(Source: FreezeFrames/Shutterstock.com)

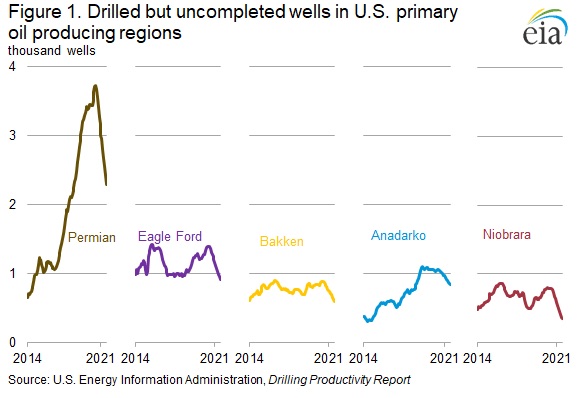

U.S. shale players are opting to finish what they’ve started, sending the number of drilled but uncompleted wells (DUCs) down to levels not seen since November 2017, data from the Energy Information Administration (EIA) show.

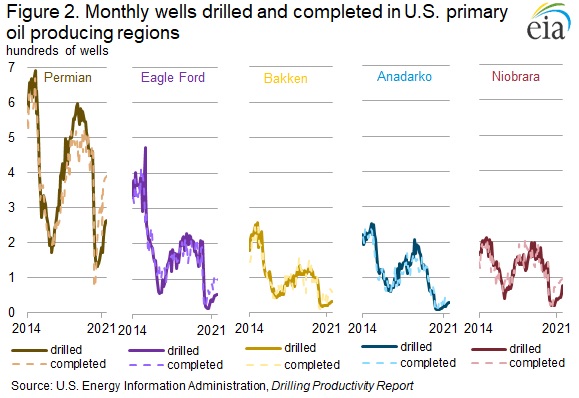

The activity has kept frac crews busy in recent months, but a slowdown appears imminent in the months ahead—unless more rigs are added to drill and complete more new wells.

“Indicators of new well drilling in the United States remain subdued,” the EIA said Aug. 25 before referring to the latest Baker Hughes oil rig count of 405 rigs. Though the rig count is nearly double what it was a year ago, the EIA called it “historically low” compared to times of similar oil prices. “If drilling activity doesn’t increase, then well completions and production may be limited as the inventory of DUCs continues to fall.”

The DUC count dropped to 5,957 in July, down from 6,215 in June, according to the EIA. All major oil- and gas-producing regions in the U.S. saw declines. Counts in the Eagle Ford, Bakken and Niobrara oil basins hit their lowest levels since December 2013, while DUC inventories in the Anadarko and Permian Basin hit levels not seen since June 2018.

The biggest decline was evident in the Permian Basin, the nation’s largest oil field, where the EIA estimated there was less than six months of DUCs left in July 2021. At that time, EIA data showed there were about 2,289 DUCs in the Permian, down 130 from the previous month. Citing its latest Drilling Productivity Report, the EIA said 393 wells were completed in the Permian in July.

“The combination of more wells being completed but fewer wells being drilled is contributing to the return of oil production in the Permian region,” the EIA said this week. “However, it is driving the current DUC inventories down, which could limit oil production growth in the United States in the coming months.”

It later added, “The low months of inventory in the Permian region may affect completion activity [slowing it down] or new well drilling activity [speeding it up].”

Still under pressure to control spending, U.S. shale producers have been able to quickly increase output as oil prices rebound from pandemic-induced lows by turning to DUCs.

This comes as crews continue gaining efficiency by advancing completion techniques with new processes like simul-frac—a process in which two horizontal shale wells are stimulated at the same time with one pressure pumping fleet to cut time and save money.

Diamondback Energy, which produced more during the second quarter with fewer drilling rigs and completed wells, is among the companies running simul-frac crews. During its latest earnings call, CEO Travis Stice said the company was completing about 2,800 lateral feet per day in the Midland Basin, nearly a 70% improvement compared to its early zipper frac designs.

“We’re completing 270 wells and drilling 220 this year,” Diamondback CFO Kaes Van't Hof added on the call. “That’s about another $100 million benefit. When you were running as many rigs as we were into the downturn, we decided to not pay early termination fees and instead build a DUC backlog, which was the best use of investor dollars at the time, and we’re taking advantage of that a little bit this year.”

The company dropped two rigs in the second quarter, but said it will likely bring both back.

“We’ll probably need somewhere around 11 or 12 rigs next year, three simul-frac crews and maybe a fourth spot crew to execute on that plan, which is a testament to how efficient the operations team has gotten here,” Van’t Hof said.

Pioneer Natural Resources, which also utilizes simul-frac, plans to add one to two rigs to grow 5% in 2022. CEO Scott Sheffield has previously warned that U.S. shale would not see much growth in the coming years. He anticipates little growth in the Permian with most other basins flat to declining.

“We’ll be lucky to grow 5% a year over the next several years in the U.S. Lower 48,” he said on an earnings call. “That’s my general opinion, and I think as more companies deliver their free cash flow model, they can’t change it.”

Output from U.S. shale plays is expected to rise to 8.1 MMbbl/d in September, according to the EIA. However, total oil production is forecast to fall to 11.1 MMbbl this year, down from 11.3 MMbbl/d. The EIA forecasts production to rise to 11.8 MMbbl/d next year. The U.S. produced more than 12 MMbb/d in 2019.

Recommended Reading

Cheniere Energy Declares Quarterly Cash Dividend, Distribution

2024-01-26 - Cheniere’s quarterly cash dividend is payable on Feb. 23 to shareholders of record by Feb. 6.

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.