U.S. shale players maintain focus on operational efficiencies. (Source: Austin Fellmy/Shutterstock.com)

Efficiency improvements are diluting the impacts of inflationary pressure seen in U.S. shale plays, executives say, as operators reap the benefits of simul-fracs, improved cycle times and longer lateral lengths.

How long the streak lasts remains to be seen.

The topic surfaced during second-quarter earnings calls this week with shale players such as EOG Resources Inc., ConocoPhillips Co., Diamondback Energy Inc. and Pioneer Natural Resources Co. fielding questions from analysts. Oil producers have been reporting higher quarterly profits and cash flows alongside continued efficiency gains as the world’s energy demand rises.

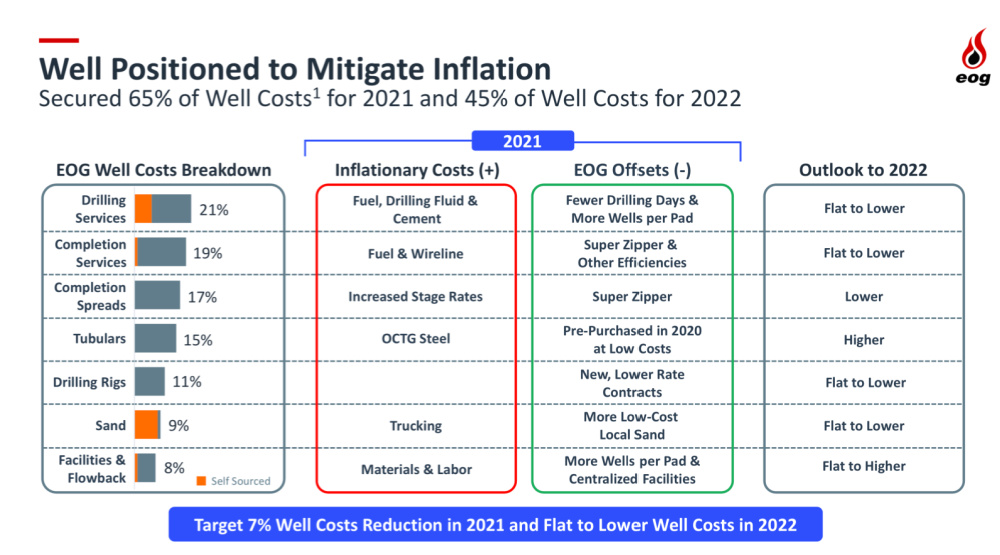

EOG has been taking a forward-looking approach while focusing on operational efficiencies by drilling wells faster and completing more lateral feet per day. The company is also seeing savings in sand costs and from water reuse and super zipper completions, which comprise about one-third of its well packages, according to COO Billy Helms.

“We continue to see operational improvements outpace the inflationary pressure in the service sector,” Helms told analysts Aug. 5.

A key component to EOG’s approach is locking in lower prices early such as for tubulars.

“Last year, we were very fortunate to take advantage of prepurchasing of tubulars we needed for this year’s program and benefited greatly from that,” Helms said. “As costs go up in the future, we use the same approach and try to take an opportunistic look at when to secure tubulars for the next coming drilling program. … Undoubtedly, it is likely that the cost for tubulars will be higher next year than they are this year.”

Inflation on diesel, steel and other materials is visible. It’s also evident for labor.

By year-end, inflation could hit 12% or more for the North American shale sector, Citigroup analysts said in a Bloomberg report. Analysts said steel prices for drill pipe could rise about 50% this year. Competition among oilfield service companies was among the factors for why service providers haven’t raised prices. Spending on such services has been flat as producers hold production steady, instead opting to reduce debt and increase shareholder payouts despite improved oil prices.

However, companies aren’t seeing inflation everywhere.

“If you’re a pure-play, one basin kind of operator, you’re probably going to experience certain categories of spend that are inflating,” ConocoPhillips CEO Ryan Lance said during the company’s Aug. 3 earnings call. “I think the advantage ConocoPhillips has right now is we’re still capturing a lot of the best practices and the synergies from the Concho transaction, plus the fact that we’re a global diversified company. Other areas around the world are not inflating maybe like some of the economies that are leading the recovery from the COVID pandemic.”

He called the inflationary issues imminently manageable this year and into 2022.

“I think the important point is that we still have wind in our sails from the transaction,” added Dominic Macklon, senior vice president of strategy and technology for ConocoPhillips. The company in late June 30 said it now expects Concho-transaction synergies and savings of $1 billion annually.

“That does not mean we are done with sourcing supply chain efficiencies and operational efficiencies,” Macklon said.

RELATED: ConocoPhillips Sees More Upside with Technology Post Concho Deal

He acknowledged seeing some inflation in tubulars and cement in the Lower 48 plus some pressure on frac crews, but said ConocoPhillips is “well-placed to manage inflationary effects” given deflation elsewhere and momentum from the transaction.

Focusing on Efficiency

Efficiency remains a key driver in companies’ ability to do more with less.

Diamondback CEO Travis Stice applauded the team during an Aug. 3 earnings call for pushing the boundaries of current thought processes and embracing new technologies and playbooks, including those brought aboard via the company’s acquisition of QEP Resources Inc.

“We’ve decreased our drill times from spud to total depth by over 30% and are averaging just over 10 days to drill a two-mile well in the Midland Basin. On the completion side, we’re now running three simul-frac crews, which lowers our downtime and improves our pad efficiencies,” Stice said. “We are currently completing approximately 2,800 lateral feet per day in the Midland Basin, an improvement of nearly 70% as compared to our early zipper frac designs. All of these operational advances translate to our ability to do more with less.”

RELATED: Fighting the Fight: Diamondback Energy Shares Survival Tactics

Such efficiencies have more than offset cost increases, he said, enabling the company to decrease the number of rigs and crews needed this year and lower its full-year capital guidance by $100 million.

Oklahoma City-based Devon Energy Corp. also said Aug. 3 that efficiency gains, particularly in the Delaware Basin where the company added acreage through its acquisition of WPX Energy, drove capex to 9% below guidance during the second quarter. Capital spend for the quarter was $509 million.

Guidance was unchanged for Devon and Pioneer.

“There’s no change to our full-year oil production guidance range of 351,000 to 366,000 barrels of oil per day and total production of 605,000 to 631,000 boe per day,” Rich Dealy, president and COO of Pioneer Natural Resources, said Aug. 3. “Similarly, capital is unchanged at $2.95 billion to $3.25 billion. But we are seeing some inflationary pressure, although most of it is being offset by our efficiency improvements by the great work by our drilling and completions and facilities team.”

Since 2017, Pioneer’s drilling and completions teams have seen a more than 75% improvement in their completed feet per day and a more than 65% improvement in drilled feet per day.

“This turns even more impressive when considering our increased activity levels, including the integration of Parsley and DoublePoint,” added Joe Hall, Pioneer’s executive vice president of operations.

The acquisitions bumped Pioneer’s Permian Basin acreage to more than 1 million acres. It has already identified more than 1,000 locations where it can drill more 15,000-ft laterals. Pioneer’s average pad size has grown to about four from three wells in 2018.

Pioneer said it is also increasing completions efficiencies with simul-frac and has plans to operate two simul-frac fleets during second-half 2021.

Stimulating two horizontal shale wells at the same time with one pressure pumping fleet is saving time and money for many operators. However, there are limitations, said Hall, who told analysts he is often asked why not convert all fleets to simul-fracs.

“One is logistics, particularly around water, because we basically double the water requirements in one area,” Hall said. “If all of our frac fleets were working under simul-frac operations, we’d have to spend a significant amount of capital to upgrade our water systems and of course, logistics around sand as well.”

Another concern involves the number of wells on a pad.

“If you have an odd number of wells on the pad, it can have a slight impact on the efficiency,” he said. “But primarily we want to make sure that we’re efficiently deploying capital and are getting the bang for the buck.”

Recommended Reading

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

PGS Wins 3D Contract Offshore South Atlantic Margin

2024-04-08 - PGS said a Ramform Titan-class vessel is scheduled to commence mobilization in June.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.

TGS Commences Multiclient 3D Seismic Project Offshore Malaysia

2024-04-03 - TGS said the Ramform Sovereign survey vessel was dispatched to the Penyu Basin in March.

Curtiss-Wright to Deploy Subsea System at Petrobras' Campos Field

2024-02-12 - Curtiss-Wright and Petrobras will combine capabilities to deploy a subsea canned motor boosting system at a Petrobras production field in the Campos Basin.