Vanguard Natural Resources said it will market about 1,700 net acres in the Delaware Basin, adding the asset to the company’s initial 10% portfolio pruning announced last year. (Image: Hart Energy)

Vanguard Natural Resources Inc. sold Williston Basin assets and is pivoting from its November divestiture plans to now include producing acreage in the Permian Basin, the company said Jan. 18.

Vanguard, which exited Chapter 11 bankruptcy reorganization in August, sold its Williston working interests and leasehold for gross proceeds of $38.5 million. But two months after laying out plans to sell about 75,847 net acres in the Williston, the Wind River Basin and in Mississippi and Alabama, a more comprehensive post-bankruptcy strategy may be emerging.

Vanguard said it would market 1,700 net acres of Delaware Basin acreage in Ward County, Texas. The assets offer undeveloped deeper shale potential and include about 300 barrels of oil equivalent per day (boe/d) of production.

The company’s deep-rights Ward assets target the Bone Spring and Wolfcamp A and B.

Richard Scott Sloan, Vanguard’s new president and CEO, said the company is continuing its previously announced divestiture plans and that he expects the “2018 divestment program will lead to a more focused and less levered Vanguard by year-end.”

Vanguard had marketed 36,970 net acres in Montana and North Dakota, which in December averaged 1,000 boe/d. The production was about 90% oil.

Net proceeds were used to pay debt and the company’s borrowing base was reduced by about $25 million for the sale.

Vanguard said in November it would sell nearly 10% of its sprawling 774,000 net acres. Including the Williston, the three asset areas are being sold through different firms.

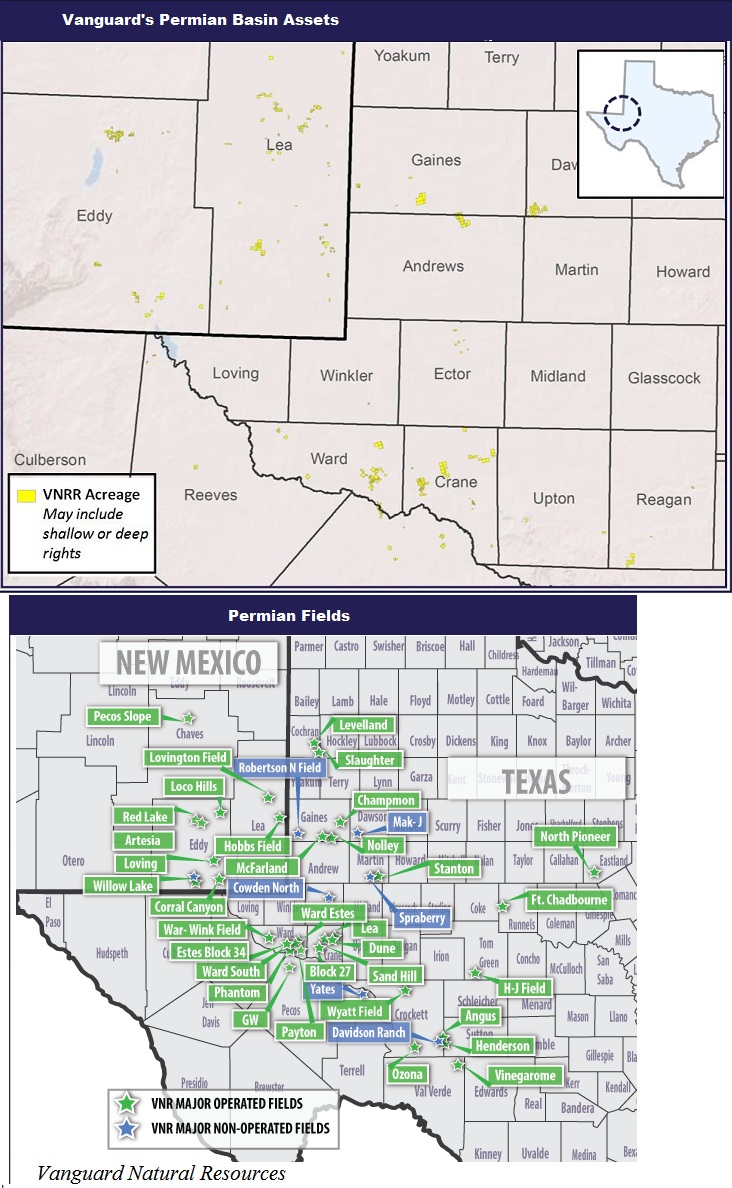

Vanguard’s assets span nearly every major basin in the Lower 48, though about 30% of its leasehold is in the Permian. Overall, the company holds 235,482 net acres within in the Permian in Texas and New Mexico, much of it HBP. However, as of Sept. 30, the acreage accounted for just 12% of Vanguard production.

Some of its others holdings in the Midland and Delaware may come up for sale since Sloan said the company intends to focus on core growth assets in Wyoming’s Pinedale and Wamsutter fields, Colorado‘s Piceance Basin and Oklahoma’s Arkoma Basin. The core positions total about 140,000 net acres.

While A&D has slowed in the Permian, acreage still transacts at high premiums and companies have increasingly gravitated to bolt-on deals rather than large-scale purchases. Since June, deals including Ward assets have averaged about $26,000 per acre.

Vanguard holds about 64,600 net acres of shallow or deep rights in core areas of the Delaware and Midland basins, the company said. In Ward, the company holds deep rights to about 1,666 net core basin acres.

Vanguard’s blocky, deep-rights leasehold is in the vicinity of Oasis Petroleum Inc.’s (NYSE: OAS) December acquisition of about 20,300 net acres for $946 million. Oasis paid about $38,200 per acre for assets in Loving, Ward, Winkler and Reeves counties, Texas.

Between a range of median acreage in the Permian and Oasis’ recent purchase, Vanguard’s acreage may be worth between $40 million and $65 million, excluding the value of production.

In September, Vanguard hired Jefferies LLC to advise its strategic opportunities committee, which is overseeing a review of the company’s portfolio and development plans to “simplify and refocus the existing asset base.”

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

DNO Acquires Arran Field Stake, Continuing North Sea Expansion

2024-02-06 - DNO will pay $70 million for Arran Field interests held by ONE-Dyas, and up to $5 million in contingency payments if certain operational targets are met.

Report: Devon Energy Targeting Bakken E&P Enerplus for Acquisition

2024-02-08 - The acquisition of Enerplus by Devon would more than double the company’s third-quarter 2023 Williston Basin production.

Talos Closes $1.29B Acquisition of GoM E&P QuarterNorth

2024-03-04 - Talos Energy closed a cash-and-stock acquisition of QuarterNorth Energy, adding scale in the Gulf of Mexico.

Eni, Vår Energi Wrap Up Acquisition of Neptune Energy Assets

2024-01-31 - Neptune retains its German operations, Vår takes over the Norwegian portfolio and Eni scoops up the rest of the assets under the $4.9 billion deal.

BOEM Announces Next Steps for GoM Lease Sales 262, 263, 264

2024-04-01 - BOEM said Lease Sale 262 is expected to take place in 2025.