(Source: Shutterstock.com)

Vital Energy Inc. is a Midland Basin pure play no more, following an agreement to purchase EnCap-backed Forge Energy II Delaware LLC’s assets in a Permian Basin in deal totaling $540 million cash.

Vital, based in Tulsa, Oklahoma, said May 12 that it has signed a definitive joint purchase and sale agreement to establish a core operating position in the Delaware Basin. The deal is the second the company has made this year following an April acquisition for Driftwood Energy Operating LLC in the Midland Basin.

Under the acquisition agreement, signed with an unnamed third-party, Vital will purchase 70% of Forge’s assets for $378 million. The third party will purchase the remaining 30% of the assets for $162 million. Vital will operate the assets.

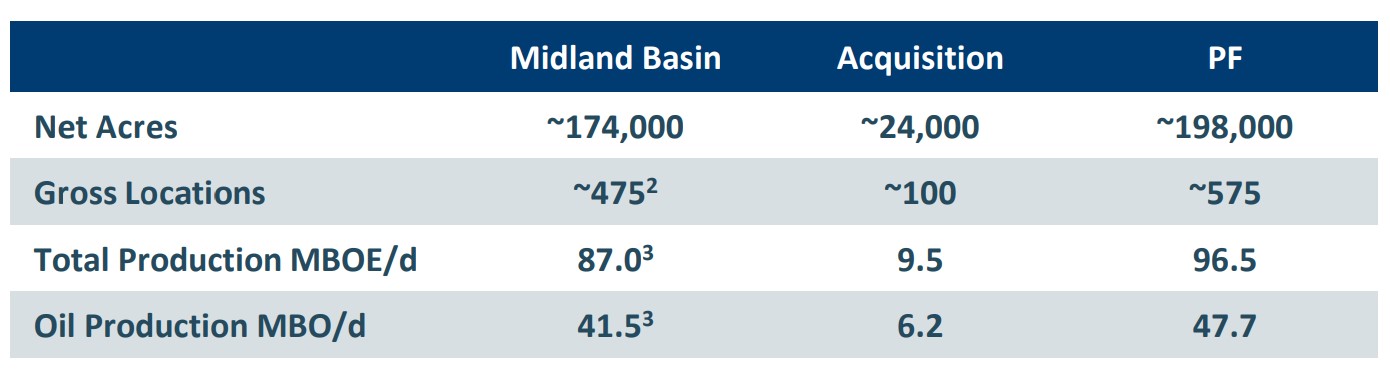

As Permian operates scramble to buy up inventory, Vital said the acquisition adds about 100 gross locations in Pecos, Reeves and Ward counties, Texas, across 24,000 net acres. The deal expands Vital’s Permian footprint to about 198,000 net acres and adds and average production of 9,500 boe/d, 65% oil, net to Vital.

The transaction adds locations in the 2nd and 3rd Bone Spring and Wolfcamp A formations. Vital Energy said the wells breakeven at an average price of approximately $50 per Nymex WTI barrel. The company also sees potential upside in the stacked formations.

The company, formerly known as Laredo Petroleum, plans to operate one rig on the acquired properties, increasing its total Permian rig count to three.

The company said the transaction is valued about 2.5x its next 12 months consolidated EBITDA based on strip pricing as of April 28, “in line with recent transaction values in the basin and estimated to be 20% accretive to next 12 months’ free cash flow [FCF]” and FCF per share.

Vital anticipated the purchase will be leverage neutral within 18 months at $75 Nymex WTI.

Vital Energy said it plans to fund the acquisition through the use of its credit facility. The transaction is expected to close in late second-quarter 2023 with an effective date of March 1, 2023, subject to customary closing conditions.

“This accretive acquisition is attractively priced and significantly expands Vital Energy’s Permian focus, adding a core operating area in the Delaware Basin,” said Jason Pigott, Vital Energy’s president and CEO. “We have a proven track record of building value through our disciplined acquisition strategy. Today’s deal significantly enhances our outlook for free cash flow generation which we will use to pay down debt and strengthen our balance sheet."

Houlihan Lokey and KeyBank are serving as financial advisers to Vital Energy and Latham & Watkins is serving as legal counsel. RBC Richardson Barr is serving as financial adviser to Forge and O’Melveny & Myers is serving as legal counsel. O’Melveny served as legal counsel to Forge Energy II.

Recommended Reading

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.