to-10-day temperature forecast predicts a lower than average seasonal temperatures on the northern belt. The Southeast, South Central and Southwest areas are seeing a warmer than seasonal weather through next weekend. With demand from different parts of the U.S. likely to cancel each other out, we see weather as having a neutral role in gas prices this week.

Supply: Negative

Dry gas production has been consistently inching higher since the start of 2019, with the past week average ending at 85.62 Bcf/d. We expect to see the same upward output trend for the rest of 2019 as well. Total supply could grow faster than the demand. If that scenario comes to pass for significant portions of the refill season that is upon us, the storage rebuild will occur faster in 2019 than it did in 2018. All in, we see supply gains as exerting a negative pressure to prices this week.

Demand: Negative

We estimate that demand from major categories such power generation, residential & commercial and industrial projects saw a decline of almost 2 Bcf/d combined in the past week. We accordingly see demand as exerting a negative pressure on this week’s gas prices.

Flows: Neutral

We do not see any upset conditions, maintenance or any freeze-offs that would affect the natural gas pipeline. We expect flows to be neutral for this week’s gas price activity.

Trader Sentiment: Negative

Henry Hub natural gas prices dipped to $2.50/MMBtu and recovered to slightly above $2.60/MMBtu as of April 23. Market participants are expecting that gas production levels should quickly fill up working gas inventories. This expectation leaves little motivation to go long or bid higher for futures prices at the current level. The CFTC's April 19 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on April 16 were 53,671 net short while reportable commercial operator positions came in with a 14,904 net long position. Total open interest was reported for this week at 1,286,210 and was up 70,947 lots from last week’s reported 1,215,263 level.

Recommended Reading

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.