The Appalachian Basin continues to create major midstream growth opportunities. Even in the midst of the current commodity downturn, the Marcellus and Utica shales remain a stronghold for producers and a hotbed for the midstream.

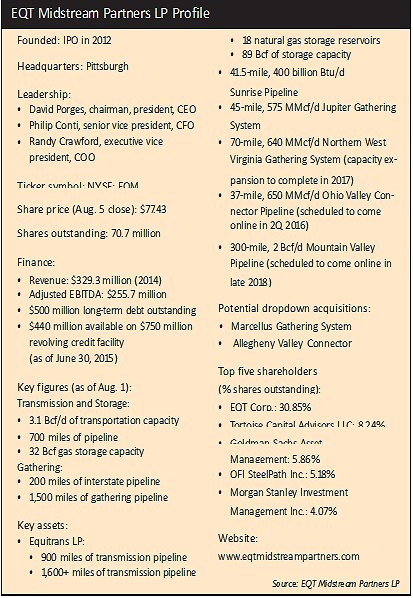

One of the most important of these midstream operators is EQT Midstream Partners LP, which was formed in July 2012 as the midstream arm for EQT Corp. Though the MLP may be just over three years old, the parent EQT boasts a 125-year history in Appalachia.

The potential for the Marcellus and Utica shales continues to grow, as evidenced by EQT’s recent announcement of very impressive results from the first dry gas Utica well drilled in Greene County, Pa. The well, which is located on an existing Marcellus pad and connected to EQT Midstream’s 45-mile Jupiter Gathering System, produced an astounding average of 72.9 million cubic feet per day (MMcf/d) over a 24-hour deliverability test.

“The ability to translate that quantity of gas to sales for EQT shows the strength of our system, which offers multiple sales outlets and significant flexibility,” Randy Crawford, EQT Midstream’s executive vice president and COO, said during a recent conference call to discuss second-quarter earnings. “We are very optimistic about the opportunity that the dry portion of the Utica creates for us, and we look forward to working with EQT and other producers as the dry Utica continues to be delineated and developed.”

The company reported strong revenue increases for second-quarter 2015 with gains of 35% to $130.9 million compared to the previous year as activity in the Marcellus remains strong.

The increase was driven by higher contracted transmission capacity and increased gathering volumes, both of which are a function of the continued growth in the Marcellus play by EQT and other producers,” Crawford said.

These volumes stand to grow in the second half of the year as EQT Midstream placed the final phase of the east side expansion for Antero Resources into service. This project added 100 MMcf/d of transmission capacity to EQT Midstream’s total capacity, which now stands at 3.1 billion cubic feet per day (Bcf/d).

Further expansion in the region will come through the company’s Equitrans system with the 37-mile Ohio Valley Connector, the 300-mile Mountain Valley Pipeline projects and a$250 million, 32-mile natural gas header system the company is constructing for Range Resources Corp. The $300 million Ohio Valley Connector will run from northwestern West Virginia into Clarington, Ohio, and connect to the Equitrans system as well as provide access to the Texas Eastern and Rockies Express pipelines in order to alleviate transportation constraints in the Marcellus when it comes online in the third quarter of 2016. The project is backed by firm, 20-year contracts for 650 MMcf/d of the system’s 1 Bcf/d capacity.

The Mountain Valley Pipeline is a joint venture with NextEra US Gas Assets LLC, WGL Midstream and Vega Midstream MVP LLC that will run from northwestern West Virginia to southern Virginia. EQT Midstream will hold a 55% majority interest and operate the system. WGL Midstream has contracted to buy 500 MMcf/d of gas. The pipeline will provide 2 Bcf/d of firm transportation capacity for Marcellus and Utica production to markets in the Mid- and South Atlantic regions via 20-year contracts. The project is expected to cost a total of $3 billion to $3.5 billion with an in-service date of late 2018.

“We are engaged with a number of producers and demand-market participants regarding both projects and are optimistic about adding commitments to both projects in the future,” Crawford added.

The Range Resources header system will be located in southwestern Pennsylvania and support dry gas production out of the Marcellus and Utica.

The trunk line system will have a capacity of more than 500 MMcf/d and expand EQT Midstream’s presence in the Utica portion of western Washington County, Pa. The project, which is backed by a firm, long-term contract, will be constructed over two phases, with the first phase in-service by the third quarter of 2016 and second phase coming online in the first half of 2017. Once online, the system will connect with a 100 MMcf/d Marcellus system.

This header system and the aforementioned east side expansion for Antero is a reflection of the gains that EQT Midstream has made since it went public three years ago. At the time of its 2012 IPO, the company reported adjusted operating revenue of $7 million from third parties in its first quarter of operation. This has now grown to $31 million in the second-quarter 2015 with a 72% compounded annual growth rate and throughput from third parties.

“To put the revenue growth into more perspective, the $31 million of third-party adjusted operating revenue in the most recent quarter is $2 million more than all of our quarterly adjusted operating revenue three years ago. The success is a validation of our strategy to become a liquidity hub for Marcellus and Utica development,” Crawford said.

The company is planning to utilize its assets in the region to create an Appalachian Basin gas hub that will provide producers with access to diverse markets and end users with access to production out of the country’s largest gas supply source.

“With every new project, we continue to expand our header system to provide producers optionality to deliver to multiple pipelines that connect to demand markets in the Northeast, Midwest, Gulf Coast and with the Mountain Valley Pipeline, the Southeast, not just a single pipeline pool. We have no intention of slowing down. In fact, as we look out over the next few years and think about organic projects like Mountain Valley Pipeline and the new trunk line for Range, we believe it’s very

achievable that 2019 revenue from third parties is three times the 2015 level, or north of $350 million,” Crawford said.

Certainly helping this outlook is the roughly $3.3 billion in capex EQT Midstream currently has in its organic growth project backlog, with the bulk of these projects having firm commitments behind them.

“[These projects] include $1.8 billion for the Mountain Valley Pipeline,

$300 million for the Ohio Valley Connector, $400 million for Equitrans expansions, $500 million for wellhead gathering and the $250 million for the Range trunk line. With the addition of these projects, we are headed toward an EBITDA level in excess of $1 billion in 2019, which is expected to be the first full year that all projects are in service,” Crawford said.

The 700-mile Equitrans system will serve as a key part of this organic growth strategy as it runs through the heart of the Marcellus. This system has already experienced steady growth as it has increased its capacity from 600 MMcf/d to 3.1 Bcf/d with future expansions expected to further increase capacity to more than 4 Bcf/d.

One avenue that EQT Midstream is unlikely to pursue is the recent trend of large M&A deals in the Northeast. “I don’t think any of the larger deals of a strategic quantity are good ideas for EQT Midstream,” Dave Porges, chairman, president and CEO of EQT Midstream, said during the conference call. He explained that it’s difficult to recoup value in large deals and those that have occurred thus far wouldn’t be consistent with the company’s core activities. Specifically, the fact that these deals have included assets outside of the Appalachian Basin and/or involve gas processing assets, both of which he said the company is not interested in entering.

The company is focused on transporting methane through gathering and transmission systems with EQT Corp. contracting with MarkWest Energy Partners LP for processing services and residue gas takeaway from the processing plant.

Its growth strategy will remain focused on organic projects for years to come. A company spokesperson told Midstream Business that economics favor this approach compared to an acquisitive one. However, the company refused to rule out potential bolt-on acquisitions in the Marcellus and Utica.

“We wouldn’t rule out something that was smaller, more tactical, that helped us. If you look at the economics, it is a lot easier to achieve value accretive investments for both EQT Midstream and EQT GP Holdings LP with organic projects,” Porges said during the conference call.

Thus far, growth has been accomplished through both organic projects and dropdown acquisitions. Dropdowns come in the form of three acquisitions: the $540 million Sunrise Pipeline drop-down in 2013, the $1.18 billion Jupiter gathering system dropdown in 2014 and the $1 billion dropdown of the Northern West Virginia Marcellus gathering system earlier this year.

The 41.5-mile Sunrise system, which has a capacity of 400 billion Btu per day, extends from Wetzel County, W.Va., to Greene County, Pa., and has been integrated with the Equitrans system. Sunrise was expanded in September 2014 through the Jefferson compressor station expansion, which added 550 MMcf/d of incremental capacity.

The Northern West Virginia Marcellus gathering system supports EQT Corp.’s wet and dry gas production out of West Virginia’s Saturn, Mercury, Pandora and Pluto development regions of the Marcellus. The system also includes a 30-mile, high-pressure wet gas header pipeline that transports wet gas to MarkWest’s Mobley processing plant in Smithfield, W.Va.

The 70-mile system is expected to grow along with production as the company is planning to spend $370 million to expand it in the next few years. This includes 100 miles of gathering pipe and five compressor units with 23,700 horsepower.

The growth of the West Virginia portion of the Marcellus will result in cash flows increasing from $100 million in 2015 to $158 million in 2018 according to EQT Midstream. This will be supported by EQT Corp.’s 76,000 net acres in northern West Virginia surrounding the system, including 59,000 net undeveloped acres.

Dropdown acquisitions will remain a fundamental part of EQT Midstream’s growth strategy as the company will benefit from a strong sponsor like EQT Corp., which has 10.7 trillion cubic feet equivalent of total proved reserves on 600,000 net acres in the Marcellus. This is resulting in EQT investing $125 million to $150 million in the midstream this year to support its production growth, which is estimated to be 25% in 2015. These assets will provide EQT Midstream with a solid base for drop-downs in the coming years.

EQT Corp’s $100 million of remaining midstream EBITDA will help fuel EQT Midstream’s evolution. Some of the potential dropdown acquisitions include EQT’s Marcellus gathering system and the Allegheny Valley Connector.

Both assets are aligned with EQT’s production growth, which also supports their long-term value.

EQT is investing between $75 million and $100 million in the Marcellus gathering system in 2015 to connect additional production sites to its pipeline systems. The 200-mile Allegheny Valley Connector has 450 MMcf/d of throughput capacity along with 15 Bcf of gas storage capacity and is also being expanded with $30 million of investments in 2015. The pipeline would have a quick transition once a dropdown occurs since it is already operated by EQT Midstream via a lease with EQT Corp.

The company’s financial profile is stable, according to its current ratings, with a strong liquidity position of approximately $440 million available on its $750 million revolving credit facility and $500 million in long-term debt. It is targeting a 3.5x debt-to-EBITDA ratio.

EQT Midstream’s current assets and its potential dropdown acquisitions fit with its fee-based revenue mix backed by long-term contracts. Its assets have an average of 16 years of transmission contract life with 84% of its gathering assets and 82% of its transmission and storage assets backed by firm contracts. The relationship with EQT has been especially beneficial to EQT Midstream’s larger takeaway projects, as it has provided an anchor customer to both the Ohio Valley Connector and Mountain Valley Pipeline.

In this way, EQT Midstream can avoid both direct and indirect commodity exposure through projects that are strongly backed. This will help support the continued growth of the Appalachian Basin as a midstream player and a major producer work hand-in-hand to develop the region.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.