(Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

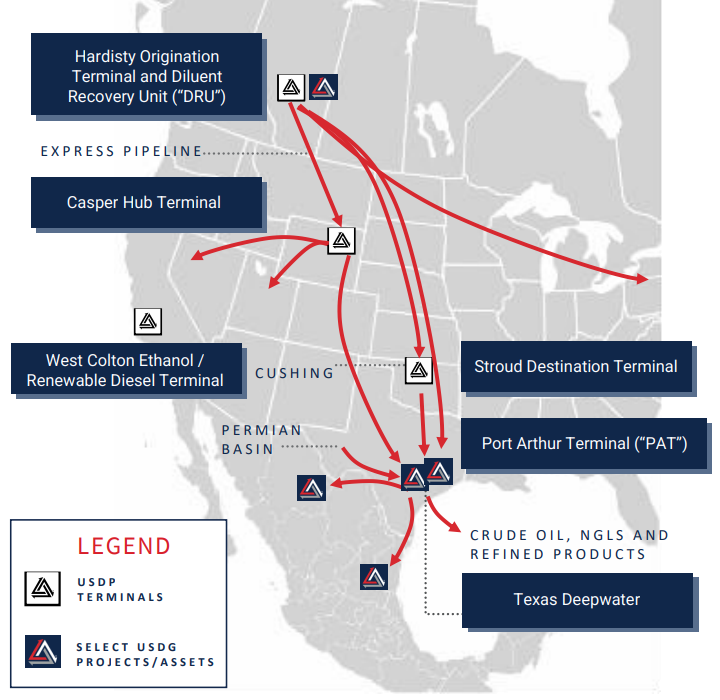

Midstream and energy logistics company USD Partners LP completed a sale of a rail terminal in Casper, Wyoming.

USD Partners (USDP) sold its Casper rail terminal to South 49 Holdings Ltd., a member of the Midstream Energy Partners group, for approximately $33 million in cash.

The deal, which was first announced on March 23, was completed on March 31, USDP said in a news release.

USDP plans to use most of the proceeds from the sale to reduce borrowings under the partnership’s revolving credit facility.

“As we continue to transition our business to lower carbon solutions, including our DRUbit™ by Rail™ network, we are reviewing all assets and their strategic fit in our growth plans,” said Dan Borgen, CEO of USDP.

USDP originally acquired the Casper terminal, a crude oil storage, blending and railcar-loading terminal, in November 2015.

Inbound heavy crude oil from Western Canada is delivered to the Casper terminal through the facility’s pipeline connection with Enbridge’s Express pipeline system, which supplies several different grades of heavy crude to customers, according to USDP regulatory filings.

The Casper facility also includes six storage tanks with 900,000 barrels (bbl) of total capacity and a train car-loading capacity of more than 100,000 bbl/d.

Outbound crude from the Casper terminal is loaded onto railcars and transported to key refining markets by BNSF.

Piper Sandler & Co. acted as financial adviser to USDP in connection with the terminal sale.

Recommended Reading

NOD Approves Start-up for Aker BP’s Hanz Project

2024-02-27 - Aker BP expects production on the North Sea subsea tieback to begin production during the first quarter.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.