(Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

TotalEnergies said Jan. 20 that it had started gas production in Oman’s onshore Block 10 and entered a new long-term LNG purchase agreement with Oman LNG, according to a press release.

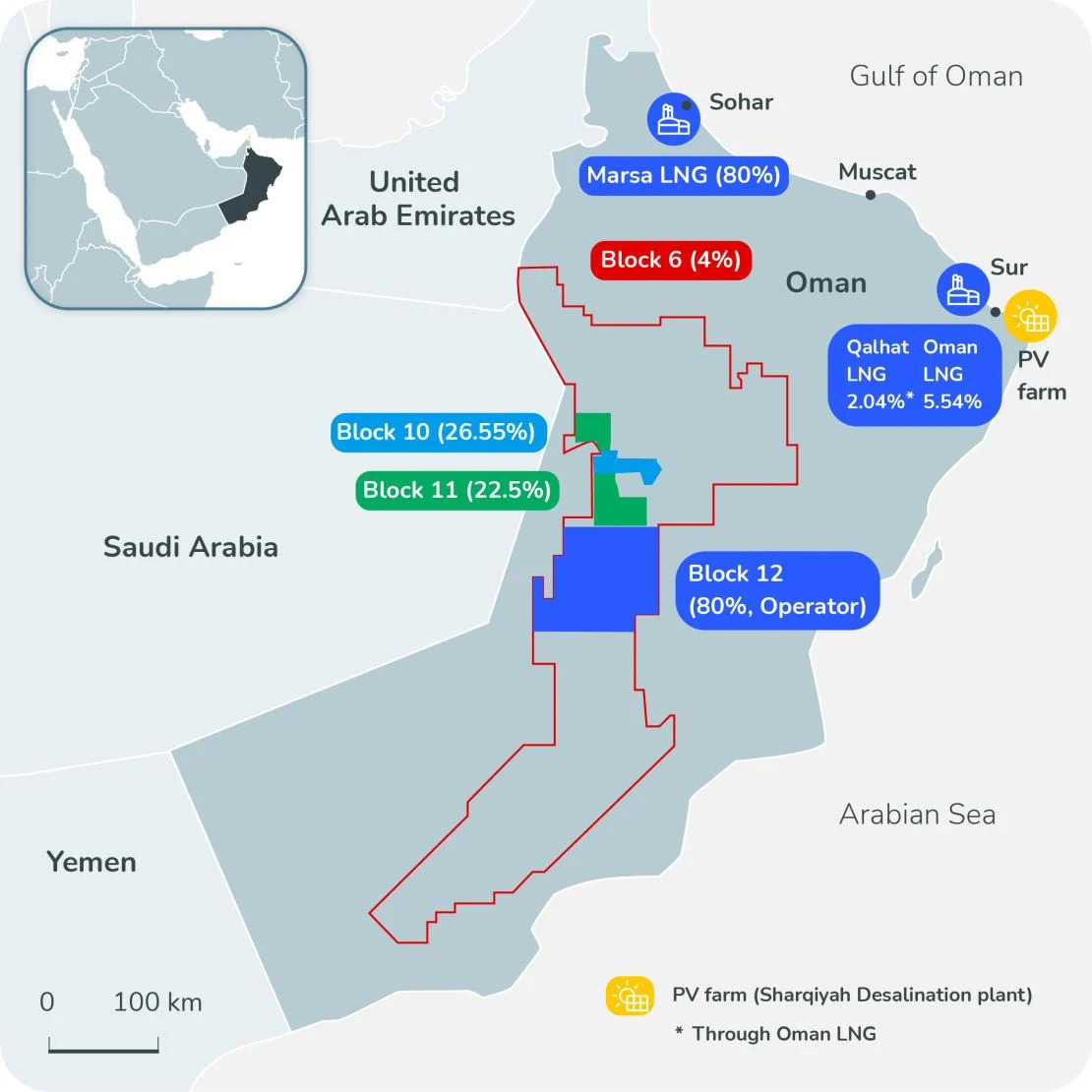

Gas production from the onshore Block 10 at the Mabrouk North-East field in the Sultanate of Oman, in which Total holds 26.55% interest, is expected to reach 500 million standard cubic feet per day (MMscf/d) by mid-2024. As the operator, Shell holds 53.45% and OQ holds the other 20%.

Gas produced from Block 10 will supply the Omani gas network to feed local industry and LNG export facilities.

In TotalEnergies’ new contract with Oman LNG, the company agreed to purchase of 0.8 million metric tons per year (MMmt/year) of LNG for a period of 10 years starting in 2025.

RELATED

Oman LNG Signs Deals with TotalEnergies, Thailand's PTT

The contract will allow TotalEnergies to address both Europe and Asian markets and reinforces the French company’s LNG integrated systems.

The French company hopes its growth strategy in gas and LNG will contribute to its energy transition. LNG from the long-term purchase agreement with Oman LNG will reduce CO₂ atmospheric emissions by providing sources of heavy emissions with LNG instead of coal, said Total in the press release, adding that a natural gas power plant releases approximately half the amount of CO₂ as a coal power plant.

“These announcements are consistent with the ambition of TotalEnergies to contribute to the energy transition and reinforce its long-standing partnerships with both Oman LNG and the Omani State”, said Patrick Pouyanné, chairman and CEO of TotalEnergies. “TotalEnergies deploys in Oman its multi-energy strategy in oil, gas and renewables and so participates in the sustainable development of the country’s natural resources.”

TotalEnergies describes itself as the world’s third-largest LNG player. In Oman, the company’s production was 40 kboe/d in 2022. Total also recently signed 30 megawatts (MW) of solar projects in Oman, including an agreement to supply Sharqiyah Desalination Company 17 MW in a joint venture with Veolia.

Recommended Reading

Baker Hughes Marks Hydrogen Milestones

2024-01-29 - The energy technology company is involved with several hydrogen projects as it works to accelerate the hydrogen economy.

Baker Hughes Makes Flare Emissions Breakthrough

2024-03-14 - Baker Hughes has developed a new application for flare.IQ, its emissions abatement technology.

Phillips 66 Reaches Milestone at San Francisco Bay Area Refinery

2024-04-02 - By the end of second-quarter 2024, Phillips 66 aims to have the complex finished and producing more than 50,000 bbl of renewable fuels.

Tangled Up in Blue: Few Developers Take FID on Hydrogen Projects

2024-04-03 - SLB, Linde and Energy Impact Partners discuss hydrogen’s future and the role natural gas will play in producing it.

Shell Taps Bloom Energy’s SOEC Technology for Clean Hydrogen Projects

2024-03-07 - Shell and Bloom Energy’s partnership will investigate decarbonization solutions with the goal of developing large-scale, solid oxide electrolyzer systems for use at Shell’s assets.