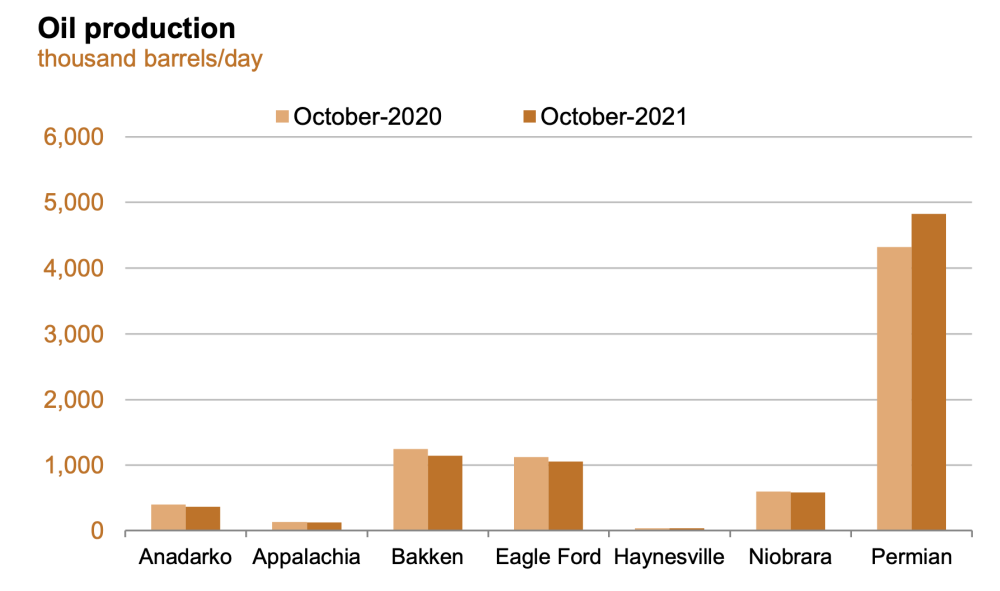

On a year-over-year basis, only the Permian Basin is expected to see an increase in oil production, with volumes up 503,150 bbl/d, or 12%, says Enverus’ Erin Faulkner. (Source: Photo collage by Hart Energy; images from Hart Energy, Shutterstock.com)

Oil and gas production from major U.S. shale plays is expected to rise in October, largely driven by an anticipated increase in Permian Basin output, according to the latest forecast by the Energy Information Administration (EIA).

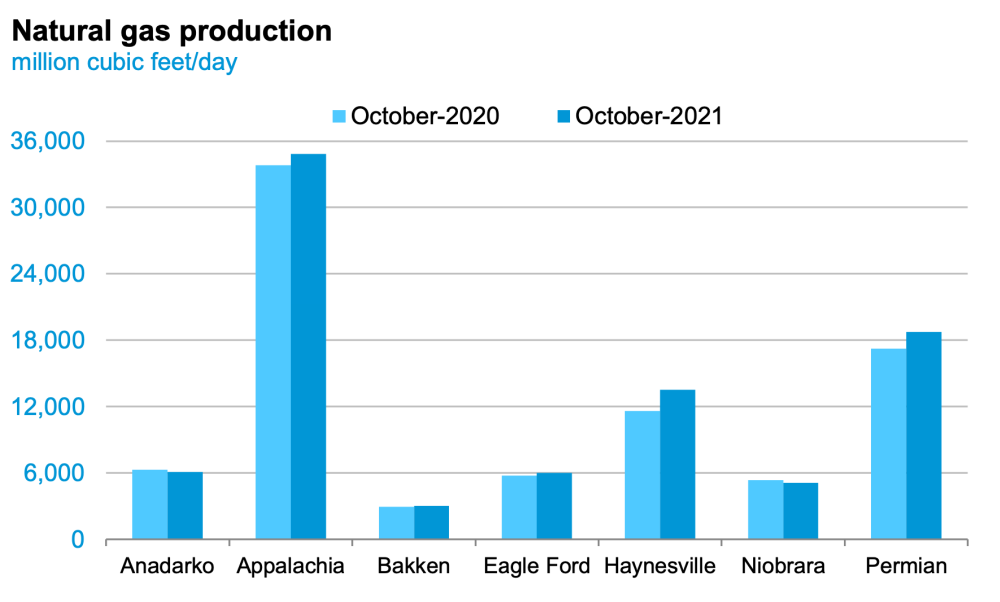

For the seven key shale regions included in the EIA’s monthly Drilling Productivity Report, the government agency is forecasting oil output will rise 66,000 bbl/d sequentially to 8.135 million bbl/d in October. Similarly, the EIA predicts shale gas volumes will increase 219 MMcf/d to 87.339 Bcf/d.

The projected increase in production follows recent reports by the EIA of a sharp decline in the DUC count in all major U.S. shale regions. The DUC well inventory typically “functions as a necessary buffer between drilling activities and oil demand,” the EIA noted in a supplement to its Drilling Productivity Report.

“Because drilling new wells has been significantly reduced, the inventory of DUC wells provides short-term reserve for the completion of new wells,” the EIA wrote.

The EIA Drilling Productivity Report uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil and natural gas wells to provide estimated changes in oil and natural gas production for several key shale regions in the U.S. These regions are comprised of the Anadarko, Appalachia, Bakken, Eagle Ford, Haynesville, Niobrara and Permian basins.

RELATED:

US Shale DUC Count Continues to Plunge

According to the EIA report published Sept. 13, the Permian Basin will see the largest increase in oil production. Volumes in the Permian are forecast by the EIA to rise in October by 53,000 bbl/d to 4.826 million bbl/d.

Oil production in the Niobrara, Bakken and even Appalachia is also set to see an increase—the Niobrara by 9,000 bbl/d to 585,000 bbl/d, the Bakken by 5,000 bbl/d to 1.144 million bbl/d and Appalachia by 1,000 bbl/d to 126,000 bbl/d.

However, Eagle Ford oil production will remain unchanged at 1.053 million bbl/d and oil production in the Anadarko Basin is projected to fall 2,000 bbl/d to 367,000 bbl/d.

“On a year-over-year basis, only the Permian is expected to see an increase, with volumes up 503,150 bbl/d, or 12%,” wrote Enverus’ Erin Faulkner in a research note by the firm on Sept. 14.

As for natural gas, every shale play is expected to see a month-over-month increase in production except for the Anadarko Basin, where output is forecast to fall by 37 MMcf/d to 6.102 Bcf/d.

The Haynesville will lead in natural gas production, increasing 82 MMcf/d to 13.497 Bcf/d. Gas production in the Appalachia and Permian basins will also rise—Appalachia by 74 MMcf/d to 34.857 Bcf/d and the Permian by 63 MMcf/d to 18.763 Bcf/d.

Recommended Reading

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Segrist: The LNG Pause and a Big, Dumb Question

2024-04-25 - In trying to understand the White House’s decision to pause LNG export permits and wondering if it’s just a red herring, one big, dumb question must be asked.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.