In a dialog with Hart Energy’s Richard Mason that was recorded before the company announced its merger with Devon, WPX Energy President and COO Clay Gaspar focused on technology in the Permian Basin. (Source: Hart Energy)

New oil and gas exploration is all about understanding technology and innovation, and “that’s being on the computer front or the drill bit front,” said Clay Gaspar, president and COO of WPX Energy Inc.

“We have to innovate to maintain our position and even garner a few incremental spots along the way,” Gaspar said during Hart Energy’s DUG Permian Basin and DUG Eagle Ford Virtual Conference.

While Gaspar and WPX Energy highlight the industry news of the week, thanks to the announced merger agreement between WPX and Devon Energy Corp., Gaspar encapsulated much of the feelings of the Permian players who spoke on the second day of the two-day virtual event.

In a dialog with Hart Energy’s Richard Mason that was recorded before the merger announcement, Gaspar focused on technology in the Permian Basin. He also stressed the importance of overcoming cultural challenges in the industry, particularly as it undergoes a digital transformation and increase on ESG reporting.

RELATED:

Virtual DUG Day 1 Recap: Permian Basin Relevancy Faces Bumpy Ride Ahead

Eagle Ford Oil

In the day’s second keynote address, Mike Henderson, senior vice president of operations at Marathon Oil Corp., kicked off a block of Eagle Ford discussions.

Texas has been particularly hard hit in the wake of demand destruction. The U.S. Energy Information Administration reported that the Lone Star State had the largest drop in oil production from April to May than any other state. It saw a loss of 700,000 bbl/d, a 15% decrease, in May.

The Eagle Ford has been notable in its production loss as rigs went offline, falling all the way to eight operating rigs at one point. That’s why, Henderson, stressed the need for resiliency in the basin.

“The fact that we’re all participating in this conference is further evidence of our collective resiliency,” Henderson said. “I truly believe this is our time. Everyone can see what we’re really made of as individuals, as communities, as companies and as an industry.”

Henderson touched on several topics, including the idea of prorations, which Marathon opposed during consideration by the Texas Railroad Commission earlier this year. “The effect on the global supply would have been minimal that we didn’t feel there was any benefit,” he said.

While Marathon shut-in wells in the Permian, it shoes to optimize in the Eagle Ford. “Our approach is fairly straightforward when it comes to capital allocation. We are going to allocate to the basins where we can generate the best returns,” Henderson said. “At the moment that is the Bakken and the Eagle Ford.”

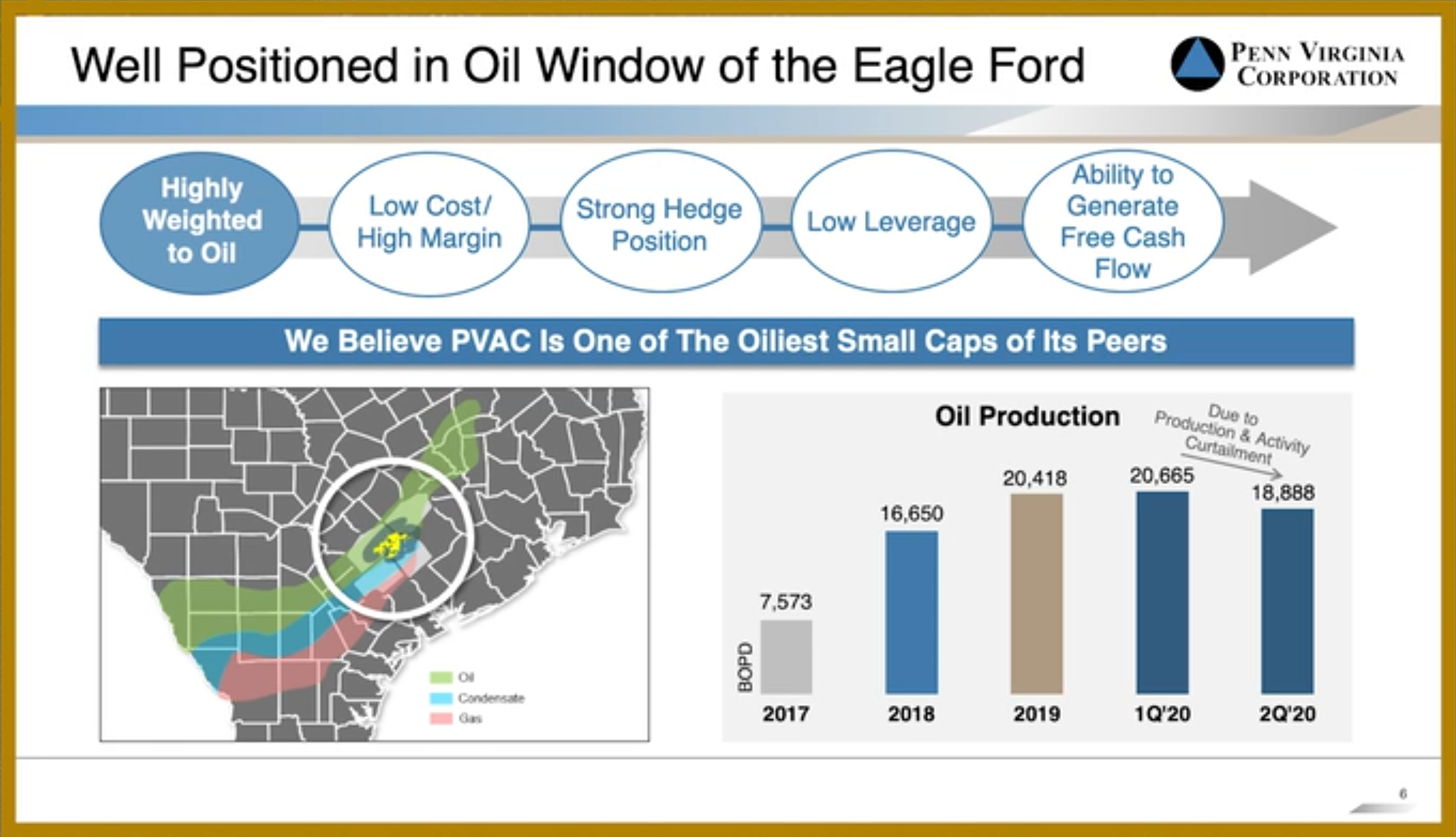

Pure-play Eagle Ford operator Penn Virginia Corp. holds 86,500 net acres in Gonzales, Fayette, Lavaca and DeWitt counties in South Texas. President and CEO Darrin Henke said the company—which is heavily weighted to oil—has been able to mitigate commodity price volatility through its robust hedge book.

He expects his company to remain “laser-focused on financial discipline” in light of the current market conditions. “The most important measure is generating free cash flow,” he added. “We must live within our means. We have accomplished that for the first half of the year and expect that trend to continue through the balance of the year.”

“We believe this makes Penn Virginia unique, a proven small-cap that can generate free cash flow,” he continued.

In addressing the industry’s M&A environment he said, “I believe the industry is absolutely ripe for consolidation, specifically, the Eagle Ford Basin. We’re positioning Penn Virginia to be the consolidator of choice within the basin. That being said, everything we do around consolidation and M&A activity will focus on shareholder return. We won’t do it just to have M&A activity and grow. We will do it with the shareholder’s objective in mind.”

Eagle Ford Gas

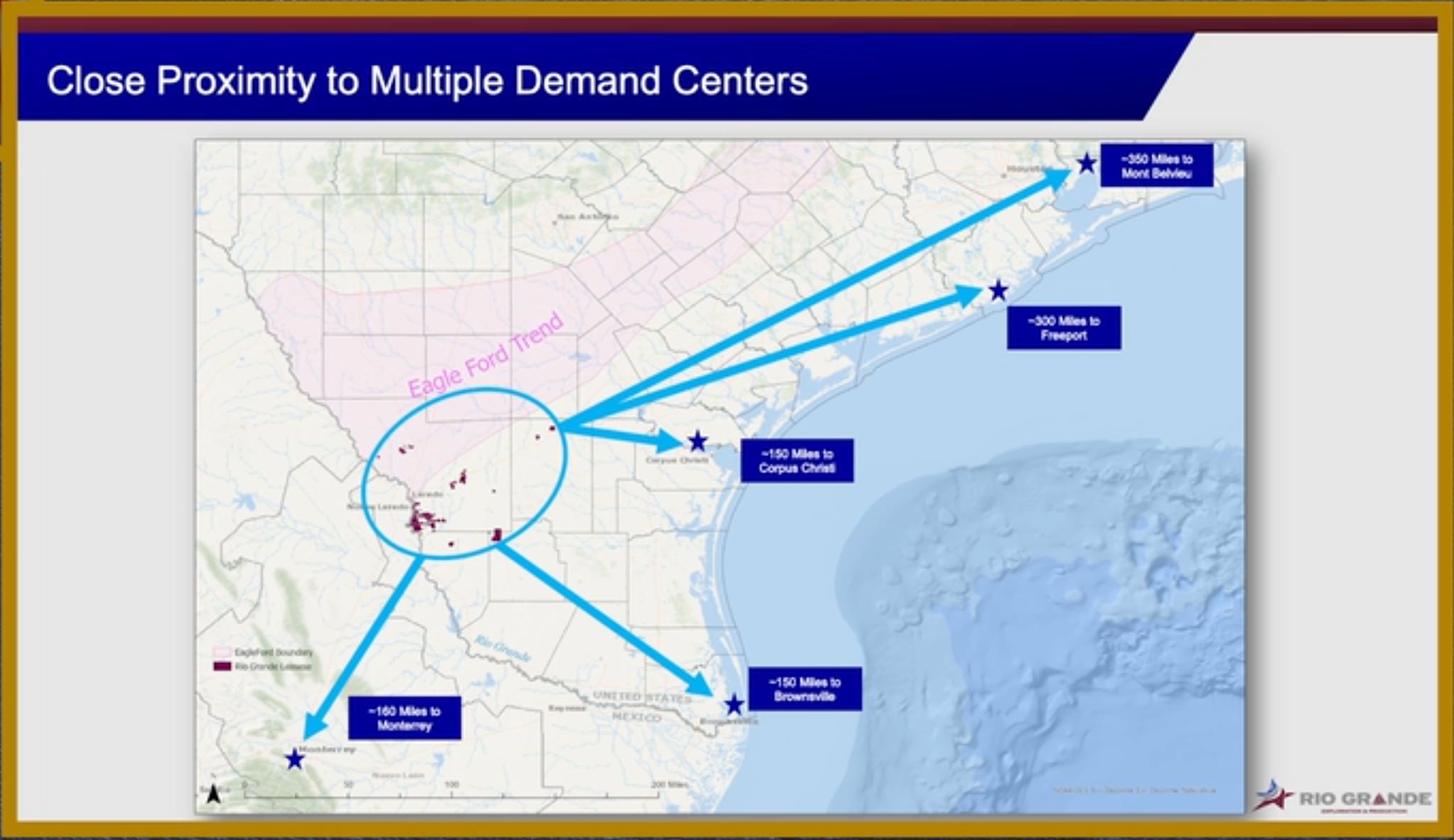

Webb County has fueled Texas gas production over the years and that’s where Rio Grande Exploration & Production set up shop. Glenn Hart, president and CEO, said one of the main driver’s for success in the county has been technical innovation. “It’s been one of the hallmarks of the play,” he said.

He also pointed to its proximity to natural gas demand centers. “You can see from our acreage position, Monterrey, Mexico. Monterrey is probably the largest, single industrial city in North America right now,” Hart said.

He also gave a nod to LNG growth, saying it continues to give a price boost to South Texas natural gas pricing.

Hart said Rio recently moved a rig into the region and will drill a two wellpad. “We were faithful in our promise to make sure the well was going to be good,” he said. “We thought we needed at least nine months of solid production history.”

Frac Fleets and Consolidation

There’s no doubt the oil and gas playing field has been reset in 2020. But how long will the $40 price environment last?

Ian Macpherson, managing director and senior research analyst of oil service for Simmons Energy, said the need for consolidation will be one of the determining factors. “We still have a few dozen pressure pumpers in the U.S. and that’s too many,” he said bluntly. “I think we’ve consolidated now to the point were the top 10 players comprise nearly three-quarters of the market from a capacity or an active fleet standpoint. That’s marginally better than it was a year or a year and a half ago.”

Asked if he thought the industry could be smaller but stronger coming out of this downturn, he said, “We think there will be a Darwinian outcome where companies that have the best equipment, durable balance sheets and continue to drive innovation are going to thrive.”

You can view both days of the conference with a complimentary registration at https://bit.ly/3l1pRFP.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.