Demand for renewables, which has become competitive with fossil fuel-fired power generation, has been increasing, company executives said on second-quarter earnings calls. (Source: Shutterstock.com)

Electric utility companies are ramping up renewable generation projects as they work to reduce emissions and enhance transmission infrastructure.

Demand for renewables, which has become competitive with fossil fuel-fired power generation, has been increasing, company executives said on second-quarter earnings calls. This comes as a heat wave sweeps across the globe, natural gas and coal prices rise and market volatility alongside inflationary pressure persist—contributing to higher utility bills for consumers.

The push toward renewables could help change that, with favorable regulatory moves, while boosting profits for companies making the switch. Some are already reaping the benefits as planned renewable energy projects in the queue grow.

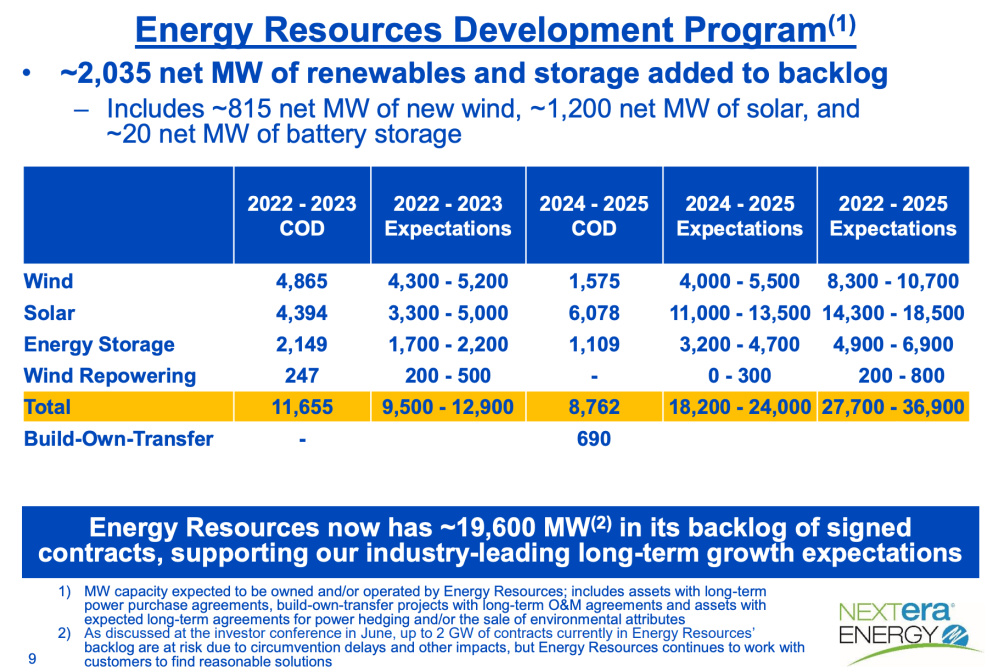

NextEra Energy Inc.’s energy resources unit, which focuses on clean energy, added 2,035 net megawatts (MW) of renewables and storage projects to its backlog during second-quarter 2022, the Juno Beach, Florida-based company reported last week.

The additions helped to push the total renewables and storage backlog to about 19,600 MW. NextEra Energy Resources’ adjusted earnings for the quarter rose 19% to $683 million.

“We believe that a number of powerful tailwinds support continued strong renewables demand, particularly in the context of high power prices and high gas prices, that are helping to make renewables the most economic form of generation,” NextEra Energy CFO Kirk Crews said on the company’s latest earnings call. “We expect these economic value drivers for new renewables, coupled with Energy Resources’ significant competitive advantages, to translate into a tremendous opportunity set as we deliver clean energy solutions to our customers seeking to both lower their energy bills and reduce their carbon emissions.”

Through year-end 2025, NextEra Energy Resources plans to build about 28 to 37 gigawatts (GW) of renewables and storage projects. Confidence in future development expectations, Crews said, was reinforced by the Biden administration’s directive to waive additional duties on solar panels imported from Cambodia, Malaysia, Thailand and Vietnam for two years.

“LCOEs (levelized cost of energy) for conventional generation have deteriorated making an even greater case for renewables,” Credit Suisse analysts said in a June 15 note, “and management is incorporating all renewable supply chain disruptions, including AD/CVD impacts to its forecasts.”

Net income attributable to NextEra for the three months ended June 30 was $1.38 billion, compared with a profit of $256 million a year ago, the company said July 22.

RELATED:

Questions Remain after Latest Trade Policy Twist for Solar Sector

US Solar Sector Gets Industry Boost as Concern Lingers

Tapping Solar

Southern Co., a gas and electric utility holding company, outperformed expectations.

The Atlanta-headquartered company reported second-quarter earnings on July 28 of $1.1 billion, up from $372 million a year ago. It said higher revenues associated with increased usage, changes in rates and pricing, and warmer than normal weather at regulated electric utilities, partially offset higher non-fuel operations and maintenance costs.

Just last week, the Georgia Public Service Commission approved the 2022 integrated resource plan (IRP) for Southern’s Georgia Power, outlining clean energy plans for its 2.7 million customers.

“The approved plan includes the addition of 2,300 megawatts of new renewable resources as part of Georgia Power’s long-term plan to double its renewable generation by adding an additional 6,000 megawatts by 2035,” Southern CFO Dan Tucker said July 28. “The plan also approved the addition of over 750 megawatts of battery energy storage project, the retirement of over 1,500 megawatts of coal by 2028 and the continuation of existing grid investment and ash pond closure programs.”

The IRP also includes plans to continue Georgia Power’s hydro modernization program.

Southern appears to favor solar as it looks to grow renewable generation, though natural gas remains an option, particularly in the northern part of the state.

“Our big answer on renewables across the system is most likely solar, not wind. We just don’t have the climate to do widespread wind … Putting more solar in the south part of the state with a much better terrain does make sense,” CEO Tom Fanning said. “In order to locate more generation in the state, in order to balance the needs in the north, we’ll need to build significant transmission. The beauty of our market structure here is we are allowed to iterate among and between generation and transmission as an optimal portfolio solution. The so-called organized markets have difficulty doing that.”

Wind Generation

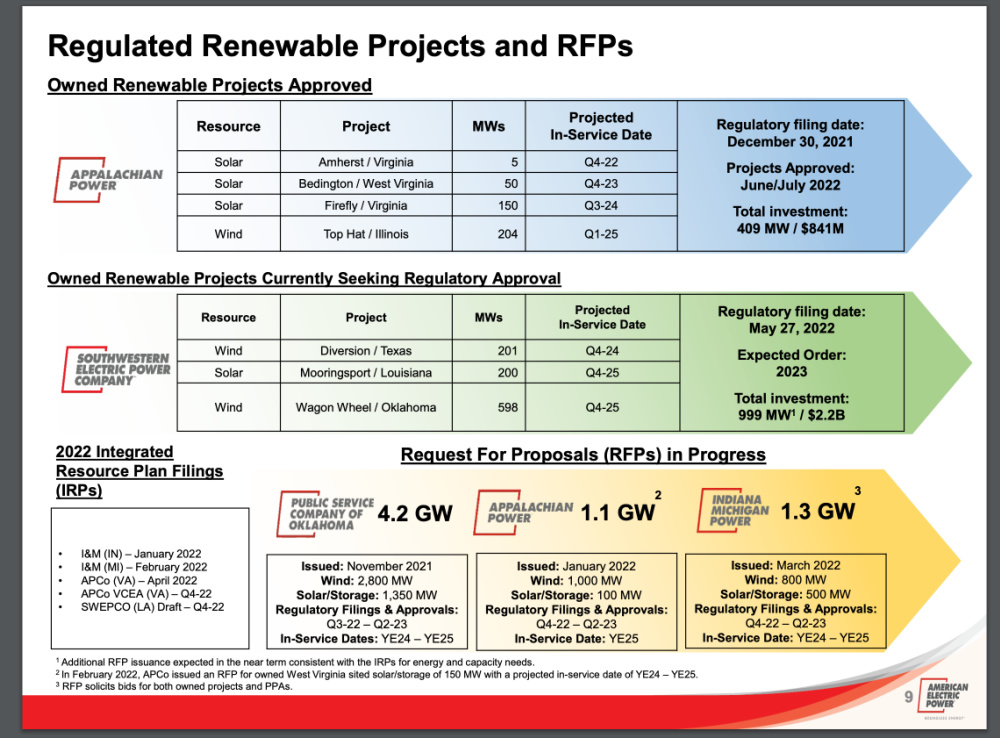

American Electric Power (AEP), which aims to shift its generation portfolio to more than 50% renewable resources by 2030 and hit net zero by 2050, also looks to strengthen the grid on its clean energy drive.

As it sheds unregulated renewable assets to derisk and focus on regulated renewables and transmission, the pure-play regulated utility, based in Columbus, Ohio, plans to add about 16 GW of regulated renewable generation by 2030. AEP has allocated $8.2 billion through 2026 on the efforts.

Earlier this year, AEP brought the 998-MW Traverse Wind Energy Center online in Oklahoma. With 356 turbines, the facility is among the largest in operation today. It is the second of a three-part 1,485-MW, $2 billion North Central Energy Facilities project that includes the 199-MW Sundance Wind Energy Center, which went online in 2021, and the 287-MW Maverick, which began commercial operation in September.

Combined, the three projects—developed by Invenergy and owned by AEP’s Public Service Co. of Oklahoma and Southwestern Electric Power Co. (SWEPCO) subsidiaries—are expected to generate enough energy to power 440,000 homes, AEP has said.

The company is directing capital from transaction proceeds to its regulated business, where AEP CEO Nick Akins said the company has a pipeline of investment opportunities and recognizes the value of a diverse resource portfolio amid energy-related volatility.

“SWEPCO is taking steps to secure renewable resources, making regulatory filings in May in Arkansas, Louisiana and Texas to own three renewable turnkey projects totaling 999 megawatts. This $2.2 billion investment is currently reflected in our five-year $38 billion capital plan,” CEO Nick Akins said. “SWEPCO expects to issue another RFP (request for proposal) in the near term consistent with its RFP for energy and capacity needs. APCo’s (Appalachian Power Co.) 409 megawatts of owned solar and wind resources were approved by West Virginia and Virginia, marking an $841 million capital investment that is also included in our current capital plan.”

Regulatory filings to acquire additional renewable resources before year-end 2022 are also in the works.

“Generation fleet transformation plans are well on track. We remain fully committed to our target of an 80% carbon emission reduction rate by 2030 and net zero by 2050. We are proud of the work well underway to help us achieve this goal,” Atkins said. “Reaching these targets is foundational to our long-term strategy, and we believe we are on the right path toward prioritizing regulated investment opportunities and transitioning our generation fleet.”

AEP reported on July 27 second-quarter operating earnings of $618 million, up from $589.5 million a year earlier.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.