The deal will help consolidate Chesapeake’s position in Louisiana’s Haynesville basin and add about 370 drilling locations, betting on the field's proximity to the growing U.S. Gulf Coast export hub. (Source: Shutterstock.com/Hart Energy)

[Editor's note: This story has been updated from a previous version posted at 8:24 a.m. CT Aug. 11.]

Chesapeake Energy Corp. agreed on Aug. 11 to acquire Vine Energy Inc., which is set to make Oklahoma City-based Chesapeake the largest producer in the Haynesville Shale.

The acquisition is a “zero premium” transaction valued at approximately $2.2 billion, based on a 30-day average exchange ratio as of close on Aug. 10, equating to $15 per share. The deal is also expected to help consolidate Chesapeake’s position in Louisiana’s Haynesville Shale, as the company bets on the gas basin’s proximity to the growing LNG export hub along the U.S. Gulf Coast, according to Andrew Dittmar, senior M&A analyst at Enverus.

"Given its high focus on gas with nearly 90% of capital spending slated for the Haynesville and Appalachia, it makes sense that the company would look to one of those two basins for an acquisition," Dittmar said in an emailed statement. "With a mix of public and private acquisition opportunities, strong well results, and higher confidence around future pricing for production given its geographic location close to Gulf Coast gas markets and adequate infrastructure, it is easy to see why Chesapeake ultimately chose the Haynesville for expansion."

RELATED: Chesapeake Energy Aims to Take Lead in Responsibly Sourced Gas Movement

Vine shareholders will receive fixed consideration of 0.2486 shares of Chesapeake common stock plus $1.20 cash per share of Vine common stock, for total consideration of $15 per share, comprising of 92% stock and 8% cash with Blackstone Energy Partners, which owns 70% of Vine shares outstanding.

"For Vine, the deal ends a brief run as a publicly traded company that started when the Blackstone-funded private E&P went public at $14 per share in March of this year," Dittmar said. "That fits the common theme that investors are not interested in growing the ranks of publicly traded E&Ps and want fewer and larger companies in the shale plays. This deal moves the industry one step closer to that goal."

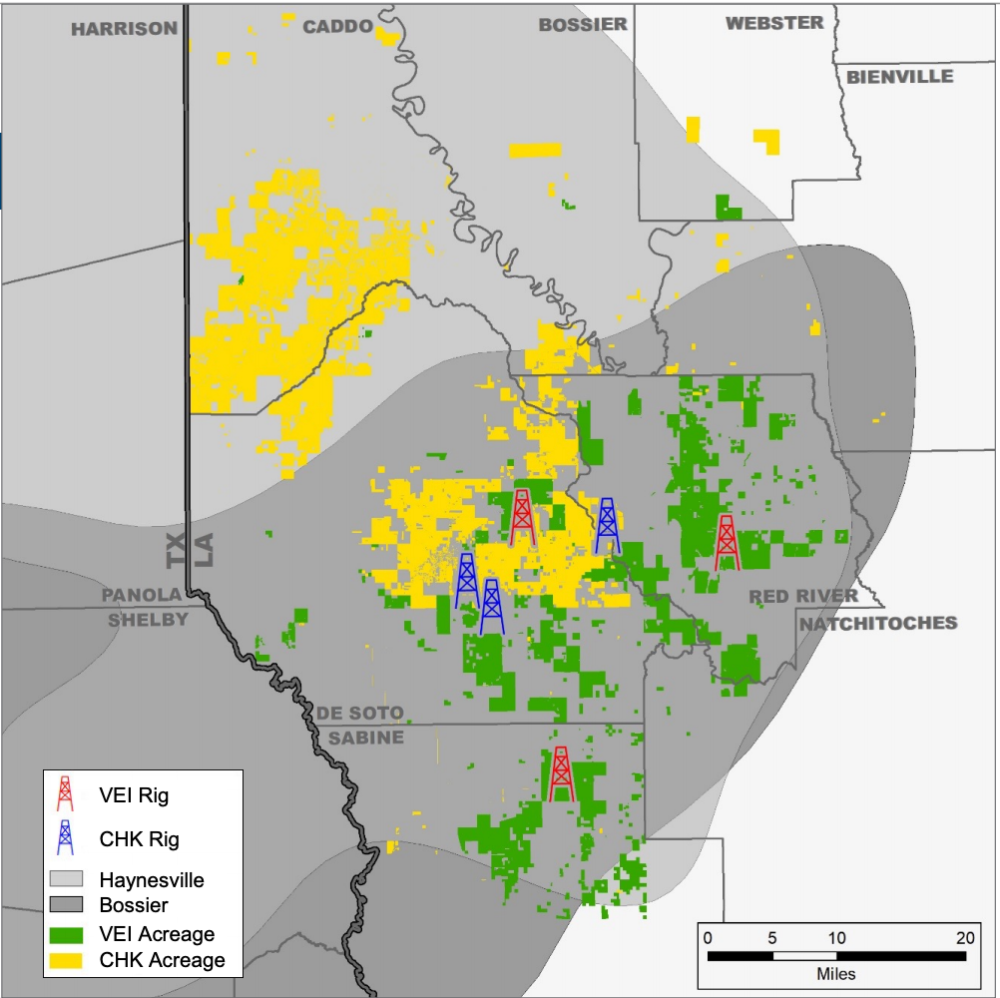

Based in Plano, Texas, Vine Energy held 227,000 net effective acres in the Haynesville Basin located in North Louisiana with exposure to two substantial pay zones: the Haynesville and Mid-Bossier. The company first entered the basin in 2014 through the acquisition by its predecessor of Royal Dutch Shell Plc’s Haynesville position.

Earlier this month, Vine Energy also pledged to become the first natural gas producer in the Haynesville Basin to certify 100% of its assets as “responsibly sourced” through an agreement with Project Canary, joining Chesapeake Energy which had already announced a similar partnership with the Denver-based firm.

Chesapeake expects the acquisition of Vine to add roughly 370 premium drilling locations with greater than a 50% rate of return at $2.50 gas. The company also said the deal will be accretive to operating cash flow per share and free cash flow per share, with $50 million in savings expected on operating and capital synergies.

Upon closing, Chesapeake shareholders will own approximately 86% and Vine shareholders will own approximately 14% of the fully diluted shares of the combined company. Additionally, the company’s board had approved an increase on the common dividend of 27% to $1.75 per share on expected cash flow accretion.

“In our view, strategic rationale of the deal makes sense given acreage footprints, increasing Chesapeake’s Haynesville exposure to 348,000 net acres with pro forma second-quarter net production of 1.58 Bcf/d,” analysts at Tudor, Pickering, Holt & Co. (TPH) wrote in a research note.

According to TPH analysts, Chesapeake’s standalone guidance may draw some attention on capex of $900 million to $1.2 billion versus TPH estimate of $840 million and a street value of $820 million.

“We think the delta lies in rig addition to oil weighted assets,” TPH said. “Our current model shows two rigs allocated to oil plays with production of 20.4 MMbbl (low end of the 20 to 22 MMbbl 2022 guidance and vs. street 19.1 MMbbl), a quick sensitivity by adding a third rig would increase production to 21.7 MMbbl and $1.05 billion, aligning with the midpoint of capex.”

The acquisition increases Chesapeake's cumulative five-year free cash flow outlook by approximately $1.5 billion, or 68% of the transaction value, to approximately $6.0 billion, or 66% of pro forma enterprise value.

“By consolidating the Haynesville, Chesapeake has the scale and operating expertise to quickly become the dominant supplier of responsibly sourced gas to premium markets in the Gulf Coast and abroad," said Mike Wichterich, Chesapeake's board chairman and interim CEO.

On Aug. 10, Chesapeake raised its full-year forecasts for adjusted income and production after beating second-quarter estimates, expects to increase its base dividend by 27% to $1.75 per share after the deal closes, expected in the fourth quarter.

Chesapeake's preliminary plan is to operate 10 to 12 rigs in 2022, with 8 to 9 rigs focused on its gas portfolio and 2 to 3 rigs concentrating on its oil assets. The company will maintain its commitment to a disciplined capital reinvestment strategy, anticipating a 2022 reinvestment rate of 50% to 60%.

“The move today adds Chesapeake to the list of companies taking a ‘basin dominance’ growth strategy," Wood Mackenzie’s Lower 48 team said while commenting on the acquisition. “This deal reminds us somewhat of Concho and RSP Permian. An all-stock transaction that elevates the benchmark for basin consolidation. After Concho/RSP, other big deals followed as competitors didn't want to be left behind. What will Comstock or even Tellurian do now?”

Recommended Reading

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.