With billions of expected investment in carbon capture, utilization and storage projects over the next decade, Section 45Q is an important tool that companies looking to invest in this space must use.

Section 45Q of the U.S. federal income tax code provides a tax credit for carbon, capture, utilization and sequestration (CCUS) of carbon. While this tax credit has been around since 2008, the credit was expanded and enhanced in 2018. Since then, a proverbial wall of capital has been inching closer to deployment in CCUS projects. The capital is flowing in from all directions; companies historically invested in hydrocarbon industries, private equity, banks, power generation and the federal government. In light of qualification for the tax credit currently requiring projects to “begin construction” by 2025 and the longer development cycles involved in bringing carbon capture projects to life, the time to start getting smart on 45Q and carbon capture generally is now.

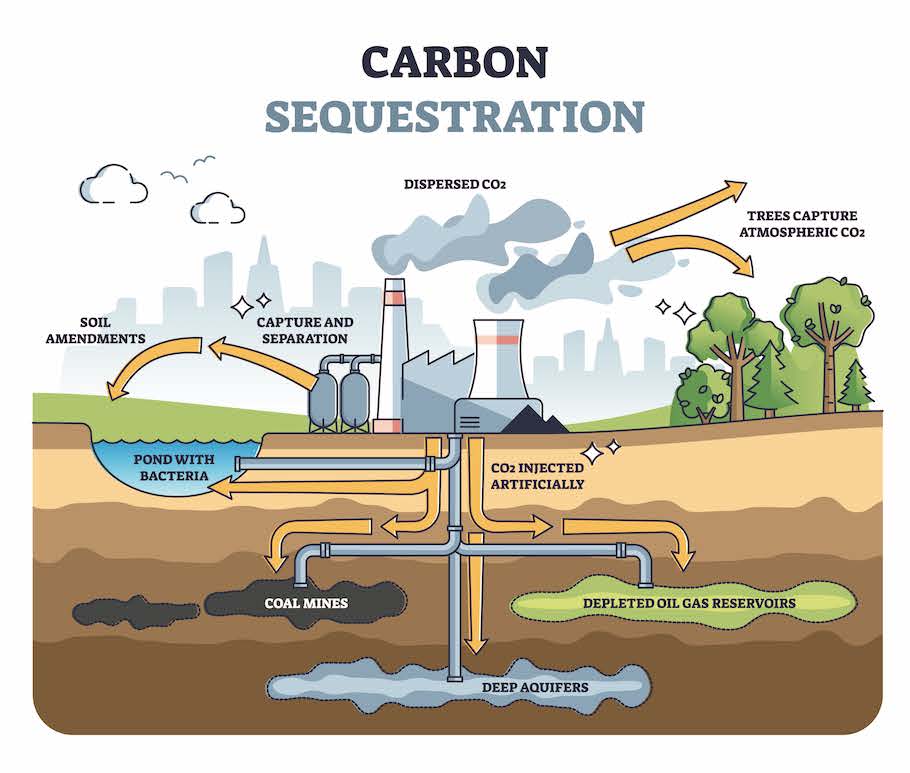

Section 45Q provides for a tax credit per metric ton (mt) of carbon that is captured and either sequestered into a secure geologic storage site, utilized as a tertiary injectant in an enhanced oil or gas recovery project, or utilized in some other manner approved by the Departments of Treasury and Energy that produces a reduction in life-cycle greenhouse-gas emissions during the first 12 years following placement in service of the capture assets. The amount of the credit changes each year. In 2026 the credit will be at least $35/mt of carbon utilized in an EOR project, or some other Departments of Treasury and Energy approved manner, and $50/mt of carbon permanently sequestered into a secure geologic storage site.

(Source: VectorMine/Shutterstock.com)

The projects must “begin construction” as defined by the IRS before Jan. 1, 2026, which the IRS generally defines as occurring once a certain threshold of actual physical construction of a project occurs or by the owner actually incurring a certain threshold of costs. The IRS has published guidance on how projects “begin construction,” and a tax professional should be consulted in qualifying a project at the onset. There are both traps for the unwary and pro-taxpayer gifts from the IRS, making expert tax advice and planning essential.

Which projects qualify?

(Source: JHVEPhoto/Shutterstock.com)

While it seems straightforward to qualify for Section 45Q tax credits, there is a bit of a catch as these projects need to be large. Section 45Q requires projects to capture a certain threshold amount of emissions to qualify for the credit at all. For example, at least 500,000 mt must be captured each year from most power plants that sell power, and at least 100,000 mt must be captured each year from almost all other types of projects. Additionally, for projects that receive approval from the Departments of Treasury and Energy for a non-EOR utilization, there is a lower 25,000-mt annual threshold for certain types of projects to qualify.

Assessing the volumetric capture potential of a project is a good first step in determining whether a proposed project can qualify for Section 45Q credits. The thresholds have proven to be a barrier to many projects qualifying for the Section 45Q credits. To overcome this barrier, one of the many adjustments that would have been made in the on-hold Build Back Better Act was to dramatically lower the annual volumetric capture thresholds for a project to qualify for the Section 45Q credits (the highest threshold after Build Back Better would have been 18,750 mt per annum; although there also would have been a new requirement to capture at least 75% of the carbon emissions in the case of a power plant that sells power). As the Build Back Better Act’s prospects are uncertain, it is uncertain when (or if) the thresholds will be lowered for more projects to qualify for the Section 45Q credits.

Efficiently utilizing the tax credits

Once a project qualifies for tax credits, often the next step is figuring out how to utilize the credits most efficiently.

Looking at the minimum thresholds and credit rates, the minimum credit creation for an EOR project is $42 million (100,000 x $35 x 12 years) and for a secure geologic storage project is $60 million (100,000 x $50 x 12 years). Oftentimes, the developers of these projects do not have a sufficient tax liability to efficiently utilize these tax benefits. Other times, even if the developer does have an appetite, the funds that can be raised against those future tax benefits can be an attractive source of project capital.

In either case, enter tax equity as a capital provider. A tax equity investment is what the finance world calls an investment by a bank, financial institution or other U.S. taxpayer with a sufficient forecasted tax liability that it intends to offset by investing into a partnership with a developer to efficiently utilize the tax benefits of a project. The tax equity investor will usually become a partner in a joint venture between the developer and tax equity investor in which, in accordance with IRS guidance, the tax equity investor can be allocated 99% of the tax benefits and retain only a 5% residual interest in the project after the 12-year tax credit period.

Tax equity has existed in various forms for 50-plus years, and the major players that have dominated the solar and wind tax equity markets for the last decade are all eagerly eyeing tax equity in carbon capture projects, whether altruistically as an ESG play or as an emerging profit center for their tax equity desks.

Increased interest in carbon capture

Section 45Q tax credits can be a very effective tool for companies in the oil and gas industry that are looking to invest in and exploit the CCUS value chain. Whether it is a knowledge of and comfort with subsurface work, ownership of an emitting asset or expertise in pipeline development, the knowledge set and infrastructure of the oil and gas industry can be and is being leveraged in the burgeoning CCUS industry.

Interest from the oil and gas sector in carbon capture seems to be at an-all time high and still growing, and understanding Section 45Q is an essential piece of the puzzle and a vital tool in structuring and creating a viable and attractive CCUS project.

About the authors:

Akin Gump partner Shariff Barakat represents clients involved in the acquisition, development and financing of infrastructure and power generation projects, with a particular focus on tax equity financing.

Akin Gump partner Matt Kapinos guides energy and infrastructure clients through all phases of drafting and negotiating agreements for the purchase, sale, development and financing of energy and infrastructure projects.

Recommended Reading

Marketed: Sage Natural Resources 34 Well Package in Tarrant, Wise Counties, Texas

2024-02-02 - Sage Natural Resources retained EnergyNet for the sale of a 34 package (ORRI) in Tarrant and Wise counties, Texas.

Marketed: Mississippian Play Opportunity in Blaine County, Oklahoma

2024-02-02 - An undisclosed seller retained EnergyNet for the sale of a Mississippian play opportunity in the Webb 15-22-1XH Well in Blaine County, Oklahoma.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.

Marketed: Bendel Ventures 73 Well Package in Texas

2024-03-05 - Bendel Ventures LP has retained EnergyNet for the sale of a 73 well package in Iron and Reagan counties, Texas.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.