(Source: Hart Energy; Shutterstock.com)

[Author’s Note: This review of acreage prices was written prior to the recent collapse in crude prices and market volatility. Its primary goal is to provide historical prospective on pricing in key plays. Any forward-looking statements should be read in context of current market conditions. A version of this story appears in the April 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

The past year was a pivotal time for U.S. upstream deal markets and the broader industry. Investors who funded the shale revolution over the past decade became increasingly vocal in advocating for payouts and to cut back on providing new capital. That flowed through to limited M&A and a challenging reaction to deals for much of the year.

While Enverus tracked $96 billion of U.S. oil and gas M&A in 2019, the annual total was substantially skewed by Occidental Petroleum Corp.’s $57 billion acquisition of Anadarko Petroleum Corp. in May. Backing out the Occidental/Anadarko deal, 2019 saw $39 billion in deals or just one-half of the average $78 billion for annual U.S. oil and gas M&A over the past 10 years.

Occidental’s acquisition of Anadarko highlighted 2019’s consolidation in the shale patch. The deal is in the ballpark of Exxon Mobil Corp.’s 2009 acquisition of XTO Energy Inc. as the most spent on shale in a deal. Occidental saw 75% of Anadarko’s value in shale, including the Permian Basin. After allocating value across Anadarko’s portfolio, Enverus estimated the Delaware acreage price at $58,300 per acre, in line with top-tier Permian corporate sales in past years.

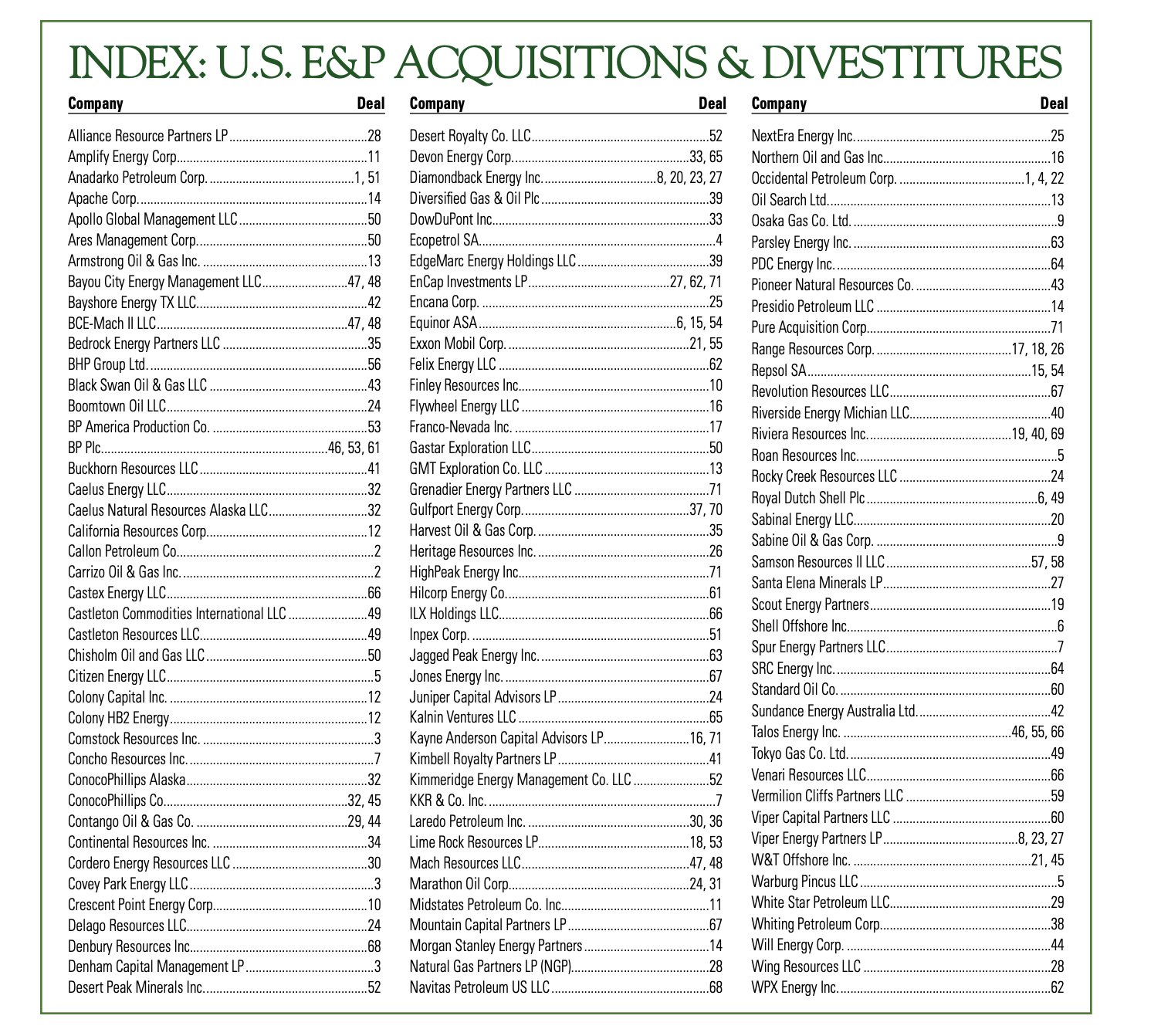

Scroll to end for a comprehensive list of

U.S. E&P A&D deals closed in second-half 2019.

Most of 2019’s other marquee deals also focused on the Permian but came in the back half of the year as sellers seemed to adjust pricing expectations on acreage downward. After the Occidental/Anadarko deal, 2019’s largest corporate deals were Callon Petroleum Co.’s $2.7 billion merger with Carrizo Oil & Gas Inc., WPX Energy Inc.’s $2.5 billion buy of private Felix Energy II and Parsley Energy Inc.’s $2.3 billion acquisition of Jagged Peak Energy Inc. These deals ranged from $6,700 to $10,800 per acre for Permian leasehold.

Buyer demand for undeveloped land outside of the Permian was limited, and few deals saw a substantial payment over production value. The highest priced non-Permian deal was a $185 million acquisition by Marathon Oil Corp. in the Eagle Ford valued at $4,200 per acre. The Williston Basin and the Haynesville Shale saw a number of deals priced in the $2,000 to $3,000 range. In other plays like the Scoop/Stack, buyers proved largely unwilling to pay for undeveloped land.

Overall, all the plays that were surveyed reached their highest average acreage prices between 2016 and 2018 and showed a noticeable drop in 2019. Land valuations in the past year looked similar to where deals were pricing in 2015. As of late February, 2020 has usurped 2019 as the slowest start for upstream deals since 2009. The year has currently recorded less than $1 billion in upstream transactions versus a $9 billion average from 2010 to 2019. With limited buyer appetite, particularly when it comes to paying for upside, acreage values look poised to remain beneath recent 2016 to 2018 highs.

Here is a play-by-play look at pricing across six key unconventional liquids-focused areas, the two most active gas plays plus the Gulf of Mexico. All acreage prices are adjusted for PDP value using flowing production multiples, and averages are based on deals with a disclosed value greater than $50 million.

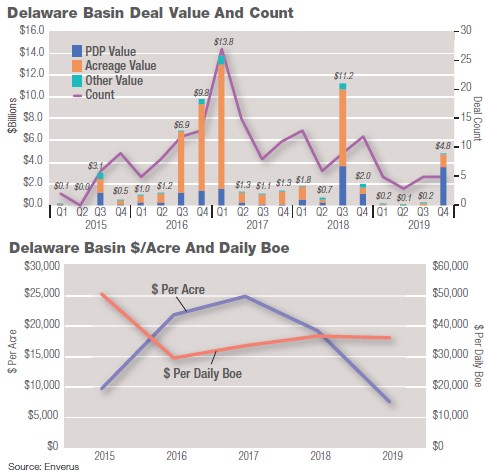

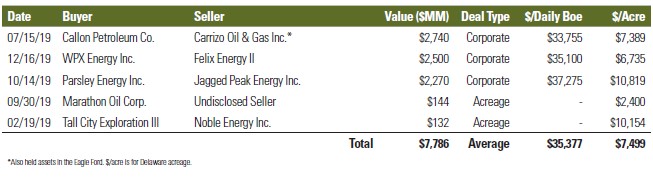

Delaware Basin 2019 M&A review

The Delaware Basin has been a leading play for deal activity, particularly with a land-buying boom that peaked in early first-quarter 2017, when nearly $14 billion in assets changed hands. Leasehold pricing also peaked in 2017 at an average of $25,000 per acre with numerous deals in 2016 to 2018 pricing at $30,000 per acre or more.

Early in 2019 would-be sellers appeared to hold onto past years’ acreage valuations, leading to a high bid/ask spread and trouble negotiating deals. A very notable exception was Occidental Petroleum Corp.’s acquisition of Anadarko Petroleum Corp. for $57 billion in May. While Anadarko held a diversified global portfolio, the Delaware leasehold was among the crown jewels. After adjusting for other assets, Enverus estimates Occidental paid about $58,000 per acre in the Delaware, comparative to top-tier pricing in past Permian corporate deals.

By the back half of the year, seller expectations seem to have moderated, and public buyers began to make acquisitions. Callon Petroleum Co. made an offer for Carrizo Oil & Gas (which also held Eagle Ford assets) although the deal met substantial pushback from Callon shareholders and ultimately required a reworking of deal terms implying a Permian land valuation of $7,400 per acre. Additionally, Parsley Energy Inc. bulked up its position in the Delaware with the acquisition of pure-play Jagged Peak Energy Inc. in a deal valued at $10,800 per acre.

To close the year, WPX Energy Inc. bought EnCap Investments-sponsored Felix Energy II for $2.5 billion, or $6,700 per acre. Excepting the price, the deal had shades of the 2016 to 2018 land-buying boom as a public E&P bought out a premier private-equity operator. Encouragingly, investors cheered the deal with a boost in WPX’s stock as they considered the acreage quality and a moderate price. Delaware leasehold overall averaged $7,500 per acre in 2019, a significant discount from past years and possibly a price that will spur additional deal activity.

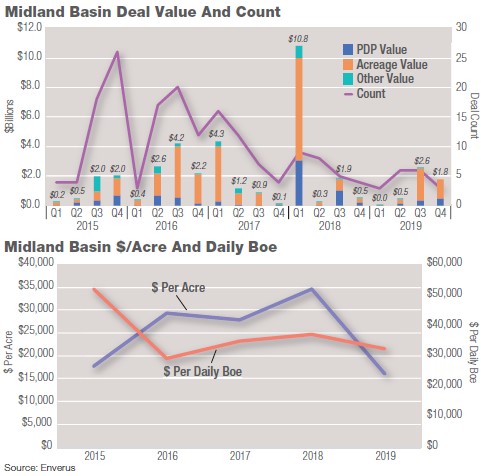

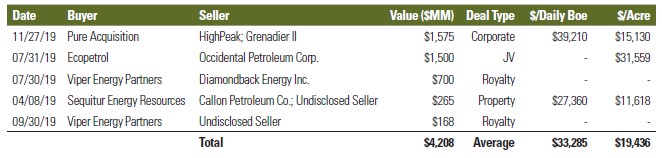

Midland Basin 2019 M&A review

The Midland Basin, along with the Delaware, has accounted for the bulk of the Permian’s rise to the top of U.S. shale regions. The transaction market trajectory of the Midland Basin is slightly less dramatic than its counterpart to the southwest though. With an earlier start to unconventional drilling, Midland Basin leasehold was averaging $15,000 per acre in 2013, at a time when Delaware positions could still be had for a few thousand dollars per acre. Its corresponding rise when Permian land buying kicked off in earnest in 2016 was therefore less dramatic, although average acreage prices did double from $17,800 per acre in 2015 to $34,600 per acre in 2018.

In 2019, Midland deal activity slowed substantially from an average $10 billion per year in 2016 to 2018 to $4.8 billion. In a fairly unique deal, Occidental was able to bring in Colombia’s Ecopetrol as a joint-venture partner for $1.5 billion or $31,600 per acre, fully in line with past Midland pricing. A shrinking buyer pool seems to have taken effect on prices late in the year with HighPeak Energy forming a new northern Midland Basin pure play in a series of combinations implying $15,100 per acre.

Overall, acreage in the Midland Basin averaged $16,000 per acre in 2019 or 50% off the 2018 highs. Prices in the northern and central portions of the basin were on average higher than in the southern Midland. Although the Midland has consistently shown a higher dollar per acre average than the Delaware, that may be primarily a function of fewer transactions, particularly in Tier 2 or 3 areas. It is likely Tier 1 positions in either basin would draw comparable valuations. Acreage prices at this level could spark additional buyer interest. The Midland has a handful of select consolidation targets including some significant private companies, although fewer than in the Delaware.

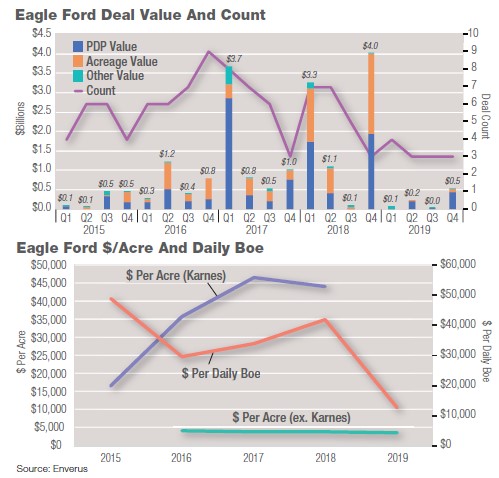

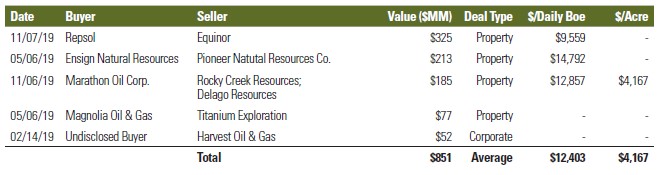

Eagle Ford 2019 M&A review

Deal activity and pricing in the Eagle Ford consists of several subportions of the play tied together by a few overarching themes. The most active years of Eagle Ford M&A were largely in the first half of the past decade, with 66% of total value and 74% of land value paid prior to 2015.

The Karnes Trough area primarily in Karnes County plus portions of Gonzales and DeWitt counties stand out as unique among Eagle Ford areas on pricing. With well economics competitive with the best, core acreage in this narrow area averaged $42,000 per acre 2016 to 2018. This is not indicative of prices in the remainder of the play, however. Additionally, being a core position for a number of large operators, this area rarely trades and had no significant deals in 2019.

Excluding Karnes Trough, prices have remained consistent around $4,500 per acre since 2015 with most deals targeting a section of the black oil or condensate windows. Marathon’s $185 million acquisition from Rocky Creek Resources and Delago Resources in November 2019 was representative at $4,200 per acre. Moving into the thinner areas of the black oil window, acreage values have generally averaged $1,000 to $2,000 per acre with little appetite among buyers in 2019. The gassy portions of the Eagle Ford have particularly struggled with a weak commodity price environment.

Like other plays, the Eagle Ford has recently struggled with a lack of a buyers. Two public stalwarts, Pioneer Natural Resources Co. and Equinor, worked hard to find exits in 2019 and ultimately ended up with what look to be production value only deals. In the past few years, private equity was an active buyer but looks to have pulled back on challenging exit options. The Eagle Ford still plays a key role for big operators including EOG Resources Inc. and ConocoPhillips Co. that rarely participate in M&A.

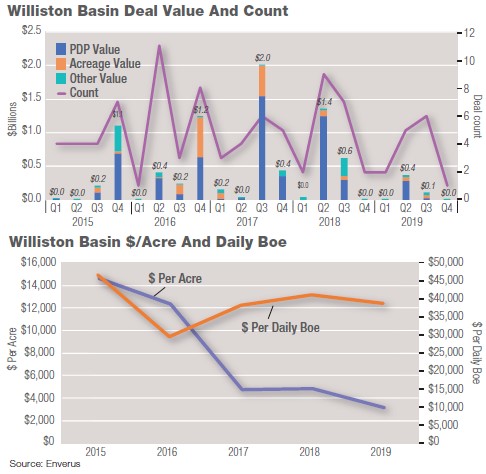

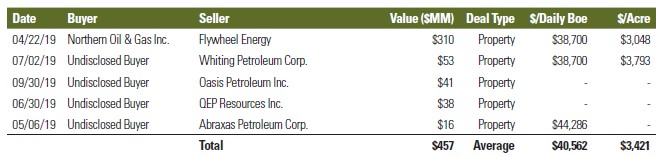

Williston Basin 2019 M&A review

There were limited transactions targeting the Bakken and Three Forks in the Williston Basin during 2019 with just over $500 million in deals, down 66% from the $1.5 billion worth of assets that traded hands in 2018. Along with the Eagle Ford, the Williston Basin constitutes one of the more mature shale plays that had a larger role in deal markets during prior years. Nearly 80% of reported Bakken/Three Forks M&A took place prior to 2015 and 87% of the value paid for land transacted prior to 2015.

Williston Basin acreage values have ceded ground in recent years. The play reached a peak for land valuations in 2015 and 2016 at $14,900 and $12,600 per acre, respectively, before a sharp drop to an average of $5,000 per acre in 2017 and 2018. In 2019, prices further declined to an average of $3,400 per acre.

The bulk of 2019 value came from one transaction, the acquisition of a nonoperated stake by Northern Oil & Gas Inc. from Flywheel Bakken for $310 million, or an adjusted $3,050 per acre. The second-largest deal of 2019 was also comprised of a nonoperated interest with Whiting Petroleum Corp. selling a position for $53 million, or $3,800 per acre.

Reasons for the decline in Williston valuations likely include more attention on the Permian, oil price differentials and relatively high development of the core. Available positions may have less remaining inventory or be located towards the fringier areas. The highest acreage values appear to have been paid in the east-central portion of the Williston, consisting mostly of parts of Dunn, McKenzie, Mountrail and Williams counties, N.D. Like in the Eagle Ford, the Williston remains a key position for a number of large operators that actively drill their core areas but rarely participate in deal markets.

Rocky Mountain 2019 M&A review

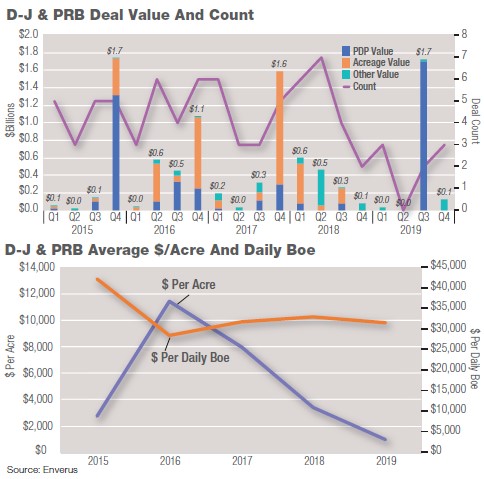

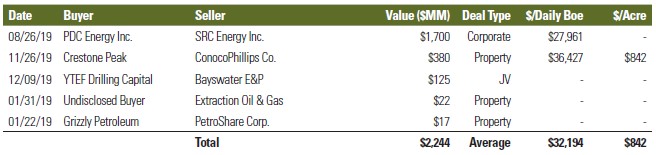

In the Rocky Mountain region, the Denver-Julesburg (D-J) Basin and the Powder River Basin have emerged as the two most consistently active unconventional plays with some similar trends in valuations and deal activity and are the focus of this analysis.

Between the two areas, the D-J Basin has the longer history and has historically been more active for deals. Acreage values in the D-J Basin rose rapidly from $3,000 per acre in 2015 to $11,500 per acre in 2016. Pricing slipped a bit in 2017 to an average of $8,000 per acre, and then land buying evaporated in 2018 with no significant acquisitions. That trend carried over into 2019, with only one transaction specifically focused on the D-J Basin with an implied acreage value. That deal was Crestone Peak Resources’ $380 million acquisition from ConocoPhillips, which implied $842 per acre.

While the D-J Basin lost deal momentum in 2018, the Powder River recorded its most active market ever with nearly $1 billion in transactions and an average price of $3,400 per acre. Leading the way was Northwood’s $500 million buy from SM Energy Co. However, the deal momentum failed to carry through into 2019 with no significant deals.

The largest development of 2019 in the D-J Basin was long-standing operator Anadarko’s acquisition by Occidental for $57 billion. Also, PDC Energy Inc. acquired D-J pure-play SRC Energy Inc. for $1.7 billion. Investors cheered the deal with a boost in stock prices, likely on the low premium, all-equity consideration and sensible in-basin consolidation. Given the weakness in SRC’s stock price, the deal implied $28,000 per flowing barrels of oil equivalent (boe) with no value allocated for acreage.

Additional corporate consolidation seems like the most likely route forward for deals in the D-J, while the Powder River Basin has a few significant operators that could consider a bolt-on deal at the right price.

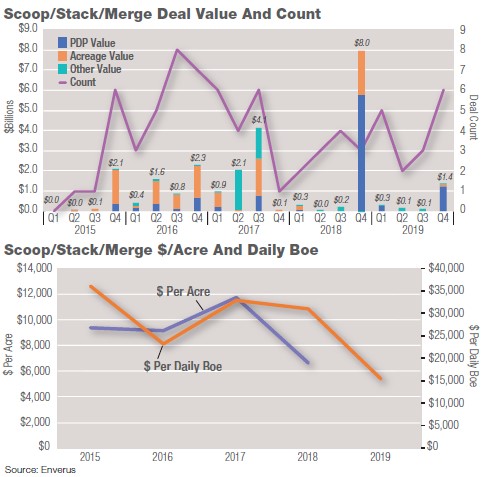

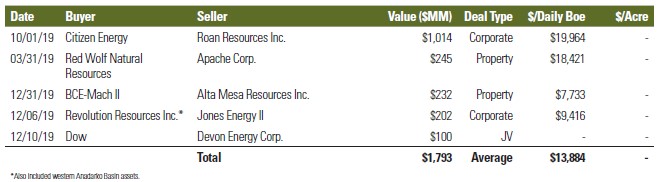

Scoop/Stack/Merge 2019 M&A review

The Scoop/Stack/Merge has had a fairly dramatic trajectory for M&A during the past few years. It began to gain some traction in M&A markets in 2015 and became a major target in 2016 to 2018, averaging $6.9 billion transacted per year. Acreage values rose slightly from an average $9,300 per acre in 2015 and 2016 to a high of $11,800 per acre in 2017. M&A began to slacken off a bit in the play in 2018, but the year ended with Newfield’s $7.7 billion acquisition by Encana Corp. (Ovintiv) in a deal largely focused on the Stack that valued the land at $5,600 per acre.

In 2019, significant challenges emerged, including producers struggling to rein in capex, a sharp drop in gas and NGL pricing and some inconsistent well results. All this amounted to a near-complete lack of appetite for paying up for acreage in the play during 2019.

The year was mostly notable for the exit of public companies into private ownership, all in production value-only deals. In the largest deal of the year, Roan Resources was acquired by Warburg Pincus-backed Citizen Energy for $1.01 billion or $19,964 per boe/d after a brief run in public markets. Jones Energy II was similarly taken private by Revolution Resources (sponsored by Mountain Capital Management) for $202 million, or $9,416 per boe/d after it emerged from Chapter 11.

To end the year, Alta Mesa and its subsidiary Kingfisher Midstream received a stalking horse bid in Chapter 11 from a joint venture between Tom Ward’s Mach Resources and Bayou City Energy. The offer was approved in 2020 for $320 million including $232 million, or $7,733 per boe/d for the upstream assets, ending Alta Mesa’s public market run that started with a special purpose acquisition company deal in 2017. The outlook for valuations in the Scoop/Stack/Merge remains challenging with current commodity prices.

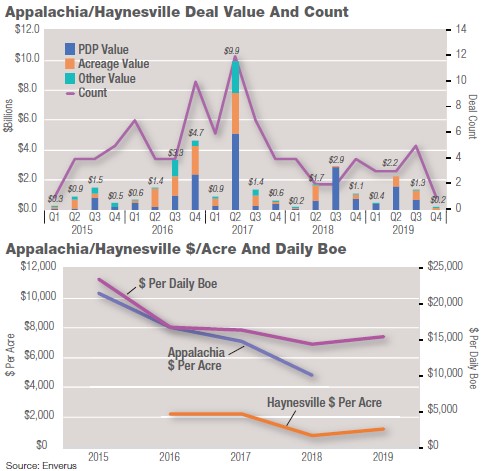

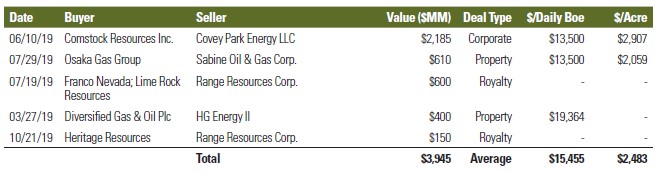

Appalachia/Haynesville 2019 M&A review

Lower 48 gas producers have been challenged by persistently low prices for several years. That has scaled back deal activity to the most economic areas. Outside of the occasional Barnett exit or Rocky Mountain legacy area deal, gas-focused M&A has mostly been in Appalachia and the Haynesville.

Appalachian M&A was fairly active in 2016 to 2018 at an average $7.9 billion per year. Acreage prices however showed a significant and persistent decline, falling from $10,335 per acre in 2015 to an average $4,800 per acre in 2018. Deals in 2018 shifted toward wet-gas areas including the Utica in Ohio to take advantage of favorable NGL pricing relative to gas. However, the 2019 decline in NGL prices looks to have closed that window as well.

The cumulative effects of low gas prices and corresponding financial troubles for producers ground the market for Appalachian acreage to a standstill in 2019 with no significant deals for working interest acreage. Deals have shifted primarily to production value, including Diversified Gas & Oil Plc buying legacy assets from HG Energy II for $3,200 per thousand cubic feet equivalent daily.

The Haynesville has been a more recent M&A target after private equity led a resurgence starting in 2016. However, similar to other areas exits for these operators have proven challenging. Dallas Cowboys owner Jerry Jones has become a major backer of the play via his controlling interest in Comstock Resources Inc. In 2019, he merged with Denham Capital’s Covey Park Energy LLC in a $2.2 billion deal valued at $2,900 per acre.

The Haynesville’s favorable positioning for Gulf Coast LNG export has also drawn the attention of Asian buyers, including Osaka Gas’ $610 million acquisition from Sabine Oil & Gas at $2,100 per acre. After averaging $4,600 per acre in 2016 and 2017, Haynesville prices have declined to an average $2,000 per acre the past two years.

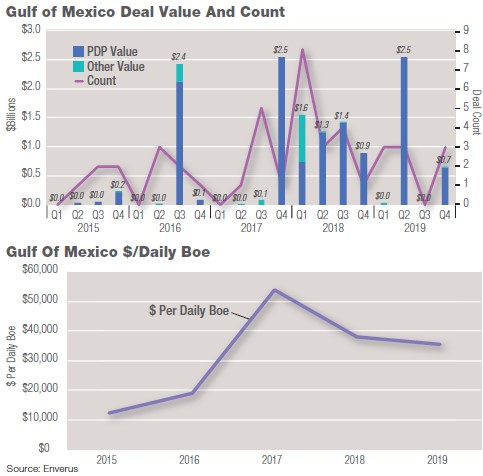

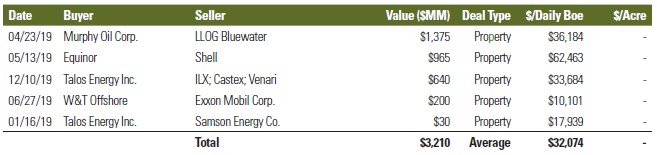

Gulf of Mexico 2019 M&A review

The late 2014 fall in crude prices hit Gulf of Mexico M&A particularly hard. In the years that followed, U.S. independent producers were particularly enthusiastic about the growth prospects for shale and invested significant capital to snap up leasehold while pulling back from offshore operations.

This led to a moribund Gulf of Mexico (GoM) M&A market that saw few deals and, when a deal did occur, low valuations. The most notable deal during this stretch was Anadarko’s acquisition of the deepwater GoM assets of Freeport-McMoRan for $2 billion, implying $21,500 per boe/d (80%-plus oil) or 1.5x EBITDA.

The GoM M&A market began a moderate resurgence in late 2017, when Talos Energy Inc. went public via a $2.5 billion combination with Stone Energy that valued the combined enterprise at $54,000 per boe/d. Since fourth-quarter 2017, GoM M&A has averaged $1.1 billion per quarter versus only $200 million from first-quarter 2015 to third-quarter 2017. Valuations for production (mostly oil-focused deals) have held relatively steady at $38,000 per boe/d and $35,600 per boe/d in 2018 and 2019, respectively.

Even with the rebound, the GoM M&A market remains fairly challenged. Valuations on production and cash flow are moderate, and deals seem to have been priced on production value only with little paid for prospects or discoveries. The buyer pool for offshore assets remains shallow. The majors and large international companies are active in the Gulf but largely focused on an exploration-driven model. Murphy Oil Corp. stands out as a unique U.S. independent that has looked to grow its offshore business in recent years including a $1.4 billion acquisition from LLOG Bluewater in 2019 valued at $36,200 per boe/d or 2.1x EBITDA. That has left mostly the two public GoM pure plays (Talos and W&T) as the primary buyers.

U.S. E&P Acquisitions & Divestitures

Deals closed from July 1-Dec. 31, 2019. Deals closed in first-half 2019 were listed in the September 2019 issue. All deals, updated in real time, are now available at HartEnergy.com/ad-transactions.

Recommended Reading

Russia Orders Companies to Cut Oil Output to Meet OPEC+ Target

2024-03-25 - Russia plans to gradually ease the export cuts and focus on only reducing output.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.

Exxon’s Payara Hits 220,000 bbl/d Ceiling in Just Three Months

2024-02-05 - ExxonMobil Corp.’s third development offshore Guyana in the Stabroek Block — the Payara project— reached its nameplate production capacity of 220,000 bbl/d in January 2024, less than three months after commencing production and ahead of schedule.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

Tinker Associates CEO on Why US Won’t Lead on Oil, Gas

2024-02-13 - The U.S. will not lead crude oil and natural gas production as the shale curve flattens, Tinker Energy Associates CEO Scott Tinker told Hart Energy on the sidelines of NAPE in Houston.