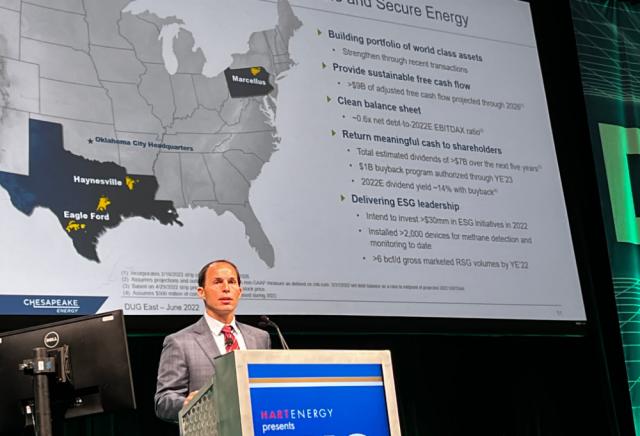

The entire industry must rise up to meet the challenges facing the world, and Chesapeake Energy is doing its part, COO Josh Viets said on June 14. (Source: Jennifer Pallanich / Hart Energy)

PITTSBURGH—Causes behind the world’s energy shortage, though exacerbated by current events, actually stretch back over the last two decades, according to Josh Viets, executive vice president and COO of Chesapeake Energy Corp.

A shift in investment from oil and gas to renewables combined with low natural gas storage levels and war to create the energy shortage of today. Access to energy correlates to quality of life, and the industry has a responsibility to work to provide energy that is affordable, reliable and low-carbon, Viets told attendees of Hart Energy’s DUG East Conference and Exhibition on June 14.

“As a society, we are absolutely short on energy today,” he said. “But the problems we are in today occurred about 20 years ago.”

He pointed to climate change commentary as a factor in redirecting some investment in the oil and gas supply toward renewable sources. As a result, European oil and gas production has decreased even as shale was helping the U.S. approach energy independence, he said.

“Natural gas can be part of the solution going forward and be part of a lower-carbon future.”—Josh Viets, executive vice president and COO, Chesapeake Energy Corp.

Last year was dry and low wind, which resulted in a 30% reduction in power generation from renewable sources and correspondingly helped deplete European gas storage, he said. Add to all of that Russia’s invasion of Ukraine, and the result is high energy prices with “inflation running rampant.”

And the shortages in Europe are not unique to the continent.

“We also have problems of our own,” Viets said.

The U.S. has low storage levels as well, partly due to a cold winter, an already hot summer plus an increase in LNG exports.

“Demand on natural gas is expected to be quite high, and supply is expected to be constrained,” he said.

There needs to be a conversation about balance in energy policy with a focus on the three pillars of affordability, reliability and lower-carbon future, he added. “The stakes on this are quite high.”

In short, quality of life correlates to access to energy, he said, recalling the words of Dr. Scott Tinker, director of the Bureau of Economic Geology at The University of Texas at Austin: “Energy won’t end poverty, but you can’t get out of poverty without energy.”

And natural gas can play a role in lifting the quality of life around the world, according to Viets.

“Natural gas can be part of the solution going forward and be part of a lower-carbon future,” he said.

Analysts project that natural gas demand will either remain steady or grow over the next 20 to 30 years. One contributor to that is the move to switch from coal to natural gas in an effort to reduce emissions.

But, “on the supply side, we’re going to see some constraints in the system,” he said.

And in light of Russia’s attack on Ukraine, LNG exports are expected to continue to increase, with the “U.S. expected to play a prominent role” in meeting that demand, he added. The entire industry must rise up to meet the challenges facing the world, and Chesapeake is doing its part.

Out of bankruptcy as of February 2021, Viets said Chesapeake has “absolutely learned our lessons from the past” and will not allow the balance sheet to get out of control again.

In November 2021, Chesapeake purchased Vine Energy to increase its holdings in the Haynesville Shale and, in January, purchased Chief E&D Holdings to boost holdings in the Marcellus Shale. Around the same time, the company also sold its Powder River Basin assets in Wyoming to Continental Resources.

Additionally, Chesapeake has focused on reducing its greenhouse-gas intensity and certifying its Haynesville and Marcellus operations. The Haynesville operations are 100% certified and the expectation is Marcellus will be by the end of the year, he said.

Viets also highlighted the more than 2,000 continuous monitoring instruments currently operating in Chesapeake fields, and said that number is expected to increase.

“We can respond at a moment’s notice any time a leak is reported on the field,” he said.

When the concept of responsibly sourced gas (RSG) came about, Viets said, “there was thinking it would lead to a premium in the price you receive, but if it is, it’s in the pennies.”

“But that’s not why we do it,” he continued. “We think it’s the right thing to do.”

Recommended Reading

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.