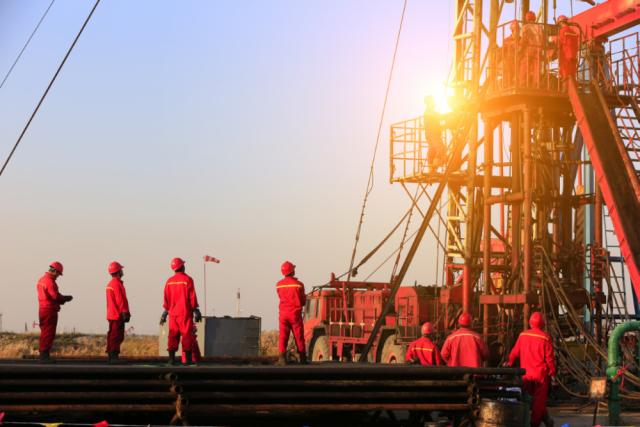

(Source: Pan Demin/Shutterstock.com)

As U.S. shale players focus on high-return, low-cost assets to regain strength amid the latest downturn, attention is turning to DUCs for short-term productivity gains as oil prices continue to stabilize.

However, a situation could arise—in terms of remaining core inventory—if DUCs targeted are in Tier 1 areas of basins, according to an energy data intelligence firm.

“For these operators with larger acreage positions, it’s worth noting that we are going to be experiencing a core inventory location drill down, which is not ideal,” said Sarp Ozkan, senior director of energy analytics for Enverus, “especially should these operators choose to not wait to complete these DUCs for cash flow purposes or going concern purposes in the coming months.”

Speaking during a webinar on Aug. 11, Ozkan said the Lower 48 DUC count has increased by more than 20% since March. Enverus data shows the Permian Basin, for example, saw its DUC well locations rise by 28% to 3,725. He pointed out that DUCs in the Delaware sub-basin have largely been focused on the core.

The inventory of DUCs continued to build this year as the COVID-19 pandemic slowed demand, consequently slowing drilling and completions activity as the oil and gas industry awaited improved market conditions.

“So as prices dropped not only did operators focus in with their rigs on these Tier 1 areas, but they also chose to drill and leave uncompleted wells in these regions,” Ozkan said.

Tier 1 wells in the Delaware typically produce about 1.25x the EUR oil compared to Tier 3 across all formations within the type curve area, he explained. That means “the DUCs that are going to come online are going to be of the highest quality in terms of well productivity,” he said.

The story is similar for the Midland sub-basin and Williston Basin, where Enverus data show Tier 1 wells respectively produce about 1.5x and 1.6x EUR oil compared to Tier 3 wells.

“If commodity prices remain sort of where they are in this $40 range and uncertainty persists in the market, operators are going to continue to consolidate their activity into areas with the best well productivity,” Ozkan said. “That means that that shift to top tier acreage across these major unconventional basins will provide an uplift to the average well level productivity that we might observe.”

Data from the U.S. Energy Information Administration show the DUC count in major oil- and gas-producing regions jumped to an estimated 7,659 wells in June, up from 7,624 in May. Reported data at the time showed increases in the Permian, Bakken, Niobrara and Haynesville, but drops in Appalachia, Anadarko and Eagle Ford. An updated report is scheduled for release Aug. 17.

Several operators have said during second-quarter earnings calls they intend to start completing DUCs. These include international E&P Occidental Petroleum Corp. among others.

“In the DJ Basin, we will begin completing a select group of high-return drilled but uncompleted wells,” Occidental Petroleum Corp. CEO Vicki Hollub said on the company’s earnings call Aug. 11. “We will also selectively resume activity across other assets including completing key development sections in Permian Resources within Greater Sand Dunes and Silvertip during the fourth quarter.”

Permian pure-play Parsley Energy CEO Matt Gallagher anticipates a “nice tailwind from the expected drawdown of about 20 to 25 drilled but uncompleted wells” in 2021.

“This is roughly a $50 million benefit,” Gallagher said on the company’s earnings call Aug. 6. “Additionally, our base decline shallows during 2021, requiring less replacement barrels in 2022, so all else equal $600 million would also be a fair assumption for a 2022 maintenance capital program.”

Exxon Mobil Corp. also spoke briefly about DUCs on its earnings call in late July. Neil Chapman, senior vice president for Exxon, said wells decline rapidly if there is no investment. He also pointed out the substantial number of DUCs.

“You’re also aware [that] it’s a much higher cost to frac than it is to drill,” Chapman said when speaking about 2021 capital plans. “That’s really important.”

Enverus expects completion of DUCs in core areas will be prioritized by oil and gas companies, and the focus on top tier across could uplift decline rates across major U.S. unconventional basins.

Shale wells come on with strong production but decline quickly, Ozkan said, leading to a need to drill new and better wells to offset steep declines. “These wells, in most cases, will decline about 60 to 80% in the first year of their production,” he said. If drilling stopped today, the pace of declines would be “quite alarming,” eventually dropping to levels seen in 2010, Ozkan added.

Operators working with service companies have made strides in gaining efficiencies, drilling wells faster and modernizing completions with longer lateral lengths and higher proppant intensity. These moves have contributed to productivity gains. However, Ozkan noted such gains have slowed as other challenges—such as spacing and parent-child well interaction—emerged. It’s led to changed development methods for some and pushed others toward areas with better productivity and economics.

“As commodity prices remain flat and uncertainty persists in the market,” Ozkan said in his presentation, “operators will continue to consolidate their activity into areas with the best well productivity.”

Recommended Reading

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.

Endeavor Integration Brings Capital Efficiency, Durability to Diamondback

2024-02-22 - The combined Diamondback-Endeavor deal is expected to realize $3 billion in synergies and have 12 years of sub-$40/bbl breakeven inventory.