UGI Corp. agreed to acquire the Stonehenge Appalachia natural gas gathering system for approximately $190 million on Jan. 4 set to further bolster its growing position in the region.

Headquartered in Pennsylvania, UGI is a distributor and marketer of energy products and services including midstream energy assets within the Appalachian Basin across Pennsylvania, Ohio and West Virginia.

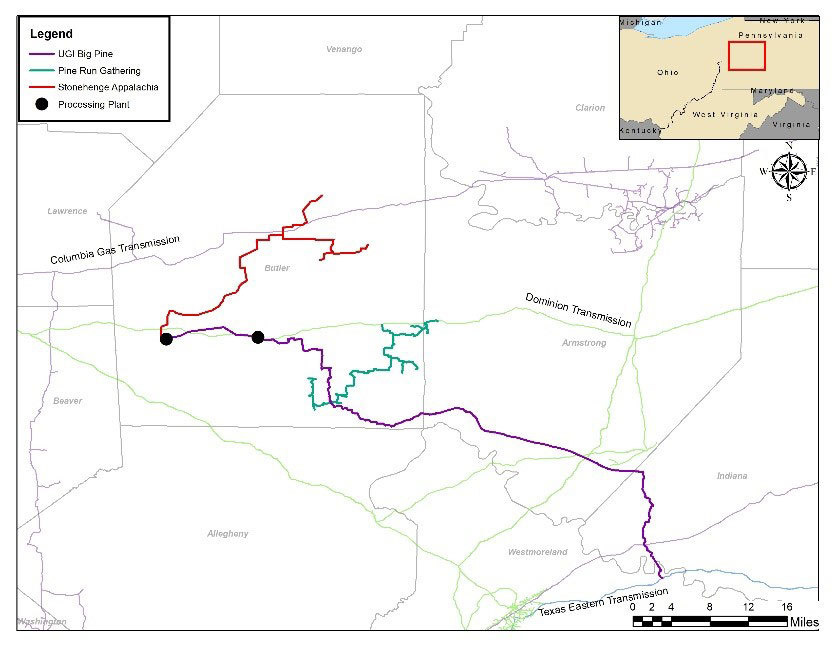

Since the roughly $1.3 billion acquisition of TC Energy’s Appalachia affiliate, Columbia Midstream Group, in 2019, UGI has continued to grow its footprint in the basin including the acquisition of an ownership stake in the Pine Run natural gas gathering system through a joint venture with Stonehenge Energy in early 2021.

“When we acquired the assets of Columbia Midstream Group in 2019, we committed to additional investments to build or buy quality systems in the region,” Robert F. Beard, executive vice president – natural gas, global engineering, construction and procurement, commented in a UGI company release.

“The acquisition of Stonehenge, in addition to our recent purchase of an ownership stake in the Pine Run gathering system,” Beard continued, “demonstrates our commitment to the Appalachian Basin, which averaged a record 31.9 billion cubic feet per day of production in the first half of 2021, the highest for a six month period since production began in 2008.”

The Stonehenge system, located in Pennsylvania’s Butler County, includes more than 47 miles of pipeline and associated compression assets, and has gathering capacity of 130 MMcf/d. Importantly, Beard added that the Stonehenge transaction has stable cash flows underpinned by a long-term contract with minimum volume commitments and significant acreage dedications in what he described as “some of the most prolific production areas in the Appalachian Basin.”

UGI Energy Services LLC, a UGI subsidiary, entered a definitive agreement to acquire Stonehenge Appalachia LLC from Stonehenge Energy Holdings LLC, according to the company release. The transaction, which UGI expects to be immediately accretive to adjusted earnings, is set to close by Jan. 31.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.