[Editor's note: This story originally appeared in the January 2020 edition of E&P. Subscribe to the magazine here.]

The global gas industry would appear to have much to cheer about. In recent years, technology breakthroughs have increased upstream productivity and lowered breakeven costs. These improvements have opened up new reserves and boosted production growth. However, the industry needs to urgently find ways to stimulate demand if this abundant supply of natural gas isn’t to become a burden.

Record low benchmark gas prices underline the new dynamic. In the U.S., the Henry Hub spot price remained below $2.50/MMBtu for much of 2019. Spot prices in the Permian Basin turned negative in May 2019, with some producers paying others to take their output. In Europe, the Dutch Title Transfer Facility spot price hit a low of $3.20/MMBtu in July 2019.

As the Northern Hemisphere enters the peak winter heating season, key trading hub prices are rebounding slightly but remain at multiyear lows for this time of the year. Short-term cyclicality in gas markets and a global supply surplus of LNG are part of the reason for the low prices. But the more fundamental cause is long-term structural trends reducing the cost of production and increasing the availability of resources.

In the U.S., rig productivity in key basins has more than tripled, and breakeven costs have halved, as producers of shale and other unconventional gas have embraced new technologies. As a result of these improvements, following a slow start, unconventional gas production is growing worldwide. Argentina, Algeria, China and Saudi Arabia are all ramping up production. New sources of oil and NGL also are leading to an increased supply of associated gas at zero, or even negative, marginal costs.

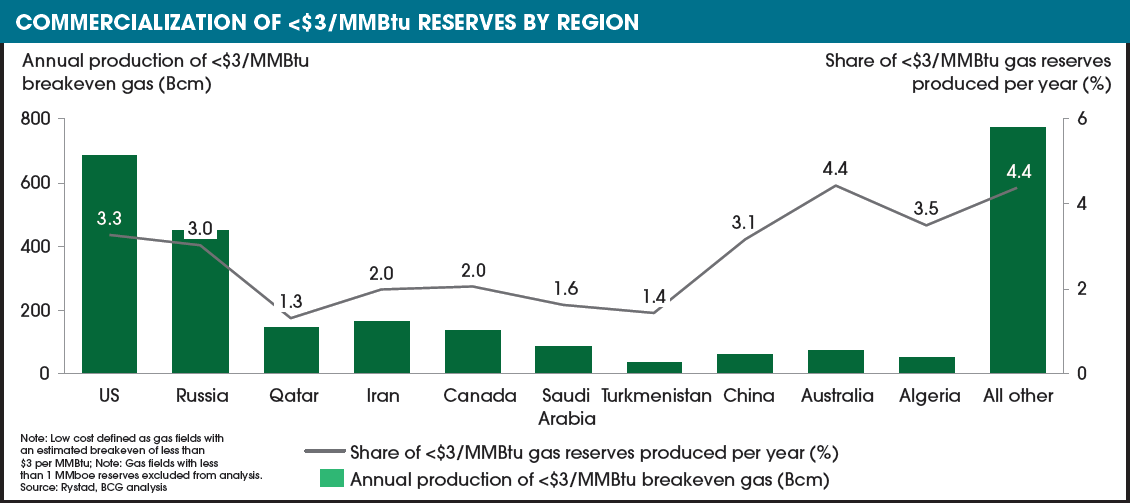

Boston Consulting Group estimates nearly 100 Tcm of proved gas reserves are contained within fields where average breakeven costs are less than $3/MMBtu. Currently, only about 2.7 Tcm are produced each year from these fields (Figure 1). At this rate, they could generate about 35 years of supply of natural gas. The development of additional assets and further reductions in production costs will only increase the quantity of low-cost reserves.

Given these trends, the pressing challenge confronting the industry is not related to the supply of natural gas. It involves ensuring there is sufficient demand for the gas that the industry produces.

Global demand for natural gas has risen rapidly over the past two years, but the growth is concentrated in just a few countries. Over the last year, the U.S. and China accounted for more than 60% of global gas demand growth. Asia offers significant growth potential for natural gas given that today it supplies less than 10% of total energy supplied to the region. Yet, Asian markets outside China have been slow to develop.

Climate change fears, skepticism surrounding the role of natural gas in energy transitions and the rise of renewables are contributing to the downward pressures on gas demand. The European Investment Bank was recently the first major multilateral lender to stop lending for natural gas projects due to concerns that gas is incompatible with a 2 C pathway. Other lenders have curbed lending to gas pipeline projects, jeopardizing investment in the infrastructure needed to encourage demand. In the power generation sector, declining costs for solar, wind and battery storage mean they are a competitive alternative to gas.

Because of these forces, gas demand in Europe is projected to plateau and start to decline in the 2030s. Demand in North America could follow the same pattern, possibly in the same time frame.

Faced with a scenario of weakening demand, the gas industry will need to act and facilitate the development of gas markets if it is to guarantee future demand.

Failure to do so could result in stranded assets for companies across the value chain. Countries including Canada and Turkmenistan are already producing gas at levels far below their potential. Turkmenistan is one of several producers that have signifi cant low-cost reserves but are hampered by poor pipeline infrastructure, limiting their access to external markets for their gas.

Boston Consulting Group believes there are three immediate steps the industry can take. First, it needs to accelerate efficiency improvements across the supply chain, particularly with a focus on midstream and downstream where costs remain high. In the midstream segment, 60% of the delivered cost of LNG comes from transmission, liquefaction and regasification. In the downstream segment, reducing the capital costs of accessing gas supply as well as for combustion equipment will be critical to bolster demand. New innovations, such as microturbines and small-scale LNG, are helping to reduce midstream and downstream costs, but the industry needs to do more.

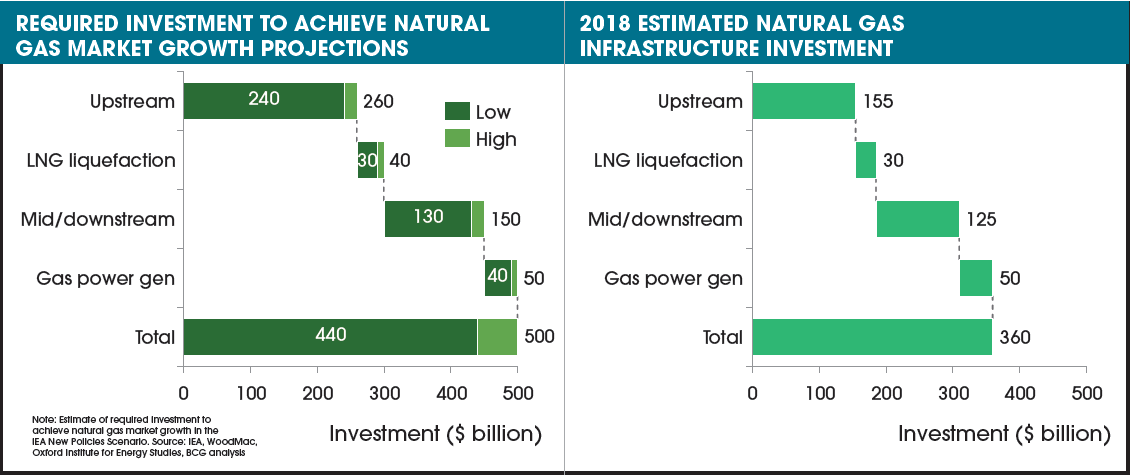

Second, greater infrastructure investment is required to allow broad market access to gas. Global investment in gas infrastructure was about $360 billion in 2018, but the annual figure should be between $440 billion and $500 billion if demand growth is to increase in line with forecasts (Figure 2). A key investment gap exists in transmission and distribution infrastructure, particularly in non-OECD markets. In Asia, the region with the greatest potential, growth is significantly constrained by a lack of access to gas.

Third, supportive government policies are needed to enable fuel switching to gas. In countries that have adopted clear and consistent climate and air quality measures, switching from more polluting fuels to natural gas has helped to reduce greenhouse-gas (GHG) emissions and improve air quality. However, such measures remain insufficient in most markets.

To increase the positive, near-term impacts of natural gas in reducing GHG emissions and improving air quality, governments need to establish an adequate carbon price and effective pollution controls. Over the longer term, consistent policies are required that enable the development of technologies that reduce the emissions intensity of gas consumption, either through the application of carbon capture, utilization and storage or the supply of biomethane and hydrogen. To make the case for gas, the industry must start by demonstrating material progress in reducing its own methane emissions.

Natural gas often is described within the energy industry as the fuel of the future due to its low-carbon properties and affordability. Upstream developments are helping to build solid foundations for the fuel and make this vision a reality. However, these efforts could be for naught without a greater focus on building market demand through increased midstream and downstream investment.

Have a story idea for Industry Pulse? This feature looks at big-picture trends that are likely to affect the upstream oil and gas industry. Submit story ideas to Executive Editor Jennifer Presley at jpresley@hartenergy.com.

Recommended Reading

Excelerate Energy, Qatar Sign 15-year LNG Agreement

2024-01-29 - Excelerate agreed to purchase up to 1 million tonnes per anumm of LNG in Bangladesh from QatarEnergy.

UK’s Union Jack Oil to Expand into the Permian

2024-01-29 - In addition to its three mineral royalty acquisitions in the Permian, Union Jack Oil is also looking to expand into Oklahoma via joint ventures with Reach Oil & Gas Inc.

Permian Resources Continues Buying Spree in New Mexico

2024-01-30 - Permian Resources acquired two properties in New Mexico for approximately $175 million.

Eni, Vår Energi Wrap Up Acquisition of Neptune Energy Assets

2024-01-31 - Neptune retains its German operations, Vår takes over the Norwegian portfolio and Eni scoops up the rest of the assets under the $4.9 billion deal.

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.