Presented by:

An abundance of shallow-water resources with depths below 60 m, warmer climates and access to offshore supply chains with skilled workers bodes well for the U.S. Gulf of Mexico’s (GoM) future in offshore wind, experts say.

Add to this is the positive momentum being built by policymakers eager to diversify energy supplies. As a result, the GoM—home to oil rigs, marine life, shrimp boats, ships passing through and military activity—may be on its way to becoming the world’s next wind energy powerhouse.

That is if offshore wind players see beyond risks and pursue leases when the Bureau of Ocean Energy Management (BOEM) offers acreage for development, a move that could come in early 2023.

Between now and then, there is plenty for stakeholders to think about including the weather. Specifically, can offshore wind turbines withstand a Category 5 hurricane that packs a wind speed of at least 157 mph and a potential storm surge greater than 20 ft?

“I know that many companies are looking at it [GoM wind area leasing] right now. It doesn’t mean that they’re going to participate but I know everybody’s paying attention,” said Ella Foley Gannon, a partner and permitting lawyer with the Morgan Lewis law firm. “There’s an interesting blend of consortiums of different developers who are getting joint ventures together for these sorts of efforts. Do I think that we’re going to see the same sort of interest that we saw in the Bight? I don’t think so. But do I think we’ll see significant interest? Yes.”

“The oil and gas experience that exists in this part of the country is directly applicable to the type of work that needs to be done to create offshore wind.”—Ella Foley Gannon, Morgan Lewis

Expanding the budding U.S. offshore wind sector has been a key cog in the Biden administration’s clean energy ambitions, which include deploying 30 GW of offshore wind by 2030. So far, only two wind farms are operating in federal waters off the East Coast—Block Island off Rhode Island and the Coastal Virginia Offshore Wind project. However, several more are in the works—mostly off the East Coast—and more could be on the horizon.

Which GoM areas go on the auction block, should the BOEM call a lease sale and whether offshore wind players dive into GoM action remains to be seen. Some say state incentives, contracts and financing are among the factors that will determine success.

The Next Wave

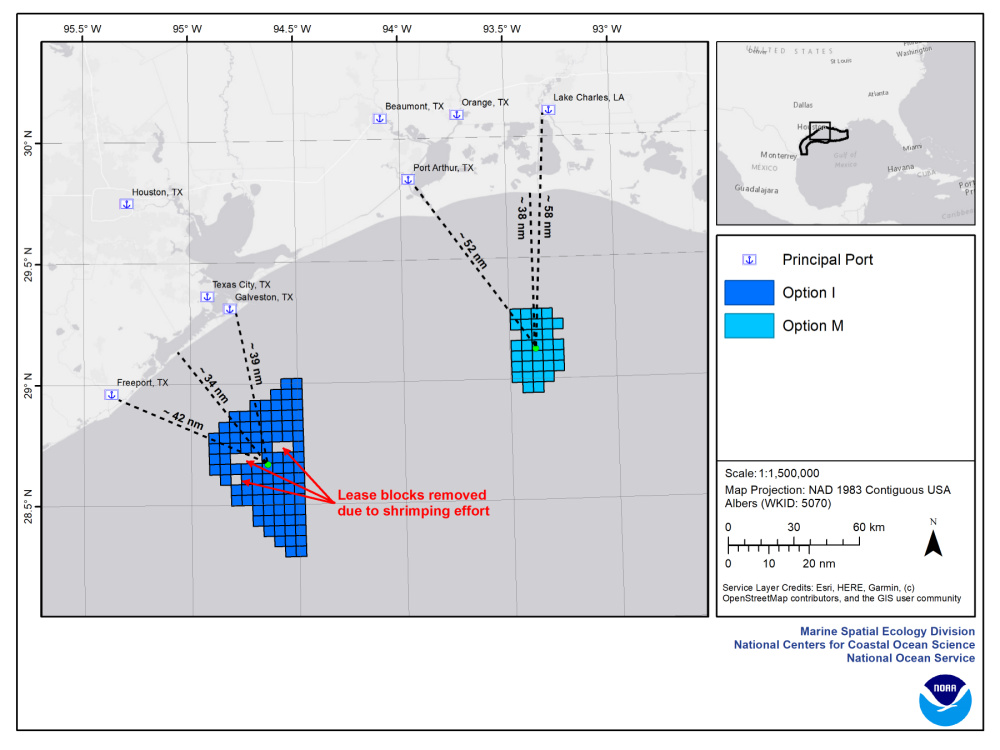

The U.S. is seeking public comment on nearly 735,000 acres identified offshore Texas and Louisiana for potential wind energy development in the Gulf of Mexico (GoM) with a potential to power more than 3 million homes.

The areas—one about 24 nautical miles off the coast of Galveston, Texas, and the other about 56 nautical miles off the coast Lake Charles, La.—were unveiled July 20 by the BOEM. The acreage is a sliver of the initial 30 million-acre area in the GoM presented in 2021.

Decisions have not been made yet on which parts of the identified acreage would ultimately become part of future leases.

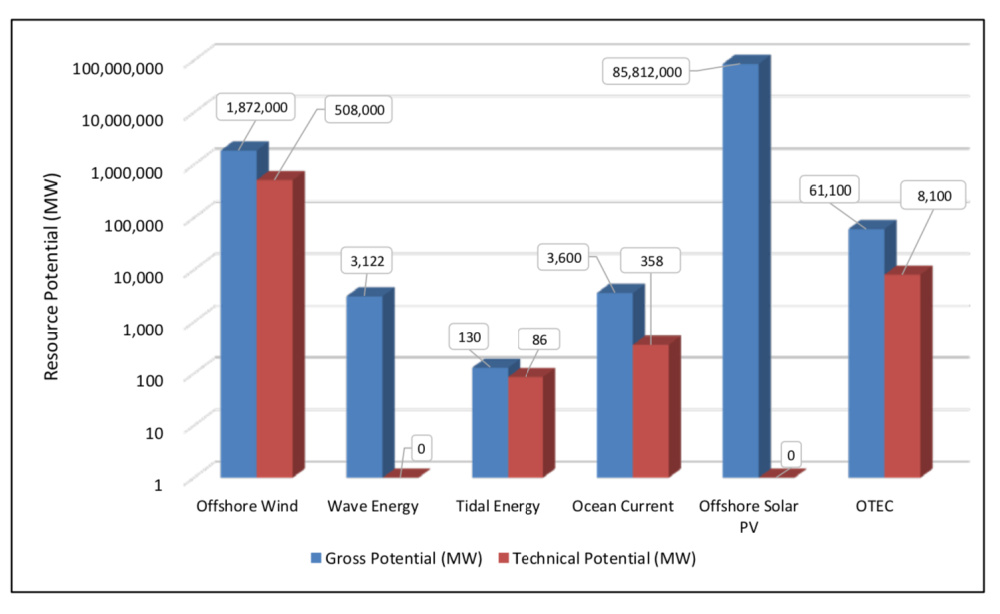

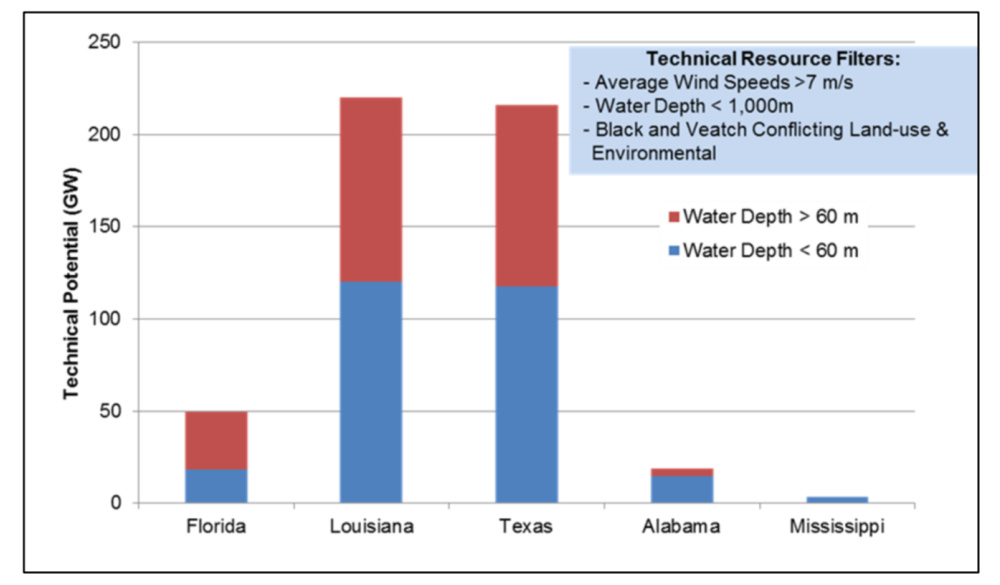

A two-part 2020 study, prepared by the National Renewable Energy Laboratory (NREL) for BOEM, shed light on the region’s high potential to deliver utility-scale electricity based on resource adequacy, technology readiness and cost competitiveness.

Though the GoM’s wind resources are lower than northern Atlantic and Pacific coastal states, the study stated, resource capacity is large in GoM shallow water less than 60 m deep. Under certain conditions, it ranked offshore wind resource capacity offshore Louisiana, Texas and Florida among the highest in the U.S.

“The primary technical challenges for offshore wind turbines in the GoM are gaps around hurricane design, lower wind speeds, and lower soil strength,” NREL added. “None of these challenges are insurmountable, but all will require some additional investment in research, development, and deployment to adapt the technology and gain the experience needed for commercial acceptance. Each challenge could result in incremental capital cost increases.”

Better turbine access, shallow-water siting, lower labor cost and direct access to the oil and gas industry’s supply chain, however, could help offset higher costs. State and federal policies to incentivize development and procurement of offshore wind is a key component, Gannon said.

“That will define where we’re going to have at least the initial success of offshore wind,” she said.

Policy Push

State programs and momentum behind such efforts should be top of mind for companies interested in developing GoM wind energy projects, according to experts.

“I think [they] made the difference in the prices we saw in the New York Bight versus what we saw in Carolina,” she said. “Without having any contracts in place or any definitive signs that you’re going to get contracts in place, you can’t put as much capital at risk.”

In New York, policymakers are aggressively pursuing clean energy. Here, law mandates that 9,000 MW of offshore wind energy must be developed by 2035 and at least 70% of the state’s electricity must come from renewable energy sources by 2030.

“A lot of states on the East Coast have already done that and that inspires confidence in the market and inspires confidence in developers in knowing that once I win a lease I’m going to have somewhere to sell the power.”—Ben Koenigsberg, Norton Rose Fulbright US

North Carolina Gov. Roy Cooper called for 2.8 GW of offshore wind capacity by 2030 and 8 GW by 2040, but state law doesn’t mandate the goals.

The New York Bight offshore wind auction for six leases in February 2022 drew competitive winning bids from six companies totaling nearly $4.4 billion with bids ranging from $285 million to $1.1 billion. In May, the Carolina Long Bay Offshore Wind lease sale for two leases brought in $315 million in total winning bids—one for $155 million, the other for $160.

Looking at the GoM, Gannon said there is no government focus on contracting wind, and price challenges are expected for the foreseeable future.

“Without having sort of any firm commitment from the purchasers of the energy and from the state to purchase that energy, that’s obviously a huge challenge,” she said.

Ben Koenigsberg, co-head of projects for Norton Rose Fulbright US, agreed that public policy, including commitments by states on renewable energy goals over the next 20 years, are important to accelerating GoM wind development.

“A lot of states on the East Coast have already done that and that inspires confidence in the market and inspires confidence in developers in knowing that once I win a lease I’m going to have somewhere to sell the power,” Koenigsberg said. “One of the risks here is you win a really large lease and then you have to pretty much pay upfront the price that you won. That’s a big risk to developers if they don’t know that there’s a commitment” from states to issue solicitations to support those large leases.

Louisiana has established a climate initiatives task force and climate action plan that aims for net-zero emissions by 2050 and development of an offshore wind plan targeting 5 GW by 2035.

Texas has not set any offshore renewable energy goals, according to a BOEM Draft Area ID Memo. The state is a leader in both fossil fuel and renewable energy production, including onshore wind and solar.

“On the federal side, there’s already been a fair amount that’s been done extending the qualification for tax credits to the 30%. That’s really helpful to help spur development,” Koenigsberg said.

Eyeing Liquidity

Should companies pursue GoM wind, will they have access to capital?

“In the current market, there is a wall of liquidity and a fair amount of capital available to build these projects,” Koenigsberg said, speaking to the commercial bank market component. “It will remain to be seen where things go with the economy. … But if the last five years are an indication of what’s available in the future, there’s definitely enough capacity to get these deals done. A number of the really large projects that have been financed recently have been oversubscribed.”

Banks understand the risks associated with such projects. Getting financing wouldn’t be difficult—in Koenigsberg’s opinion—if the project is structured properly from the contract development and permitting perspectives.

However, tax equity—the other essential component—“is not in as great supply as the debt markets,” he added. Many renewable energy projects both onshore and offshore compete for limited tax equity dollars.

Direct pay to bypass the tax equity market “would help inspire more confidence in the offshore wind market and spur development,” he said. “If you don’t have that, you’re relying on the tax equity investors being there.”

If the Inflation Reduction Act (IRA) becomes law, significant benefits— including funds to staff agencies charged with permitting like BOEM—would be in store possibly speeding up processes, Gannon added. “I think these are all the right incentives. … It’s what we need to be able to get this done.”

The proposed IRA, set for a Senate vote this weekend, is boosting confidence.

“That should free up a lot of capital if it ends up passing,” she said.

Looking Forward

Another area for potential GoM wind developers to think about alongside local, state and federal agencies is the power grid, particularly in Texas where demand is great. That could be a blessing or a curse, if infrastructure is insufficient or planned poorly, for developers.

“The infrastructure is not in place, and while we’ve been hearing some support from Texas and Louisiana to support this, it doesn’t exist today,” Gannon said. “But this is the same problem we have almost all over the country: how are we going to get this into our grid effectively and efficiently? I don’t think those answers are developed yet.”

The GoM, however, has some advantages that are already helping move offshore wind ahead.

“The oil and gas experience that exists in this part of the country is directly applicable to the type of work that needs to be done to create offshore wind,” Gannon said. “This is where we’re seeing some of the real manufacturing to support the Jones Act compliant shipbuilding and turbine building. That type of manufacturing is likely to continue to grow in Texas, Louisiana, Florida, etcetera.”

The offshore GoM community is also accustomed to working together, making for fewer conflicts between different industries such as energy and commercial fisheries. “It’s a very different footprint for offshore wind, but it’s a community that is more used to dealing with problems than most places looking at developing [wind] in the Northeast and even in California,” Gannon said.

Economies of scale could also factor into companies’ decisions to enter GoM wind. That could bring some of the same players from the East Coast to the GoM. With coordination, economies of scale will carry over, including on the supply chain side, according to Koenigsberg.

What should companies considering going for GoM wind leases be doing now? Koenigsberg suggested putting thought around where the lease auctions could land, understanding the wind resource and assessing the power market.

“What you think you’re going to be able to sell the power for are obviously important factors in trying to determine whether it makes sense to bid on the next auction,” he said.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.