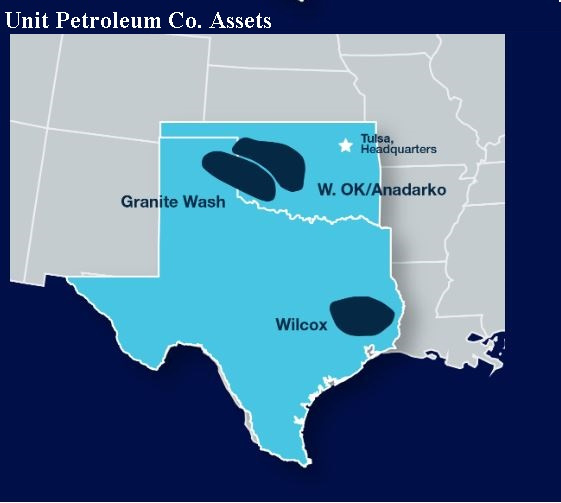

Unit Corp.’s upstream assets include locations in western Oklahoma’s Anadarko Basin, the Granit Wash and its Upper Gulf Coast Wilcox position on the Gulf of Mexico shoreline. (Source: Unit Corp.)

Unit Corp. said it has agreed to sell its Gulf Coast oil and gas assets for $56 million but will end its bid to sell its remaining assets and instead seize the opportunity from rising commodity prices to increase its share buyback program.

Based in Tulsa, Okla., Unit Corp. began a divestiture program in early 2021 to sell its noncore oil and gas assets. The company had engaged Tudor, Pickering, Holt & Co. (TPH) in January of this year to sell all of its oil and gas properties and reserves. However, in a June 10 release, Unit said it ended its agreement with TPH due to changes in the price of oil, natural gas, and NGL and “general volatility in the market.”

“The board’s decision to end the company’s engagement with TPH reflects the opportunities created by rising oil and natural gas prices and its conviction that the Company can create more shareholder value by operating the properties.” —Philip B. Smith, Chairman and CEO, Unit Corp.

In March, Unit did close on the sale of certain noncore wells and related leases located near the Oklahoma Panhandle for cash proceeds of $4.1 million, according to regulatory filings. It also sold other noncore oil and natural gas assets for net proceeds of $500,000 in the first quarter.

Unit said its Gulf Coast asset sale is set to close on July 1.

Additionally, Unit announced on June 10 the authorization by its board of a stock repurchase increase of $100 million, up from a previously announced buyback of $50 million. The company intends to fund repurchases from available liquidity.

Since July 2021, Unit has repurchased $41 million worth of its stock.

Philip B. Smith, the chairman and CEO, said Unit’s decision to end its engagement with TPH reflects “the opportunities created by rising oil and natural gas prices and its conviction that the company can create more shareholder value by operating the properties.”

“Our confidence in the company and commitment to optimizing shareholder returns is further reflected in the board’s decision to expand our stock repurchase program for a second time,” Smith said in the news release.

Unit Corp. consists of three divisions: Unit Petroleum Co., Unit Drilling Co. and Superior Pipeline Co. Its upstream assets include locations in western Oklahoma’s Anadarko Basin, the Granit Wash and its Upper Gulf Coast Wilcox position on the Gulf of Mexico shoreline.

Recommended Reading

Why Endeavor Energy's Founder Sold His Company After Years of Rebuffing Offers

2024-02-13 - Autry Stephens', the 85-year-old wildcatter, decision to sell came after he was diagnosed with cancer, according to three people who discussed his health with him.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Matador Stock Offering to Pay for New Permian A&D—Analyst

2024-03-26 - Matador Resources is offering more than 5 million shares of stock for proceeds of $347 million to pay for newly disclosed transactions in Texas and New Mexico.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.