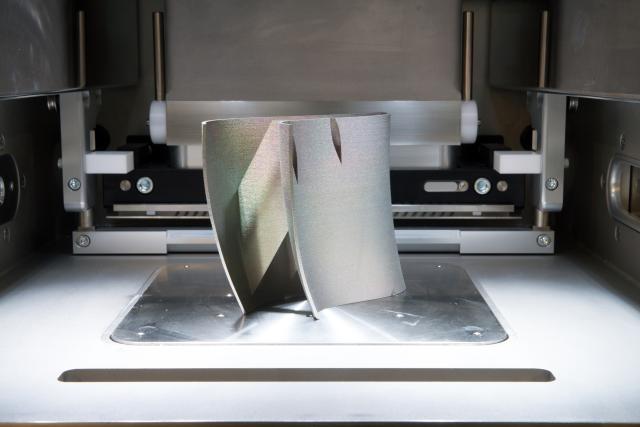

Additive manufacturing presents the oil and gas industry with opportunities to raise its efficiency and cut its carbon footprint. (Source: DNV GL)

[Editor's note: This story originally appeared in the April 2020 edition of E&P. Subscribe to the magazine here.]

Additive manufacturing, the more sophisticated industrial equivalent of 3D printing, may possibly become the most disruptive technology to source and use materials in the oil and gas industry. For example, it could revolutionize the supply of replacement parts for upstream operators. For the supply chain itself, this has the potential to invigorate business models with the integration of just-in-time manufacturing.

The impetus placed on this innovation was evident at the recent Davos 2020 Summit, where two new white papers were presented by the World Economic Forum.

Efficiency gains include shorter lead times for sourcing parts and, crucially, less need for storage as digital design files replace physical stock. By enabling onsite production, additive manufacturing also could eliminate the need to transport some components, thus helping to decarbonize oil and gas operations.

While the opportunities are clear and have been realized in other sectors, such as aerospace and medicine, the adoption of additive manufacturing is still in its infancy to support oil and gas activity.

According to DNV GL’s report “New Directions, Complex Choices,” 8% of those surveyed view spending on 3D printing/additive manufacturing as the highest priority for their business. The comprehensive global survey of more than 1,000 senior oil and gas professionals has revealed that nearly three-quarters (72%) of respondents believe digitalization is critical for their organization’s survival.

Building trust layer by layer

In November 2017, DNV GL published the first guideline (DNVGL-CG-0197) for the use of additive manufacturing in the maritime and oil and gas industries, creating a clear pathway and systematic processes to assess every parameter that will impact the final products. Most recently, a new guideline provides an internationally acceptable framework for ensuring the integrity and quality of additive manufacturing parts for use in the maritime and oil and gas industries. The guideline was developed as part of a two-year joint industry project (JIP) involving 20 companies across operators and the supply chain.

While BP, Shell and Woodside are among the most widely cited operators taking advantage of additive manufacturing, the speed of uptake is generally slow, despite the risk-free insight and financial benefits it may bring. For example, Shell used 3D printers to prototype components for its Stones project in the Gulf of Mexico in 2016. Through the adoption of additive manufacturing, oil and gas companies can shape the technology to their own purposes while learning from each other and other industries.

Optimizing design and manufacturing

The key is using digital designs to direct the printing of physical parts, larger structures or additional layers of materials. The raw materials include, among others, plastics and metals, typically supplied as powders and wires. User-friendly digital platforms can connect files, machines and users to facilitate the sharing of digital files within organizations and among their supply chains.

Iterations can be tested rapidly; there is no need for costly retooling of machines as in car manufacturing, for example. Driven by digital connectivity and the distributed manufacturing capabilities of additive manufacturing, making equipment and components could shift away from centralized manufacturing. It could move instead to locations exactly or close to where the products will be used, such as on an oil platform, and help extend the functional life of aging oil and gas assets.

Understandably, for maturing infrastructure, replacement parts can be difficult to get or make. Keeping stock for spares that may never be needed also is expensive. A form of additive manufacturing could potentially add new material to an eroded area, extending the life span of that part, thereby reducing

the life-cycle cost of equipment.

A quandary for OEMs

In the oil and gas industry, additive manufacturing also presents potential challenges and opportunities for the business models of original equipment manufacturers (OEMs). One common model is to make and deliver equipment, then collect after-sales revenue by supplying spare parts to local or regional resellers. Another is to supply equipment and keep it running efficiently over a contracted period.

To recapture market share, OEMs could take advantage of emerging digital supply-chain platform models to protect their intellectual property rights. They would supply digital files securely to selected local resellers equipped with additive manufacturing capability, thereby reproducing parts legally and safely. This would reduce the costs of parts and boost their availability.

Software companies are working on these issues using blockchain technology for auditing the life history of designs and parts. This can create an immutable register of what the part is and if someone is trying to print a counterfeit product. Artificial intelligence and its subset, machine learning, can help in this area. DNV GL is among the founding members of the International Association of Trusted Blockchain Applications, an EU-backed initiative aiming to create a framework that also will allow blockchain to flourish.

Research, investment and collaboration

In 2018 the Global Additive Manufacturing Technology Centre of Excellence opened in Singapore, where the Approval of Manufacture Scheme launched (DNVGL-CP-0267).

In June 2019, DNV GL released DNVGL-CP-0291, a Type Approval program that specified requirements to obtain, maintain and renew the company’s Type Approval certificate for the manufacturing of metal powder and wire feedstock, intended for products made by additive manufacturing.

A program was completed and a report issued following a study to consider the economic viability, technical feasibility and regulatory requirements for the printing of these parts. This involved 10 ship owners, operators and ship management companies that are members of the Singapore Shipping Association. DNV GL devised an “Additive Manufacturing Potential Matrix” and assessed the printability for the 100 most commonly ordered marine parts in Singapore.

Other collaborative initiatives include Phase 1 and Phase 2:

• Phase 1 of the Digital Warehouse JIP will investigate qualification of nondestructive testing methods for additive manufacturing and the effect of heat treatment on corrosion properties;

• Phase 2 of the ProGRAM JIP will focus on developing requirements for the qualification and production of parts by additive manufacturing for the oil, gas and maritime industries; and

• Phase 1 of the Batch Evaluation Testing JIP will develop methods to reduce the cost and time to qualify/certify additive manufacturing parts for maritime and oil and gas applications.

DNV GL also has signed a four-year research collaboration agreement with Singapore’s Nanyang Technological University that supports academic advances in additive manufacturing for the oil and gas, maritime and other industries.

Through a framework agreement with Aurora Labs 3D, based in Western Australia, DNV GL will provide certification services for the company’s unique 3D metal printers. The company was recently elected as one of the top five additive manufacturing startups in the world of nearly 240 firms reviewed.

Action for adoption

While additive manufacturing is still relatively new to the oil and gas industry, the potential rewards convince analysts that demand will develop rapidly. According to market researchers SmarTech Publishing, additive manufacturing is forecast to become a $450 million market in the oil and gas industry by 2021 and a $1.4 billion market by 2025. Once the obvious hurdles are overcome, the likely payoffs for operators and OEMs could be enormous.

As the technology undergoes rapid advances and as growth in its use is expected to increase exponentially, the challenge now is to unify understanding and build a solid framework to ensure the sector realizes the economic and environmental benefits this promising manufacturing technology brings.

References available. Contact Jennifer Presley at jpresley@hartenergy.com for more information.

Recommended Reading

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.

Imperial Oil Shuts Down Fuel Pipeline in Central Canada

2024-03-18 - Supplies on the Winnipeg regional line will be rerouted for three months.

Hess Midstream Subsidiary to Buy Back $100MM of Class B Units

2024-03-13 - Hess Midstream subsidiary Hess Midstream Operations will repurchase approximately 2 million Class B units equal to 1.2% of the company.

Apollo Buys Out New Fortress Energy’s 20% Stake in LNG Firm Energos

2024-02-15 - New Fortress Energy will sell its 20% stake in Energos Infrastructure, created by the company and Apollo, but maintain charters with LNG vessels.