The survey revealed that 40% to 60% companies placed hedges and could be one reason why respondents expect borrowing bases to remain relatively stable, said Kraig Grahmann, head of Haynes and Boone’s Energy Finance Practice Group. (Source: Shutterstock.com)

Oil and gas producers in the U.S. are expecting their spring borrowing bases to remain the same as crude oil prices have stabilized since late 2018, according to a recent survey conducted by law firm Haynes and Boone.

Crude oil prices plummeted over 22% last November in the largest monthly loss in a decade, which sparked fears in investors of a potential glut in oil supplies. Over a nearly three-month period, a bearish sentiment resulted in oil prices dipping by more than 40%.

Both U.S. West Texas Intermediate and Brent, the international benchmark, have pared back their losses so far this year aided by production cuts made by OPEC and its allies.

Redeterminations Survey

(Source: Haynes and Boone LLP)

“Prices have recovered a bit,” said Kraig Grahmann, head of Haynes and Boone’s Energy Finance Practice Group. “The decline shook up the market and created concerns about confidence and price stability from end of 2018 to the beginning of 2019.”

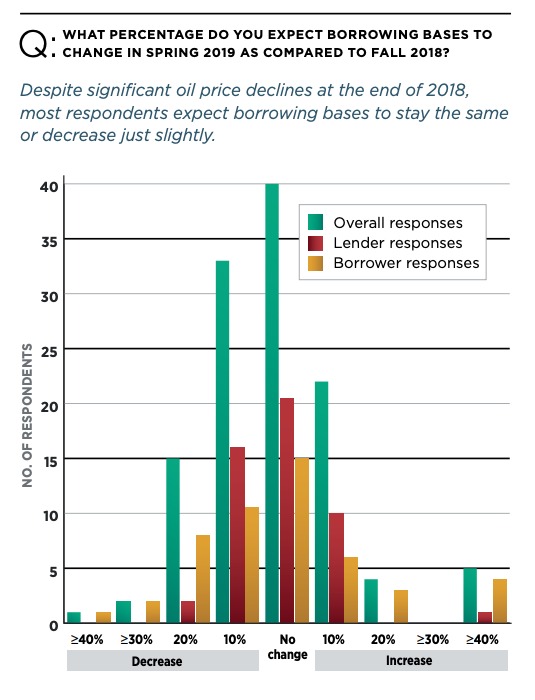

In the survey conducted by the Dallas-based law firm, both energy companies and lenders have reacted conservatively to the 2018 oil price declines. The borrowing base survey demonstrated that 40% of respondents expect borrowing bases to remain the same while more than 30% of those surveyed predict slight declines to borrowing. Only 20% of respondents expect slight increases.

Haynes and Boone released its latest “Borrowing Base Redeterminations Survey” in March, which summarized results from the firm’s recent polling of oil and gas producers, energy lenders, private equity firms, and other industry participants to get their predictions about producers’ future borrowing capacity or “borrowing bases.” The survey was started by Haynes and Boone in April 2015 and provides a forward-looking view about the projected financial state of the U.S. upstream oil and gas market.

Respondents of the Haynes and Boone survey comprise 42% are lenders, 41% are oil and gas companies while 17% are professional service providers such as investment bankers, lawyers and accountants.

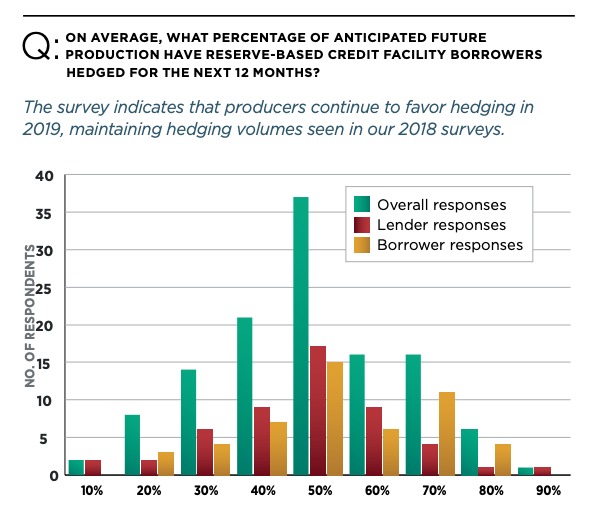

A large percentage of producers hedged their 2019 production, giving them a significant advantage over their competitors. The survey revealed that 40% to 60% companies placed hedges and could be one reason why respondents expect borrowing bases to remain relatively stable, Grahmann said.

“Many of these companies have locked in prices and have stable cash flow,” he said.

Another advantage many producers have is that they do not have additional layers of debt in their existing capital structure such as a large portion in senior unsecured debt which can be problematic if oil prices drop.

(Source: Haynes and Boone LLP)

The capital markets have fallen “significantly out of favor” on investing in upstream companies, according to Grahmann. He noted only 4% of survey respondents believe equity to be a source of capital.

The reason, he said, is due to the shift in equity capital markets from a strategy that approved of a business model where energy companies grew as much as they could, spent more than their free cash flow and operated on a large amount of debt until an acquirer purchased the company, rewarding investors.

“They are now planning for longer-term sustainable corporate model,” he said.

The oil and gas industry has been aggravated by an influx of momentum-based financing that results in overbuild, oversupply, overcapacity, commodity price decline and ultimately bankruptcy or restructuring, said Patrick Morris, CEO of New York-based HAGIN Investment Management.

“While this process is a two-way street, lenders tend to reset borrowing bases on cash flow, viable entities with substantial assets,” Morris said.

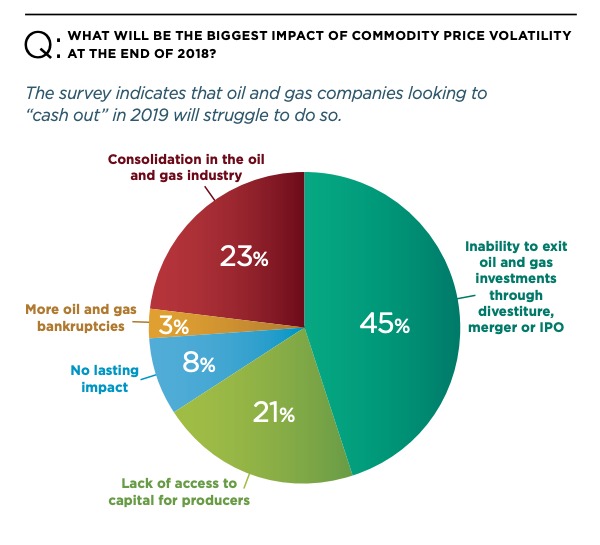

The strategy undertaken by many companies is to source capital through joint venture transactions such as farm-outs and Drillcos as monetizing oil and gas investments has reached a major hurdle.

Producers need to find a method to drill on the leases they have before their expiration dates since they cannot raise money from the capital markets. In some instances, Grahmann said private equity firms will pay for a disproportionate percentage of the drilling costs and receive a large amount of ownership in the well.

He believes companies who need to sell assets, merge or seek an IPO will find that those options will be rare. This could result in private equity firms having to hold investments for six to eight years instead of their previous desired rate of return of three to four years.

“The more years you have to hold an investment, the lower your annual rate of return becomes,” Grahmann said.

The current goal for their existing investments is to look at ways to get some money off the table, recapitalize and leverage up with a loan or sell a partial interest,” he said.

As for the public energy and production sector, investor activism has increased, Grahmann said.

Haynes and Boone’s capital markets group also tracks the players and the demands being made through shareholder activism. In addition, the firm found the number of bankruptcies filed in 2018 continued to decline with 40 companies in the oil and gas industry filing bankruptcy last year.

Recommended Reading

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

Global Partners Declares Cash Distribution for Series B Preferred Units

2024-04-15 - Global Partners LP announced a quarterly cash dividend on its 9.5% fixed-rate Series B preferred units

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.