Barrels or oil drums with American flag. (Source: Novikov Aleksey / Shutterstock.com)

Increasing gas, diesel and jet fuel prices are hitting U.S. consumers and businesses hard. To partially mitigate these price effects, the U.S. government recently proposed banning refined product exports with the aim that, by cutting off the almost 2 MMbbl/d of product exports, the resultant glut of supply in the domestic market would disconnect the United States from international markets and push prices down.

The gasoline price reached an all-time high in June due to a combination of factors: disruption of supply from Russia because of the conflict in Ukraine; loss of global refining capacity due to the COVID-19 pandemic and lower long-term demand expectations owing to energy transition; a sharp reduction in Chinese exports to the global market; and a robust post-pandemic recovery of product demand. These drivers have pushed prices globally and, as U.S. product is connected to the global market through both imports and exports, an export ban would be the way to break the link and provide price relief.

Impact on balances and flows

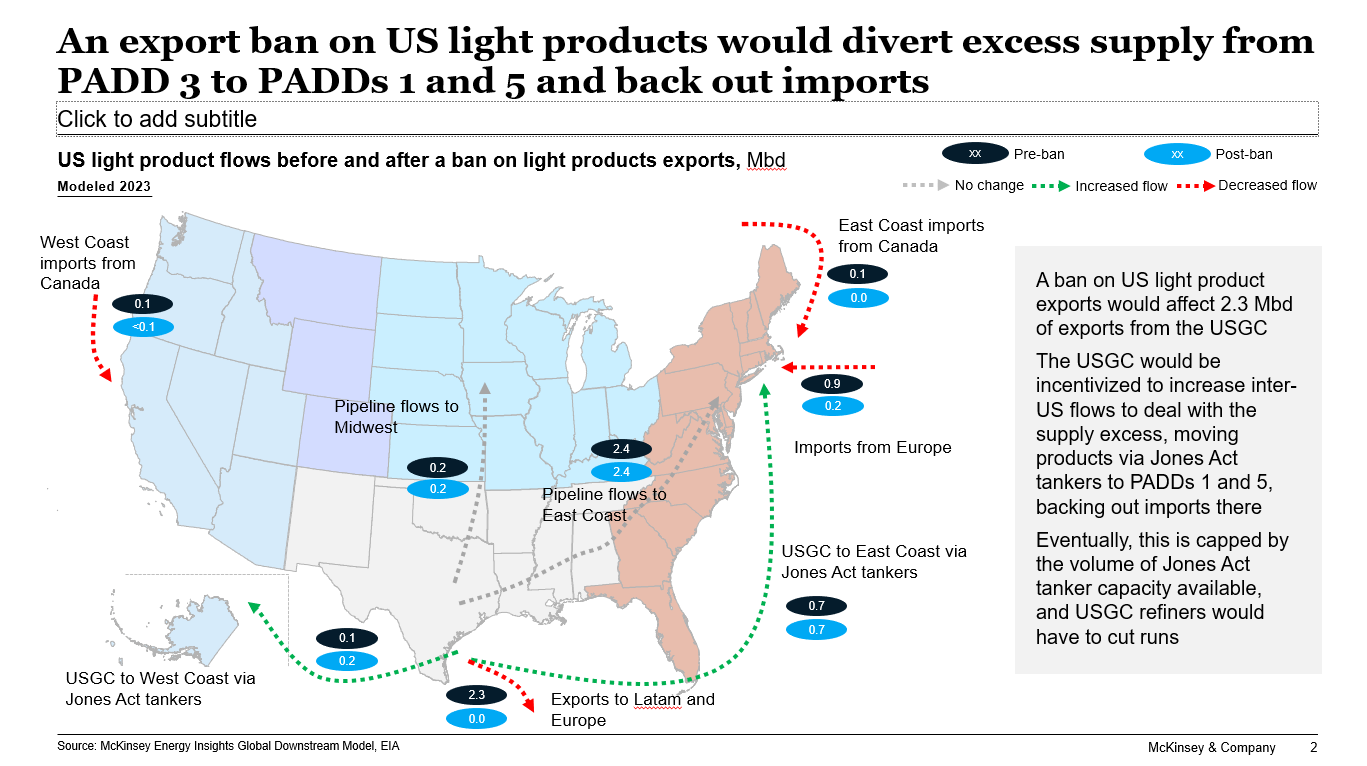

About 1.7 MMbbl/d of direct exports of gasoline, diesel and jet fuel would be removed by taking U.S. refined products exports out of the global market. Most product exports come from the U.S. Gulf Coast, where refining capacity far exceeds local demand and excess product can be efficiently moved to other parts of the country by pipeline and barge. In 2021, the majority of Gulf Coast production was for domestic use, with exports going primarily to markets with a shortage of refining capacity in Latin America. Marginal volumes of diesel move to Europe where they compete with imports coming from Asia.

Gulf Coast refiners are able to move large volumes of refined products profitably due to a number of strategic advantages: the relatively low cost of crude oil owing to a production excess; the relatively low cost of energy and hydrogen from structurally lower U.S. natural gas prices; a highly sophisticated and efficient complex of refineries with excess capacity; and its close proximity to some of the most import-dependent markets (particularly in Latin America).

If a ban on exports were implemented, a surplus on the Gulf Coast would be created that refiners could only address in two ways—reducing refinery utilization to produce less, or moving more volume to other parts of the U.S. that currently import product, especially the U.S. East Coast.

Rerouting, however, is limited by both the overall volume and cost. Total imports to the East Coast are only about 900,000 bbl/d—around 65% of the 1.4 MMbbl/d excess that the Gulf Coast would need to address. Most of the imports are into the northeast from eastern Canada, which has a strong cost advantage in supplying the market.

To displace these volumes, refineries would have to rely heavily on movements by ship or barge, as the pipeline capacity from the Gulf Coast to the East Coast is largely maxed out. However, U.S. regulations stipulate that Jones Act-compliant ships (U.S. built, owned and crewed ships) would have to be used. Yet there is little excess capacity here, and the cost of Jones Act shipping has traditionally made it uncompetitive with Canada. These costs would only rise with greater demand, resulting in an East Coast market likely still to be dependent on imports on the margin and connected to international prices or product.

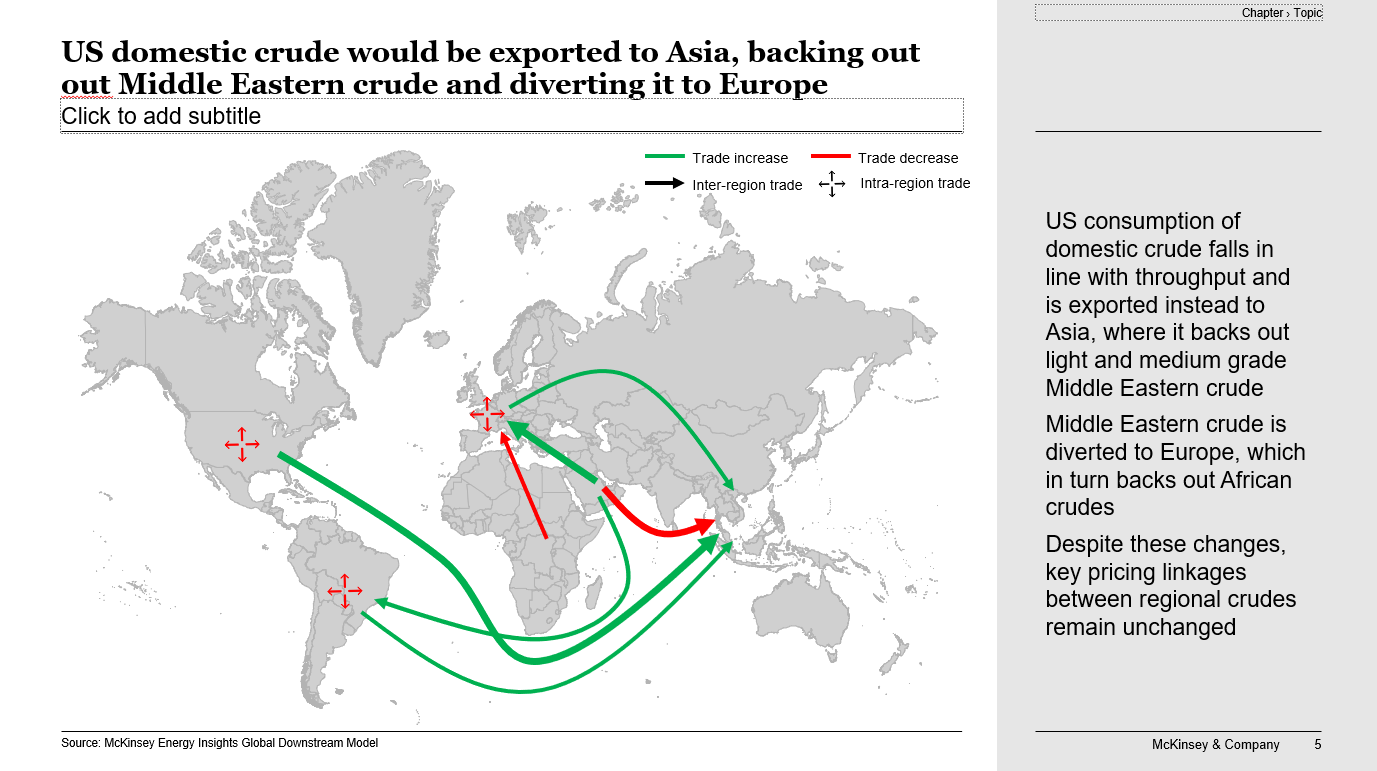

Whatever excess volume could not be redirected from the Gulf Coast would have to be eliminated by cutting refinery runs, resulting in an approximate equivalent volume of excess crude oil likely being directly exported to be run in refining capacity elsewhere in the world. And, if U.S. crude export capacity via pipelines, terminals and ships could not immediately handle this higher volume, then the global market for crude oil could tighten.

The rest of the world would likely struggle to make up the lost product from the U.S. Global refining capacity in 2022 has been running close to maximum already, a big contributor to current high prices. Any additional capacity that could be used would necessarily be the least efficient and most expensive.

In a best-case scenario, European refiners could increase utilization by 1.1 MMbbl/d by running very simple marginal capacity. The Middle East would have to divert exports currently going to Asia to make up the volumes that the U.S. would stop sending to Europe and Africa. In turn, Asian refineries would have to ramp up utilization by 1 MMbbl/d to offset the lost volumes from the Middle East.

Impact on prices

The change in balances and flows would almost certainly translate into noticeable price changes—though not positively for all consumers.

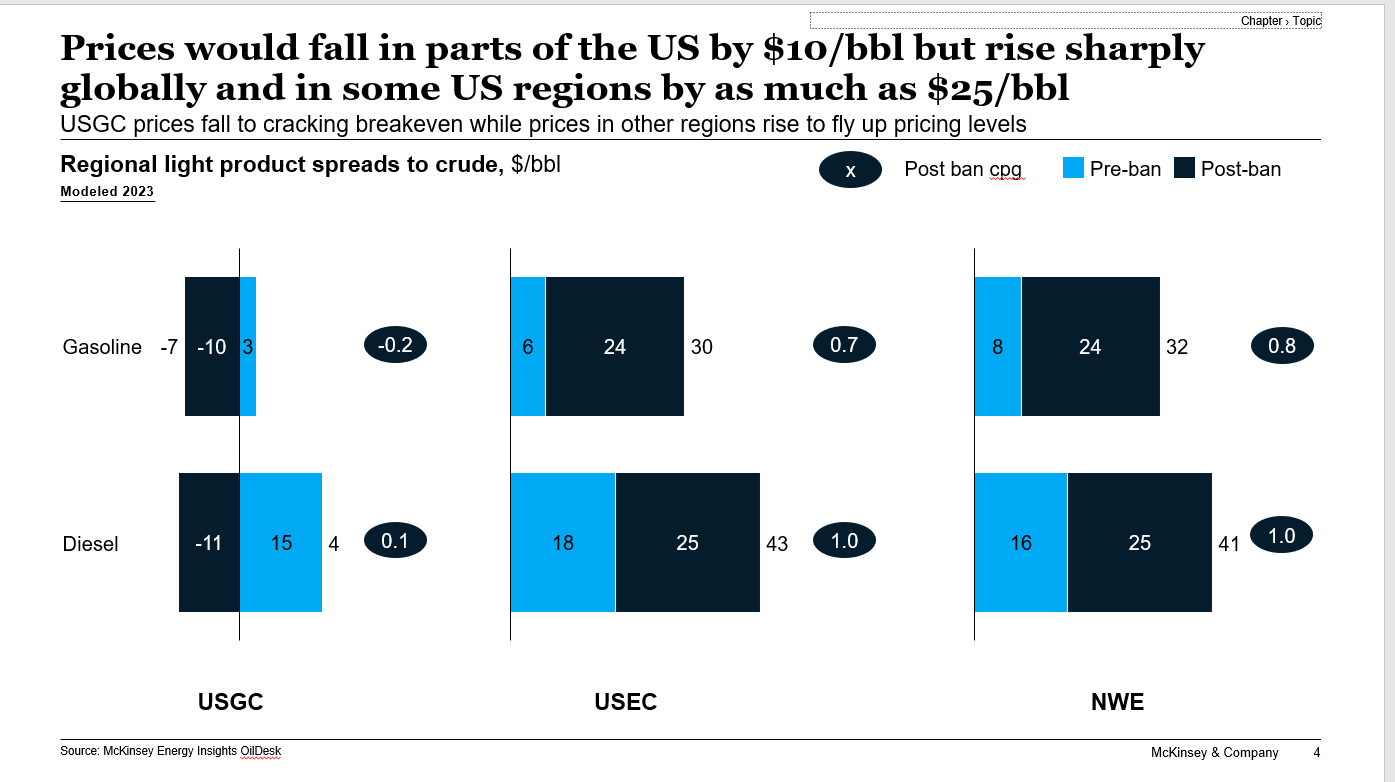

Global prices will be impacted the most significantly. With the removal of 1.4 MMbbl/d of supply, the industry will be forced to resupply from less-efficient capacity—at a minimum, prices will need to rise by about $25/bbl of crude oil to incentivize this and cover the cost of longer, higher-cost supply chains. Consumers would likely be faced with about a 60 cent/gallon price increase. More significantly, this tightening raises the likelihood of periods of fly-up pricing where capacity of any kind is not sufficient and demand is just not met. This would be similar to spring 2022 when cracks rose to $50/bbl or more ($1.20/gallon or more for consumers). The most likely outcome is a combination of the two, meaning even higher prices for product globally and for all markets connected to the global market.

With the East Coast still dependent on imports in this scenario, even with maximum rerouting of volumes from the Gulf Coast, prices could rise in line with international prices, despite a glut of product in other parts of the U.S. Additionally, the added demand for Jones Act shipping would likely lead to a fly-up in those prices, affecting pricing on the U.S. West Coast that often sets prices at Gulf Coast cost plus shipping cost.

On the positive side, prices would likely be lower for the Gulf Coast and markets linked to it, such as the Midwest. Gulf Coast light product prices are traditionally set by the value of exporting products to the international market at levels above breakeven for Gulf Coast refiners, incentivizing them to run full. Breaking this link would push prices down to breakeven levels for marginal capacity on the Gulf Coast, likely cracking configuration, resulting in a decrease in prices of about $10/bbl to $11/bbl for light products (20 to 25 cents per gallon for consumers).

Implications for players across the industry

A refined product export ban would have a material impact on refiners and consumers around the world, varying by location:

- International markets (Europe, Asia and Latin America). Most of the world would see higher prices and an incentive to run available refining capacity harder. For most refiners, this would mean even higher margins (above levels that are almost at a historical high) and, for a few, higher throughput as well—as long as prices do not spike to levels that would affect demand. For consumers, a refined product export ban would mean materially higher prices on top of the already historic highs they are facing.

- U.S. East Coast. Given that the link to international prices is probably not breakable for the East Coast, price rises in the global market will likely be experienced there as well, leading to higher prices for consumers and higher margins for the few refineries that operate in the region. It would also translate into increased rates for Jones Act ship owners and operators, and high margins for those with shipping rights on pipelines linking the Gulf Coast to the East Coast market.

- U.S. Gulf Coast and interior. Prices in these markets would likely be set at breakeven for Gulf Coast capacity, leading to lower margins and throughputs for refiners and lower prices for consumers in those local markets.

If a product export ban were instituted, it could significantly affect prices for refined products in the U.S. and globally. Policy makers will need to consider the possibility that it would not necessarily bring price relief for all and that there could be an unintended price increase in some markets. Refiners and consumers will need to be ready to adapt.

Cherry Ding is a solution manager in McKinsey’s Houston office, where Tim Fitzgibbon is a senior expert and Hari Govindahari is a partner. Micah Smith is a senior partner in the Dallas office.

Recommended Reading

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.