DENVER—The role of world’s major exporters in maintaining a reasonable supply and demand balance has become critical once again due to the rising production potential in U.S., said Thomas A. Petrie, chairman of Petrie Partners, while speaking at Hart Energy’s recently held DUG Rockies Conference and Exhibition.

Petrie characterized the global oil supply and demand dynamics as a “fragile balance” because the U.S. shale revolution, which increased production potential and turned the country into an oil exporter, has created periods of real challenge for both OPEC and non-OPEC exporters like Russia.

“OPEC decided to bend the supply curve for less than a year and unleashed the country’s degree of innovation and extension of opportunities with better frack patterns, longer reach horizontals and further development of less mature opportunities for development of wells onshore,” he said.

RELATED ARTICLES:

- Energy Sources Continue to Change, Deals Will Continue

- Rex Tillerson On The ‘Nature Of The Beast’

- San Juan Operators: Basin Ripe For New Horizontal Drilling

- DUG Rockies: A Special Address From Colorado Senator John Cooke (Video)

The U.S. is more secure than most large economies, according to a report by U.S. Chamber of Commerce’s Institute for 21st Century Energy. The report ranks U.S. seventh in the world because of new discoveries of oil and natural gas and declining power use driven by policies to promote efficiency.

“The U.S. oil and gas resource potential qualified it to reassert a meaningful degree of global energy supply leadership,” Petrie said.

WATCH: Tom Petrie's full address to DUG Rockies

The U.S. Department of Energy projects an average oil output of 13.4 million barrels per day (MMbbl/d) in 2020, and Petrie credits the increase to the buildout of infrastructure to move the oil to relevant markets.

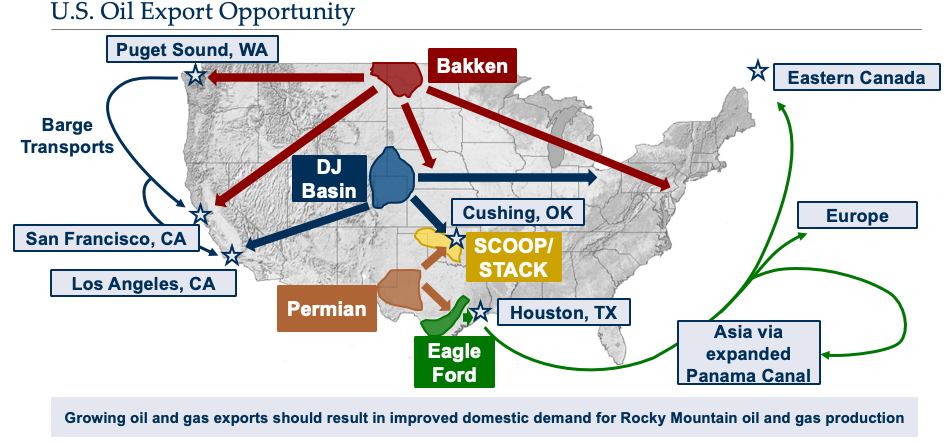

“Looking back at the period up to late 2014, development of the Bakken has led to a rapid move in production from a few thousand barrels per day to 1.4 million barrels per day. Similarly, in Eagle Ford, production exceeded million barrels per day in a very short time,” Petrie said. “During that period every onshore producer tried innovative means of transporting liquids to market. Train, railcars, barge lines and pipelines were among the main means of transportation used.”

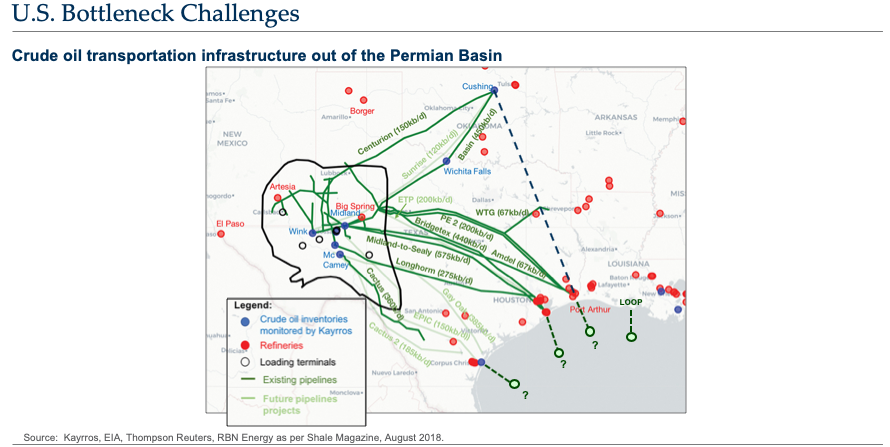

Although the Permian Basin boom has increased production capacity, there are several bottlenecks that need to be addressed. Due to the historic U.S. reliance on imports of crude, most capacity at Gulf Coast refineries was designed to process heavy crude. One of the big ongoing issues is the lack of existing refining capacity to process the light, sweet oil coming out of the Permian. Petrie explained that innovations and cost effective solutions for debottlenecking at the refinery level is crucial. Petrie also highlighted the need for the expansion of the Panama Canal owing to the increase in exports of light, sweet oil to the Atlantic Basin and Pacific Rim.

U.S. is also aiming to become one of the top three exporters of natural gas in the world, alongside Qatar and Australia. The Energy Information Administration (EIA) projects that U.S. LNG export capacity will reach 8.9 Bcf/d by the end of 2019. Petrie added that the growing oil production in U.S. shale plays is leading to large amounts of associate gas production—which is often more than local pipelines can handle. By the end of 2020, Permian gas production is expected to increase by 5.5 Bcf/d while the Marcellus gas play is projected to grow production by 6.1 Bcf/d during the same period. Petrie added that projects are underway to double the export capacity by 2021.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.