U.S. natural gas futures held near a one-year low on Jan. 6 on forecasts for warmer-than-normal weather and lower than usual heating demand to continue into late January.

With the contract now down about 17% so far this year, the gas market is on track for its worst start to a year on record, according to Refinitiv data going back to 1991, the first full year of trade for the gas futures contract.

That tops the current worst four-day start to a year of down 14% in 2006 and compares with the best four-day start of up 21% in 1997.

Low heating demand during what is usually the coldest part of the year should allow utilities to leave more gas in storage than usual this month.

Front-month gas futures for February delivery remained unchanged at $3.720/MMBtu at 9:29 a.m. EST. On Jan. 5, the contract dropped about 11% to close at its lowest since Jan. 4, 2021.

Before paring losses the contract dropped over 5% to $3.52/MMBtu in intraday trade earlier on Jan. 6, its lowest since July 2021.

For the week, the front-month was down about 17%, putting it on track to drop by about 44% over the past three weeks, its biggest three-week drop in history, according to Refinitiv data.

That keeps the contract in technically oversold territory with a relative strength index below 30 for a seventh day in a row for the first time since April 2019.

The premium of futures for March over April, which the industry calls the widow maker, fell to a record low of 7 cents/MMBtu on Jan. 5 as some in the market gave up hope that extreme cold would cause prices to spike later this winter.

The gas industry calls the March-April spread the "widow maker" because rapid price moves resulting from changing weather forecasts have knocked some speculators out of business, including the Amaranth hedge fund, which lost over $6 billion on gas futures in 2006.

The market uses the March-April spread to bet on the winter heating season when demand for gas peaks.

Traders said the market's biggest uncertainty remains when Freeport LNG will restart its LNG export plant in Texas.

After several delays from October to November and then to December, Freeport now expects the facility to return in the second half of January, pending regulatory approvals.

That is in line with what many analysts have long been saying - that Freeport would likely return during the first quarter of 2023 because the company still has a lot of work to do to satisfy federal regulators before restarting the plant.

Whenever Freeport returns, U.S. demand for gas will jump. The plant can turn about 2.1 Bcf/d of gas into LNG, which is about 2% of U.S. daily production.

Freeport shut on June 8 after a pipe failure caused an explosion due to inadequate operating and testing procedures, and human error and fatigue, according to a report by consultants hired to review the incident and suggest corrective actions.

Data provider Refinitiv said average gas output in the U.S. Lower 48 states rose to 98.2 Bcf/d so far in January, up from 96.7 Bcf/d in December but still below the monthly record of 99.9 Bcf/d in November 2022.

Even though the weather is expected to remain warmer than normal through late-January, Refinitiv projected average U.S. gas demand, including exports, would jump from 110.8 Bcf/d this week to 121.8 Bcf/d next week as temperatures ease ahead of what are usually the coldest weeks of the year.

In two weeks, however, Refinitiv projected gas demand would ease to 120.5 Bcf/d as the weather turns more mild.

Recommended Reading

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Fracturing’s Geometry Test

2024-02-12 - During SPE’s Hydraulic Fracturing Technical Conference, industry experts looked for answers to their biggest test – fracture geometry.

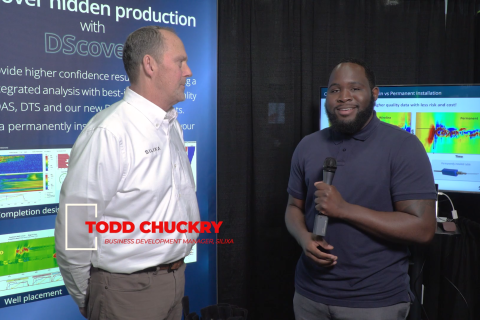

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.