Upstream deal-making value plunged 13% between 2021 and 2022, while deal activity fell to the lowest level since 2005 and was down by 24% for the year, according to Enverus Intelligence Research.

Still, dealmakers found an occasional trigger to pull on transactions — particularly, large, independent E&Ps that shook loose acquisitions for smaller private companies in the Eagle Ford and Permian Basin in the second half of the year.

“Large-cap public companies like Devon Energy, Diamondback Energy and Marathon Oil dominated deal activity in the back half of 2022,” said Andrew Dittmar, director at Enverus Intelligence Research. “These buyers have the balance sheet strength and favorable stock valuations to take advantage of large, high-quality offerings from private sellers.”

But the year also illustrated the widening mismatch between large-cap companies with attractive valuation and their smaller rivals, which are unable to compete for deals on an equity basis. Economic headwinds and commodity prices may also be at play in stifling M&A.

But in 2023, the persistent need to replenish inventory will likely keep E&Ps chasing deals.

Dittmar said that in 2022, large-cap companies were able to strike deals that were both accretive to current cash flow and extended their runway of drilling locations.

“For smaller companies, which are still having their equity value discounted, it is challenging to thread the needle of buying assets at accretive multiples and being able to pay for inventory,” he said.

Last year, deals appeared to split along two trend lines. Earlier in the year, transaction value was “heavily tilted toward production value as deals were focused on buying discounted production or modestly priced inventory,” Dittmar said.

By the fourth quarter, large-cap buyers were more willing to pay for inventory with valuations exceeding $2 million per location — including the deals by Diamondback and Marathon Oil.

“Given the need for inventory, we anticipate deals will continue to see more value allocated to the upside, both from paying more per location and targeting less developed assets with more development runway,” Dittmar wrote in the report.

40% of the operators in North America expect their capital spending to increase slightly this year, according to the findings of the winter Dallas Fed survey. And almost 25% expect a significant increase in spending in 2023.

What’s the point of this increase? Inventory.

A “maturing asset base” was among the top responses to the survey question, “Which of the following is the biggest drag on crude oil and natural gas production growth for your firm?”

Inventory is life

The need for public operators to secure inventory should provide a tailwind for M&A and private equity-backed sellers with high-quality asset packages.

Large-cap companies that have a premium valuation will “target the highest quality inventory in the core of plays—like the Permian and Eagle Ford for oil and Appalachia and Haynesville for gas,” Dittmar said. “Inventory in these plays is likely to continue to increase in value as fewer quality positions with scale remain.”

That disconnect hasn’t been lost on small- and mid-cap (SMID cap) E&Ps, such as Midland Basin operator HighPeak Energy Inc. On Jan. 23, the company, which has a market cap of about $3 billion, said it would explore a possible sale. Jack Hightower, HighPeak’s chairman and CEO, said the company is undervalued by the market — a point he effectively turned into a sales pitch.

“We believe our share price should move up the trading multiples currently realized by certain potential purchasers and large-cap pure play owners of Midland Basin assets,” he said.

Dittmar said SMID operators that need inventory but lack a supportive equity price may target less-proven areas, such as the Permian Rim and eastern Eagle Ford for oil and the Rockies regional plays for natural gas.

“A SMID-cap operator could test the market with a deal that is inventory accretive but dilutive to EBITDA multiples and free cash flow,” Dittmar said.

However, even if such a deal is strategically necessary, it may prove unpopular with investors over the short term.

“Another option is a return to public-public M&A, either from SMID mergers seeking to garner a higher multiple from increased scale or to sell to a large-cap peer that is more attractive to investors,” he said.

January M&A begins to thaw

After a slow start in January, E&Ps two megadeals were announced by mid-month.

Chesapeake Energy Corp. agreed to an initial sale of its Eagle Ford acreage for $1.425 billion — part of a larger divestiture of its assets in South Texas. In the Permian Basin, Matador Resources announced a bolt-on acquisition valued at $1.6 billion, excluding contingency payments.

Matador’s recent deal was, in part, a result of its status as SMID-cap with a higher share price than most of its peers. The company has also retained significant retained cash to make an acquisition.

Dittmar said Matador’s bolt-on acquisition of Advance Energy Partners Holdings LLC, an EnCap Investments portfolio company, appears to be a sensible bolt-on in the Delaware Basin core.

Matador was able to pay at multiples that were slightly accretive, Dittmar said, and add significant runway of high-quality locations that are immediately competitive in its portfolio for drilling capital.

“While not super cheap at about $25,000/acre, the deal prices in line with other recent M&A for core assets like Diamondback Energy’s buys in the Midland Basin in late-2022,” Dittmar said.

“Like some of the other recent buyers, it has also won the trust of investors with a successful track record on deals,” he said in Jan. 24 commentary.

Chesapeake Energy’s sale of its Brazos Valley assets to WildFire Energy I LLC advances its goal of being a pure gas producer focused on Appalachia and the Haynesville Shale, he continued.

Chesapeake’s hope is that the more specific focus raises its stock price, Dittmar said.

“The company is also unloading an asset that was no longer viewed as competitive in its portfolio, and the deal checks off one of Chesapeake’s widely telegraphed goals from last year,” he said.

Dittmar said the sales price at first glance looks “a bit underwhelming though, especially considering the company paid nearly $4 billion in the purchase of WildHorse Resource Development that brought these assets into its portfolio.”

The $1.425 billion purchase price also appears to be “a bit beneath the value of the production with no value attributed to the undrilled locations.”

The sales price likely reflects the limited buyer pool for this region of the Eagle Ford, and an overall challenging M&A market outside of the highest quality assets, Dittmar said.

“Chesapeake will likely continue to consider sales options for its remaining Eagle Ford assets, dependent on economic conditions and commodity prices,” he said.

Though the deal makes sense given Chesapeake’s goals, it is unlikely to kickstart any trend of public-to-private asset sales, Dittmar said.

“Most public companies will likely view the offers from private E&Ps as being insufficient to be worth giving up the cash flow from even non-core positions, and private companies are likely to stay conservative in their offers,” he said.

Supply and demand

OPEC predicts that the global population will increase from 7.9 billion to 9.5 billion by 2045. It estimates that the global GDP will rise from $133 trillion in 2021 to almost $270 trillion by 2045. This growth comes with an increase of 65 MMboe/d during the same period, a rise of 23%.

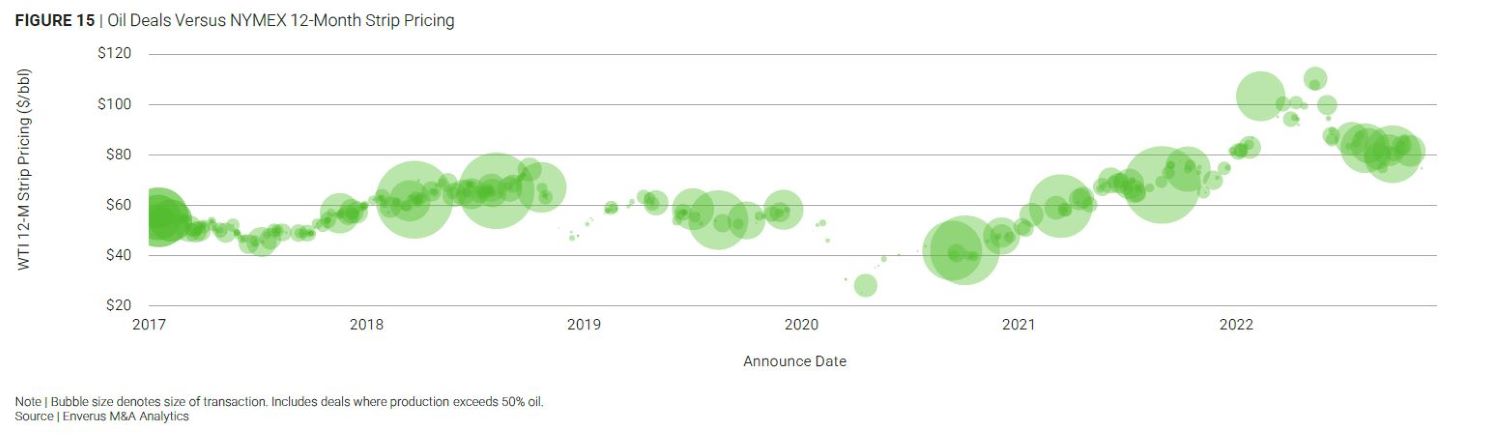

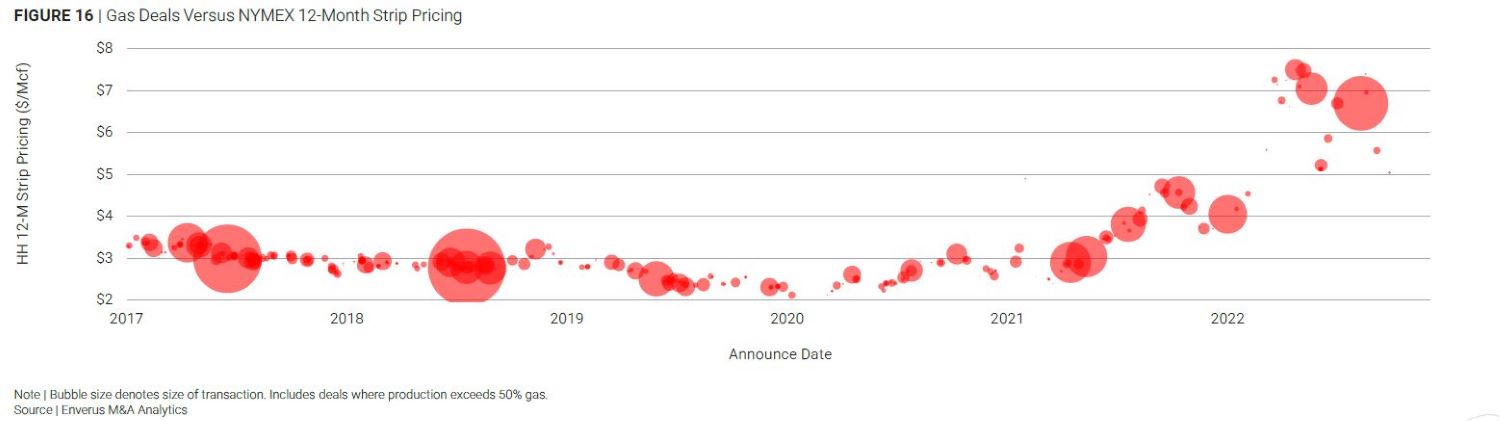

While oil production numbers hit near all-time highs, it was not enough to stabilize prices in 2022. According to the EIA, in 2022, the price of WTI ranged from $70/bbl to over $120/bbl. Natural gas saw plenty of swings ranging from $4 to almost $9 during the year.

The price volatility stifled a fast start to the mergers and acquisitions space.

The $6 billion in January deals made a five-year high, according to Enverus. Despite the hot start to 2022, Enverus reports that the year’s $58 billion worth of transactions reflected a deal volume total that had dropped to a nearly two-decade low.

“The volume of deals is relatively sluggish, but we are seeing some bigger deals get done, so values are relatively high,” Dittmar said.

“The main theme is private equity backed positions taking their positions to market looking to sell to major operators. That’s where we are seeing most of the large deals take place.”

While 2022 saw a wild swing in prices, a more stable market may be ahead for this year, said Tim Kotzman, founder and CEO of Jubilee Royalty.

“The barrier to entry to the Permian is pricing out a lot of companies who might want to get in but do not have the technical expertise or experience in the basin.”—Preston Bernhisel, Baker Botts

“We’re expecting prices to level out over the next few years,” he told Hart Energy. “The large swings and predictions for future swings have made it hard to get minerals at reasonable prices. If the market becomes more stable, that will allow for more deals.”

Stable oil prices, above break even, would be good for the industry, but it’s unlikely to cure all problems.

The primary driver of U.S. oil production has been the Permian Basin. The hyper-focus on the basin has driven up acquisition prices and might give companies pause before entering the basin.

“On the oil side, the Permian is still where it’s at. Many companies will look for opportunities in the Delaware and Midland Basins,” Dittmar said.

“Much of the core in those two basins has been acquired by larger companies that will not be looking to exit. This will push companies outside the core to look for deals priced well.”

Companies are giving prime consideration to the areas they best understand, Preston Bernhisel, chair of the Dallas corporate practice of Baker Botts, told Hart Energy.

“If you are a Permian operator, that is where you want to focus your efforts,” he said.

While it makes sense for companies to hone in on areas they believe they can exploit the best, it is keeping out companies that need more expertise and extra cash to pay the premium required to enter the Permian.

“The barrier to entry to the Permian is pricing out a lot of companies who might want to get in but do not have the technical expertise or experience in the basin,” he said.

Higher Permian prices have slowed down deal flow in the basin and pushed smaller operators to other basins such as Haynesville, Anadarko Basin, Arkoma Basin and Eagle Ford.

“We look at the deals in the Permian and can’t make that math work,” Crosby Shaver, managing member of Blue Darter Energy, told Hart Energy.

“Now, we are focusing on Oklahoma. The competition is less fierce, and the prices are more reasonable,” he said.

“Smaller companies can’t afford to hold assets on their balance sheets for years. The write-offs larger companies perform allow them to buy and hold assets for several years. Their cash positions differ completely from ours. When we buy something, at a minimum, it needs to be permitted to drill.”

Shaver’s firm is looking at acquiring smaller units than before.

“You have to be nimble. Larger units are going for a premium. We’ve found that we can acquire smaller units at a valuation that works for our investors,” Shaver said.

Smaller operators are also reconsidering the commodity they will buy as well.

“You have to be nimble. Larger units are going for a premium. We’ve found that we can acquire smaller units at a valuation that works for our investors.”—Crosby Shaver, Blue Darter Energy

“The most significant shift we have noticed is that companies are more interested in buying natural gas assets than in previous years,” Kyle Souza, “data wizard” at P&P Oil & Gas Solutions, told Hart Energy.

Ignoring the Permian and focusing on a play like Haynesville is not a cure-all. Even in the smaller plays, operators are not looking to exit right now.

“There are a lot of buyers in the market, but sellers are tough to come by,” Souza said.

It’s not a tiny uptick in buyers.

“This is the most excited we’ve seen people wanting to buy since 2015. There’s been a change in the industry's perspective. There are younger people in the companies that we work with. With the new leadership in place, it’s more about long-term returns than just expanding your drilling program or buying an asset hoping to flip it in two or three years,” Souza said.

For P&P Oil and Gas Solutions, the renewed interest in buying has pushed their company to hire new employees and leverage technology.

“We’ve had to hire people to keep up with the demand, but we leverage a lot of artificial intelligence [AI] to scale faster without hiring as much as we have historically. We can sometimes reduce the time to complete a project by as much as 50% with a quarter of the staff. The deals are complex,” he said. “With many people retiring, we’ve had to figure out how to keep up with client demand while knowing there is a tight labor market. We’ve leveraged AI to do that, and the results have been better than expected.”

There is another risk looming out there for the smaller players. Not only can larger oil and gas companies buy and hold assets in prime plays like the Permian, they will also drill wells that are less profitable to keep rigs running and frac crews busy.

2022 Deal Values By Region ($ billion)

| 1Q22 | 2Q22 | 3Q22 | 4Q22 | Full Year | |

| Multi-Region | $0.3 | $3.5 | $2.2 | $5.2 | $11.2 |

| Permian | $4.4 | $6.1 | $1.1 | $4.2 | $15.8 |

| Gulf Coast | $0.0 | $0.6 | $2.0 | $3.1 | $5.7 |

| West Coast | $0.1 | $0.3 | $3.9 | $0.6 | $4.9 |

| Rockies | $7.3 | $1.4 | $0.1 | $0.1 | $8.9 |

| Midcontinent | $0.1 | $0.9 | $0.2 | $0.0 | $1.2 |

| Ark-La-Tex | $0.0 | $0.2 | $0.1 | $0.0 | $0.3 |

| Eastern | $2.7 | $0.0 | $6.0 | $0.0 | $8.7 |

| Gulf of Mexico | $0.1 | $0.1 | $1.2 | $0.0 | $1.4 |

| Total | $14.9 | $13.1 | $16.7 | $13.3 | $58.0 |

“Our concern right now is low gas prices. The upside to buying in places like Anadarko and Arkoma is less competition. The risk is still there. We have to buy at the right price. Here, companies are less likely to keep a rig running at low prices. Each deal we look at needs to be permitted, and we want to buy the acreage with as low of a breakeven as possible. If you are not careful, you can find yourself with acreage that will not get drilled in the next year,” Crosby said.

Concerns about not making immediate returns keep excited buyers from splurging on risky deals.

“While our buyers are looking to buy, there is no push to buy today. Our clients want to make strategic purchases,” Souza said.

“Our clients can raise money. None need to exit a current position to buy a new one. They are raising money from private sources to add to their assets, but our clients focus on buying producing assets. At times, they will operate the wells. Others they want the cash flow. The priority is to buy an asset that is cash flowing, not one that might cash flow.”

Potential Buyers During The Next Wave Of A&D

| Company | Ticker | *Closing $/share | *Market cap ($/billion) |

| APA Corp. | APA | $41.05 | $14.01 |

| Civitas Resources | CIVI | $63.21 | $5.69 |

| Callon Petroleum | CPE | $39.57 | $2.58 |

| Devon Energy | DVN | $60.30 | $41.54 |

| Earthstone Energy | ESTE | $12.79 | $1.45 |

| Diamondback Energy | FANG | $141.47 | $27.16 |

| Ovintiv | OVV | $45.86 | $12.13 |

| PDC Energy | PDCE | $63.28 | $6.21 |

| Permian Resources | PR | $9.93 | $3.04 |

| Pioneer Natural Resources | PXD | $221.32 | $54.98 |

While smaller operators are looking to move into areas they have not been as active in, larger operators are focused on doubling down on their strengths. If prices stabilize, Dittmar believes that could lead to an increase in activity around mid-year – “it’s most likely to pick up in late Q2 or early Q3.”

Many of these acquisitions will be targeted at expanding drillable assets companies have on the books.

“Over the past few years, operators have proven they can return value to their shareholders. As companies evaluate their assets, they see that if they have less than ten years of inventory on the books, shareholders devalue their stock. So, companies with less than 10 years of inventory will look to acquire acreage to get above that ten-year threshold,” Dittmar said.

In 2022, private equity-backed companies were not as active as they had been in previous years allowing the larger E&Ps to close on many of the deals that were available.

“We saw fewer private equity deals in 2022 than we did before the pandemic. Depressed multiples for dispositions or acquisitions drove this. While we expect larger companies to continue to scoop up assets from smaller companies, we’ve seen hints of a more robust private equity market in 2023. This will be a mix of companies looking to exit and reinvest and new teams looking to raise and enter the market,” Bernhisel said.

Multi-basin consolidation

The Permian Basin remains the most likely spot for A&D, said analyst Neal Dingmann at Truist Securities in a note to investors.

But there are potential sellers across the Lower 48, including those with assets in Colorado’s Denver-Julesburg (DJ) Basin, the Bakken in North Dakota and the South Texas Eagle Ford Shale.

“The challenge associated with larger-scale acquisitions in more mature basins such as the Eagle Ford and Bakken will continue to be the limited amount of tier-one inventory,” Dingmann said. “With continued investor angst surrounding continuity in the Anadarko Basin and to some extent, the DJ, we believe deals in these regions would have to be somewhat discounted.”

However, Enverus’ Dittmar said that are firms in the Eagle Ford looking for an exit and there are buyers with interest in those assets. Outside of the Permian, the next major play that might see activity is the Eagle Ford shale.

“There is a tremendous amount of private equity positions in the Eagle Ford that the groups holding them would like to unwind – especially non-core assets,” he said. “We saw that recently with the WildFire acquisition from Chesapeake Energy.”

Infrastructure access

Access to takeaway capacity is a consideration in most A&D, insiders said.

“It is always an important consideration in any deal,” Dittmar said. “Your model has a certain number of volumes baked in and you have to make sure have the pipe to get those volumes to market.”

Takeaway is an issue regardless of resource, he said.

“Even when you look at gas, there are two considerations. If gas is the target, then of course you will need to get it to market,” he said. “However, if you are acquiring acreage in the core of the Permian operators will want to have access to pipelines to help reduce flaring and maximize profit off the well by selling that gas to market as well.”

Indeed, infrastructure can heighten the allure of a deal.

“Infrastructure is a concern,” Bernhisel said. “Producers with a midstream group in house, or contracts in place, are more attractive.”

Even if the activity picks up, the market should expect more volume, not larger deals than have happened already, he said.

Recommended Reading

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.