U.S. oil companies developing shale assets say they are seeing inflation in areas such as fuel, labor, pressure pumping, OCTG and sand. (Source: Freeze Frames/Shutterstock.com)

U.S. shale players are experiencing cost inflation that is expected to continue into 2022, including in the Permian Basin, as costs continue to rise for services and goods such as labor, fuel, pressure pumping, OCTG and sand, according to the head of the world’s largest independent E&P company.

ConocoPhillips CEO Ryan Lance said inflation is ranging from high single-digit to low double-digit in the Lower 48, compared to 2% to 3% inflation globally. In the U.S., inflation rates could be around the mid-single digit range going into next year. Speaking to analysts this week on the company’s earnings call, Lance said ConocoPhillips has been seeing inflationary pressures but doesn’t expect it to lead to a significant departure from the company’s June capex guidance or a shift in where capital is allocated.

“As we think about it going forward, it’s an opportunity for us to try to offset as much of that through some modest scope reduction and efficiencies,” Lance said.

Oil and gas companies have been finding lasting operational efficiency gains by drilling longer laterals, simultaneously stimulating horizontal wells with one pressure pumping unit and utilizing other time- or money-saving technologies and techniques.

Many have been doing more with less, looking to keep costs in check and investors happy, even as demand picks up and oil prices improve. The continued focus comes as the industry—like other sectors—copes with supply chain woes and labor shortages.

Oilfield service companies had already warned of inflation and passing along rising costs.

A Federal Reserve Bank of Dallas third-quarter 2021 survey of more than 140 E&P and oilfield service firms in mid-September showed costs were rising sharply. The index for input costs for oilfield service firms hit a record high of 60.8, indicative of significant cost pressures, the Dallas Fed survey said. For E&Ps, indexes for finding and development costs as well as lease operating expenses also rose.

Add to this longer supplier delivery times.

“Among oilfield services firms, the index for supplier delivery time increased from 14.0 in the second quarter to 26.7 in the third, the highest reading since the survey’s inception in 2016,” the survey showed. “The index measuring delays in deliveries increased to 26.7, also a record high. Similarly, among E&P firms, the index for supplier delivery time increased from 4.0 to 10.5.”

As ConocoPhillips finalizes plans for 2022, Lance said the company is closely watching the macro and keeping eyes on inflation and potential OBO pressures while undertaking its typical capital high-grading processes.

“It goes without saying the market certainly appears to be more constructive,” Lance said, “but we must always remember that this is an incredibly volatile business.”

Inflation was among the recurring topics of interests for analysts questioning top oil and gas executives on third-quarter earnings calls this week.

Diamondback Energy CEO Travis Stice addressed inflation concerns within the first few minutes of his opening remarks, speaking to how the company has offset inflationary items through efficiency gains in design and execution.

“On the drilling side, we’ve decreased the number of days it takes to drill from spud to total depth by nearly 30% this year alone, and we are now drilling three-mile laterals in roughly 10 days in the Midland Basin,” Stice said. “On the completion side of the business, we’ve seen a step change in efficiency as we transition the majority of our completion crews to simul-frac operations and are now completing wells in the Midland Basin nearly 70% faster than when we were utilizing the traditional zipper frac design.”

The gains, he said, drove Diamondback’s beat on capex for the third quarter and enabled the company to lower its capex for the second consecutive time this year.

Diamondback decreased its full-year capex budget by 10% to between $1.49 billion and $1.53 billion, compared to its original 2021 budget.

“The efficiencies gained this year will be permanent,” Stice said. “And while inflation may impact services prices next year, Diamondback will be more insulated than our peers given our control over the variable cost of well design, days to total depth on the drilling side and lateral feet completed per day on the completion side of the business.”

Stice said 2021 has been a year of rising costs for steel, diesel and sand. He called it logical, however, given labor tightness. Where the rig count goes next will factor into preparations for potential 2022 service cost inflation.

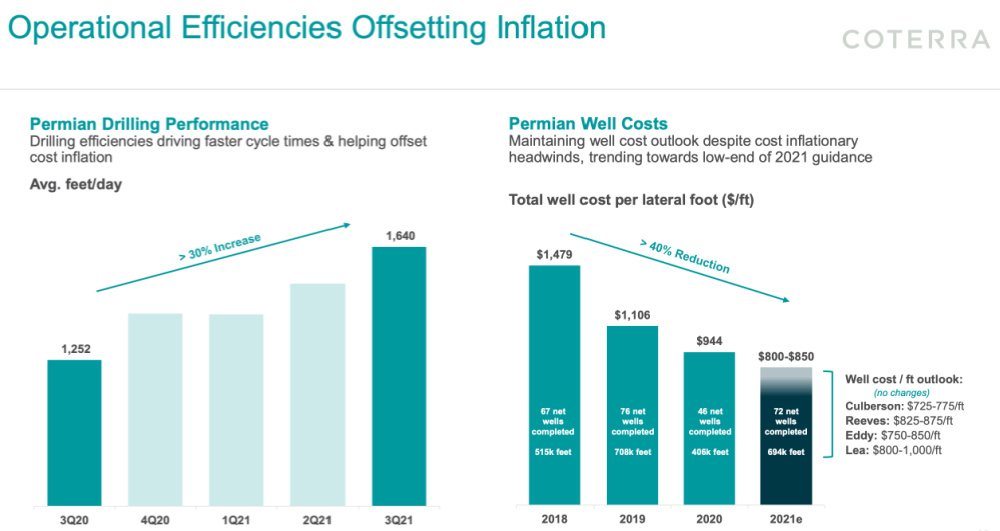

Coterra Energy, which recently formed through the merger of Cabot Oil & Gas and Cimerex Energy, has also experienced inflation. Like some of its peers, the company’s capex trended toward the low-end of guidance—thanks again to operational efficiency.

“We’ve seen inflation just like everybody else. We’ve seen it in steel; we’ve seen it in fuel; we’ve seen it in labor,” said Blake Sirgo, vice president of operations for Coterra. “We’re working right now to try to model that for ’22. ... But we expect continued operational efficiency to help offset any future inflation.”

The company, however, is still trying to quantify cost savings from simul-frac.

“Right now, we really like our zipper operations. We like our pad operations. We’ve seen tremendous efficiencies there,” Sirgo said.

Given the continued conversation about steady cost inflation and operational efficiencies, one analyst wanted to know whether the company or industry in general is thinking more about maximizing the potential of scale or perhaps focusing on a narrower set of basins.

When it comes to scale, aggregating land to be able to drill two- or three-mile laterals can lead to “tremendous cost savings,” Coterra CEO Tom Jorden said, adding aggregation to most efficiently deploy infrastructure dollars and procurement are also important.

However, he said, “scale can be overblown” once these areas are covered and great operational teams are in place.

“If scale alone was the answer, I think the majors would have the lowest cost structure in our business, and clearly that’s not the case,” Jorden said. “I think scale is important, but it’s important to a point.”

Coterra has a top tier asset base across over 700,000 net acres in the Marcellus, Permian and Anadarko shale basins.

“We think we’ve got what we need to deliver lowest cost,” Jorden said, before turning back to inflation. “Our vendors are our partners and they need to make a significant living as well. They need to show up with well-maintained equipment, a commitment to safety and well-trained crews.

“We understand some of this inflation is an inevitable outcome of good partnerships,” he added. “Of course, we’re going to complain like crazy, but we’re also going to be supportive of our vendors.”

Recommended Reading

Which Haynesville E&Ps Might Bid for Tellurian’s Upstream Assets?

2024-02-12 - As Haynesville E&Ps look to add scale and get ahead of growing LNG export capacity, Tellurian’s Louisiana assets are expected to fetch strong competition, according to Energy Advisors Group.

From Tokyo Gas to Chesapeake: The Slow-burning Fuse that Lit Haynesville M&A

2024-03-01 - TG Natural Resources rides the LNG wave with Rockcliff deal amid shale consolidation boom.

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

2024-04-09 - With buyers “starved” for top-tier natural gas assets, Appalachia could become a dealmaking hotspot in the coming years. Operators, analysts and investors are also closely watching what comes out of the ground in the Ohio Utica oil fairway.

Exclusive: Rockcliff CEO on $2.7B TGNR Deal, Value of Haynesville M&A

2024-04-10 - Rockcliff Energy CEO and President Alan Smith discusses the ups and downs of executing the transaction with TG Natural Resources and what's on the Rockcliff III radar, in this Hart Energy Exclusive interview.

An Untapped Haynesville Block: Chevron Asset Attracts High Interest

2024-04-03 - Chevron’s 72,000-net-acre property in Panola County, Texas is lightly developed for the underlying Haynesville formation — and the supermajor may cut it loose.