Steve Chazen, who resurfaced roughly a year after retiring from Oxy to form TPG Pace Energy in early 2017, will now head the newly-formed Magnolia Oil & Gas. (Image: Hart Energy)

[Editor’s note: This story was updated at 4:16 p.m. CT March 20.]

Steve Chazen, the former CEO of Occidental Petroleum Corp. (NYSE: OXY), will use the $650 million his blank-check company raised in May 2017 to form a pure-play South Texas operator in a $2.6 billion partnership with EnerVest Ltd., the companies said March 20.

Chazen’s TPG Pace Energy Holdings Corp. (NYSE: TPGE) will carve out EnerVest’s Eagle Ford and Giddings Field/Austin Chalk assets in South Texas to create a new company called Magnolia Oil & Gas Corp., which will trade on the New York Stock Exchange.

TPG will acquire EnerVest’s assets in a cash and stock deal that allows EnerVest’s owners to retain a significant ownership stake in Magnolia. TPG has also raised a $355 million through a private investment in public equity (PIPE) offering.

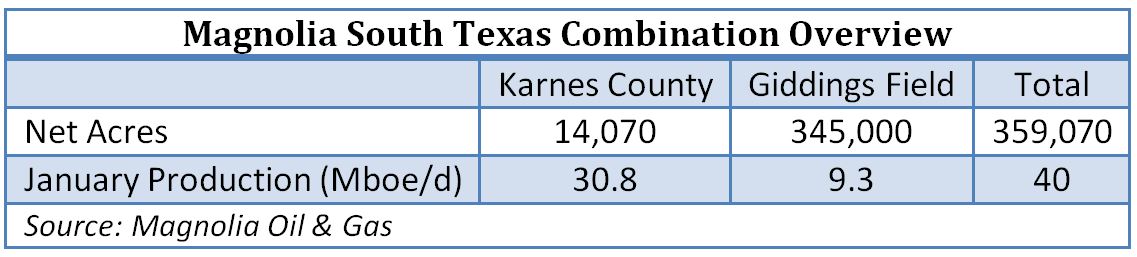

Magnolia’s assets will consist of EnerVest’s 359,000 net acres in South Texas. The position includes about 14,070 net acres in Karnes County, Texas, and 345,000 net acres in the Giddings Field.

EnerVest’s South Texas division operates about 1,200 wells. In 2016, the company purchased South Texas assets in several deals totaling $1.3 billion.

Current net production from EnerVest’s South Texas assets is about 40,000 barrels of oil equivalent per day (boe/d), with 31,000 boe/d in Karnes and 9,000 boe/d in Giddings. Production from the combined asset base is 62% oil and, overall, 78% liquids. The acreage position is almost entirely HBP, according to the companies’ joint press release.

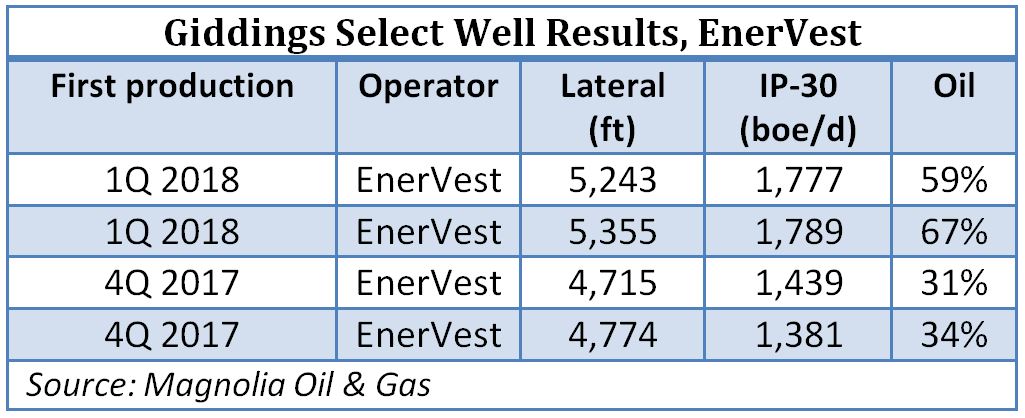

Magnolia plans to target Austin Chalk zones in Giddings, which has been commercially developed since the 1970s. The company and EnerVest will operate the assets together.

The Austin Chalk has increasingly spurred A&D activity and in South Texas has shown good results for companies such as EOG Resources Inc. (NYSE: EOG). Magnolia said that certain Karnes wells have outperformed “even the best Eagle Ford and Permian-Wolfcamp” well results.

EOG completed four Austin Chalk wells in fourth-quarter 2017 at lateral lengths of about 5,300 ft. Average 30-day IPs average 2,280 barrels per day (bbl/d) of crude oil and condensate compared to similar production in the Wolfcamp of 1,410 bbl/d using 6,000 ft laterals.

Success in Texas has bled over to deals in Louisiana’s Austin Chalk. In December, for example, PetroQuest Energy Inc. (NYSE: PQ) purchased about 24,600 gross acres in the play for $18.6 million in cash and stock in December.

Chazen formed TPG Pace Energy in 2017 roughly a year after retiring from Oxy as part of a pack of former high-profile E&P leaders whose clout helped raise at least $2.4 billion through special purpose acquisition companies (SPAC) for to-be-named-later acquisition targets.

Chazen will lead Magnolia as the company’s full-time chairman, president and CEO and is joined by Christopher Stavros, another former Oxy executive, as Magnolia’s CFO. In addition to Chazen’s leadership, EnerVest’s South Texas team will continue to operate the Magnolia assets following the closing of the transaction under a long-term services agreement with EnerVest.

“I have known Steve for more than 20 years and I cannot think of a better executive to lead Magnolia,” EnerVest CEO and founder John B. Walker said in a statement. “The playbook he perfected at Oxy is a great match for the outstanding acreage we have assembled in South Texas over the last 10 years.”

Magnolia conservatively estimates running a 2.7 rig program in 2018 with base EBITDA of $461 million. By 2019, the company estimates 12% EBITDA growth to $517 million.

Additionally, Magnolia said it will generate $241 million in free cash flow based projected West Texas Intermediate prices of $58 and $2.75 Henry Hub pricing.

Upon closing, Magnolia will maintain a seven-person board, which will include Chazen as chairman, two appointees named by each of TPG and EnerVest and two additional independent directors. EnerVest will also retain a significant ownership stake in Magnolia, the release said.

In connection with the transaction, TPG plans to raise $330 million through a private placement of roughly 33 million shares common stock. The placement, expected to close concurrently with the transaction, was anchored by certain funds and accounts managed by Fidelity Management & Research Co., Davis Selected Advisers LP, certain funds managed by Capital Research and Management Co. and several other institutional investors. In addition, Chazen and certain TPG executives will personally subscribe for an additional $25 million investment on the same terms.

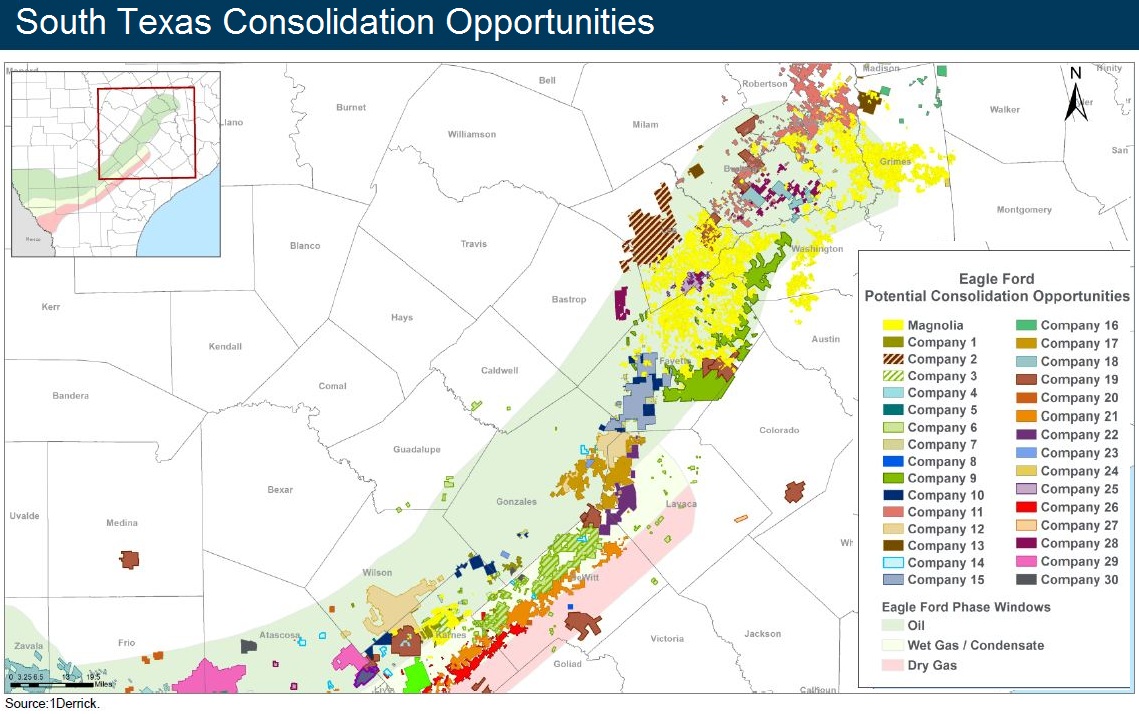

Magnolia also said a large number of potential acquisition targets are available in South Texas since “an increasing number of public companies view South Texas assets as noncore and are not actively allocating capital to the region.”

Several public companies are also actively marketing their positions, the company said.

Magnolia will trade under a new ticker upon closing, which is expected late in second-quarter 2018. The transaction is subject to approval by TPG shareholders and other customary closing conditions.

Credit Suisse Securities (USA) LLC was financial adviser to TPG. Deutsche Bank Securities Inc. and Goldman, Sachs & Co. were the company's capital markets advisers, while Vinson & Elkins LLP acted as its legal counsel. Citigroup was financial adviser and capital markets adviser to EnerVest and Gibson, Dunn & Crutcher LLP was its legal counsel. Bank of America Merrill Lynch was previously adviser to EnerVest in the divestiture of its Giddings Field assets.

Emily Patsy can be reached at epatsy@hartenergy.com and Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.