Stratas Advisors is forecasting growth this year in the Haynesville Shale driven by longer laterals and improved completion designs. (Image: Hart Energy)

This excerpt is from a report that is available to subscribers of Stratas Advisors’ North American Shale service.

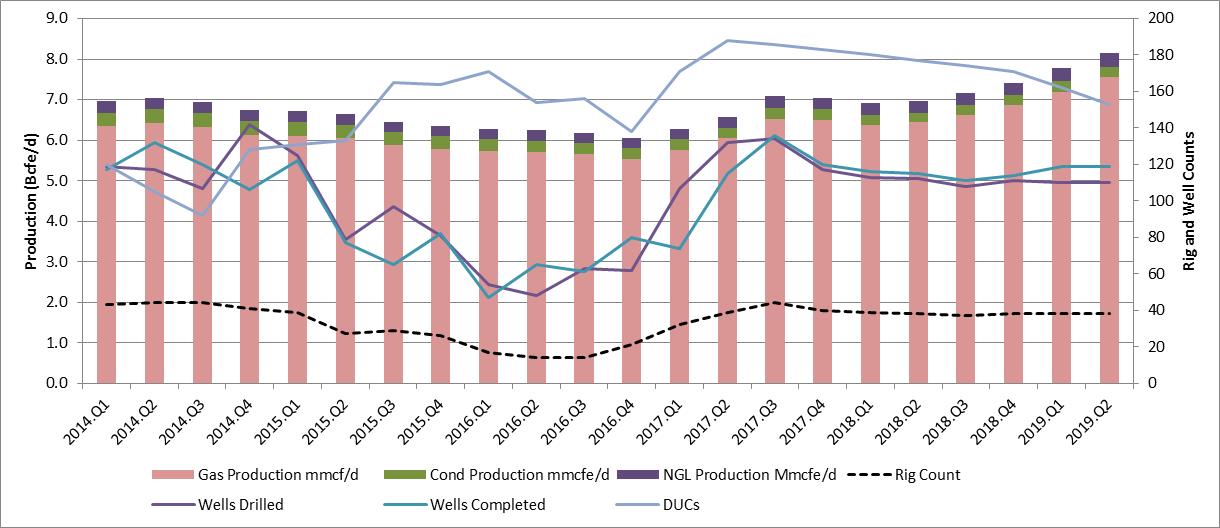

Haynesville production is expected to rise to 7.5 billion cubic feet equivalent per day (Bcfe/d) by year-end 2018, an increase of 4% from the 7.2 Bcfe/d reported for September 2017, according to a recent report from Stratas Advisors.

Growth in the Haynesville is supported by the shift toward extended-reach laterals, coupled with improved completion designs in recent years. Historically, lateral lengths in the Haynesville averaged less than 5,000 ft. Recent wells have lateral lengths of 7,500 ft to 10,000 ft, and possibly longer. These longer lengths, coupled with strong productivity per foot of wellbore, have resulted in wells with much stronger well-level economics. Production related to the conversion of drilled but uncompleted (DUC) wells to producing wells also contributes to 2018 production growth, albeit the volumes are quite small.

Speaking of DUCs, a brief review and a few words on our methodology seems prudent even with our view of a minimal production impact to the Haynesville in 2018. DUCs on the scale seen in recent years is a byproduct of pad drilling, batch processes to minimize damage and disruptions, and infrastructure planning. Observations of data reveal two important insights. First, the number of “steady state” DUCs moves in tandem with rig counts. “Steady state” refers to DUCs that are a result of normal business practices. A good rule-of-thumb for estimating the steady state DUC count is: Steady state DUCs equals rigs times wells per month per rig times three months.

As rig counts climb, the steady state DUC count also climbs. In tracking DUCs and their potential impact on production, Stratas advises to net out these “steady state” DUCs from the gross DUC count. This leads to proper timing of production additions over the forecast horizon. The second insight is that DUC inventories typically adhere to a first-in, first-out inventory model. Most wells are completed between 120–210 days after drilling is finished.

The application of extended-reach laterals and tighter stage spacing to the Haynesville on a broad scale is a key factor to the growth picture. Fortunately, no apparent evidence for geologic constraints on such enhanced completion methods in the Haynesville Shale, Bossier Shale or the Cotton Valley Group has appeared thus far. The Haynesville’s geological setting and the recent fall in operating costs overall has enabled operators to increase proppant loads from 1,750 pounds per foot to 3,000 pounds per foot, while maintaining an order of cost control. Hence, breakeven prices for these newer Haynesville designs are competitive with Appalachia shales, delivered at Henry Hub.

The Haynesville Shale is a Late Jurassic, carbonate- and organic-rich mudstone, which is overpressured due to rapid deposition and hydrocarbon generation during and after the Cretaceous period. This overpressured reservoir regime is a key factor in its higher porosity, permeability and free gas measures. These factors also cause production declines of about 80% in the first year. Haynesville dry gas production can be attributed to high thermal maturity and reservoir temperatures. Additionally, the Haynesville contains significant silica content such as quartz and feldspars, which leads to improved fracture propagation during hydraulic fracturing. Recent progress with longer laterals and new completion designs has led to strong improvements in well-level economics. The key question for 2018 and 2019 centers on how much running room the play has for these bigger wells. Stratas views the Haynesville as the ideal asset to assume the swing producer role for Lower-48 natural gas.

Recent activity in the Haynesville is almost entirely concentrated to a few “specialist” operators. These companies include Chesapeake Energy Corp. (NYSE: CHK), Comstock Resources Inc. (NYSE: CRK) and Exco Resources Inc. (NYSE: XCO). These operators maintained a level of activity through the downturn and then began deploying more capital and increasing rig counts in the region in 2017 as prospects improved. Other companies, such as BHP Billiton Ltd. (NYSE: BHP) and ExxonMobil Corp. (NYSE: XOM) continue to operate in the region but are viewed as having light presences in the area. The "lower for longer" price environment caused many operators to focus on liquid-rich assets and, in some cases, exit the Haynesville entirely. Operators such as Anadarko Petroleum Corp. (NYSE: APC), EOG Resources Inc. (NYSE: EOG) and EP Energy Corp. (NYSE: EPE) divested the Haynesville from their portfolios and deployed the proceeds elsewhere.

Stephen Beck can be reached at sbeck@stratasadvisors.com.

Recommended Reading

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.