Domestic oil and gas drilling finished 1999 on a strong note, two separate reports indicate. But one of them suggests that drilling could experience a moderate seasonal decline during the next few months. Estimated completions of U.S. oil and gas wells and dry holes increased 4.9% year-to-year to 5,442, from 5,188 during fourth-quarter 1998, according to the American Petroleum Institute's latest quarterly well-completion report. Natural gas provided the impetus for the increase as the number of gas wells drilled climbed 17.7% to 3,363, from 2,857 in 1998's final three months. During that same period, oil well drilling declined by 3.3% to 1,236 from 1,278 wells, while the number of dry holes dropped 19.9% to 843 from 1,053. Total estimated exploratory completions declined 10.8% year-to-year, to 481 from 539, while development completions rose 6.7% to 4,961 from 4,649 in the comparable 1998 period. API also reported a 31.8% decrease in total footage drilled during 1999's fourth quarter to 19,551,000 feet from 28,685,000 feet a year earlier. Meanwhile, Salomon Smith Barney Inc. reported a 31.2% increase in its adjusted total of U.S. drilling permits, to 2,445 in December 1999 from 1,864 a year earlier. On a month-to-month basis, the latest total represented a 21.8% decline from November 1999's level of 3,125, the peak level for the year. "The recent sequential and year-over-year changes suggest a moderate seasonal decrease in drilling activity in the coming months," said Mark S. Urness, who follows drilling contractors for Salomon Smith Barney in New York. His survey indicates that a large part of the decrease during December occurred in Texas, where the total number of drilling permits, on a gross basis, dropped 39.1% to 602 from 989 in November. December's figure also represented a 40.9% plunge from September's 1,018 drilling permits, a six-year peak for the Lone Star State. But it also came in 55.6% higher than the May 1999 total of 387, which represented a six-year low for Texas, according to Salomon Smith Barney's figures. -Nick Snow

Recommended Reading

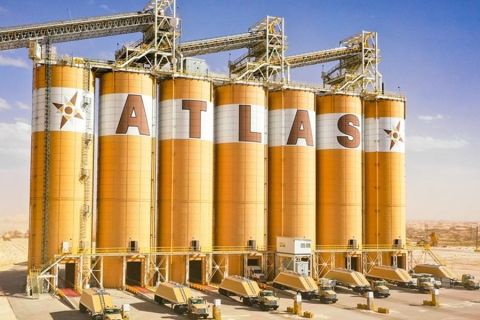

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.

Majority of Recent CO2 Emissions Linked to 57 Producers - Report

2024-04-03 - The world's top three CO2-emitting companies in the period were state-owned oil firm Saudi Aramco, Russia's state-owned energy giant Gazprom and state-owned producer Coal India, the report said.